Xmas Eve 🏴booster/3rd primary update:

A disappointing 493k today, down a third on last week, breaking the stellar run we've seen in the last 10 days.

Maybe it's a Xmas effect, but we can't afford too much down time over the festive period.

Total is now 27.1m.

1/

A disappointing 493k today, down a third on last week, breaking the stellar run we've seen in the last 10 days.

Maybe it's a Xmas effect, but we can't afford too much down time over the festive period.

Total is now 27.1m.

1/

We can see the effect here, with the weekly total turning down. From here on it's going to be somewhat distorted by the Xmas period, so is likely to be of less value. I've assumed there will be little activity on 25th/26th, even if some centres are open.

2/

2/

The pale blue "to dos" now total just over 10m, but realistically, assuming 90% take-up, it would be around 6.5m.

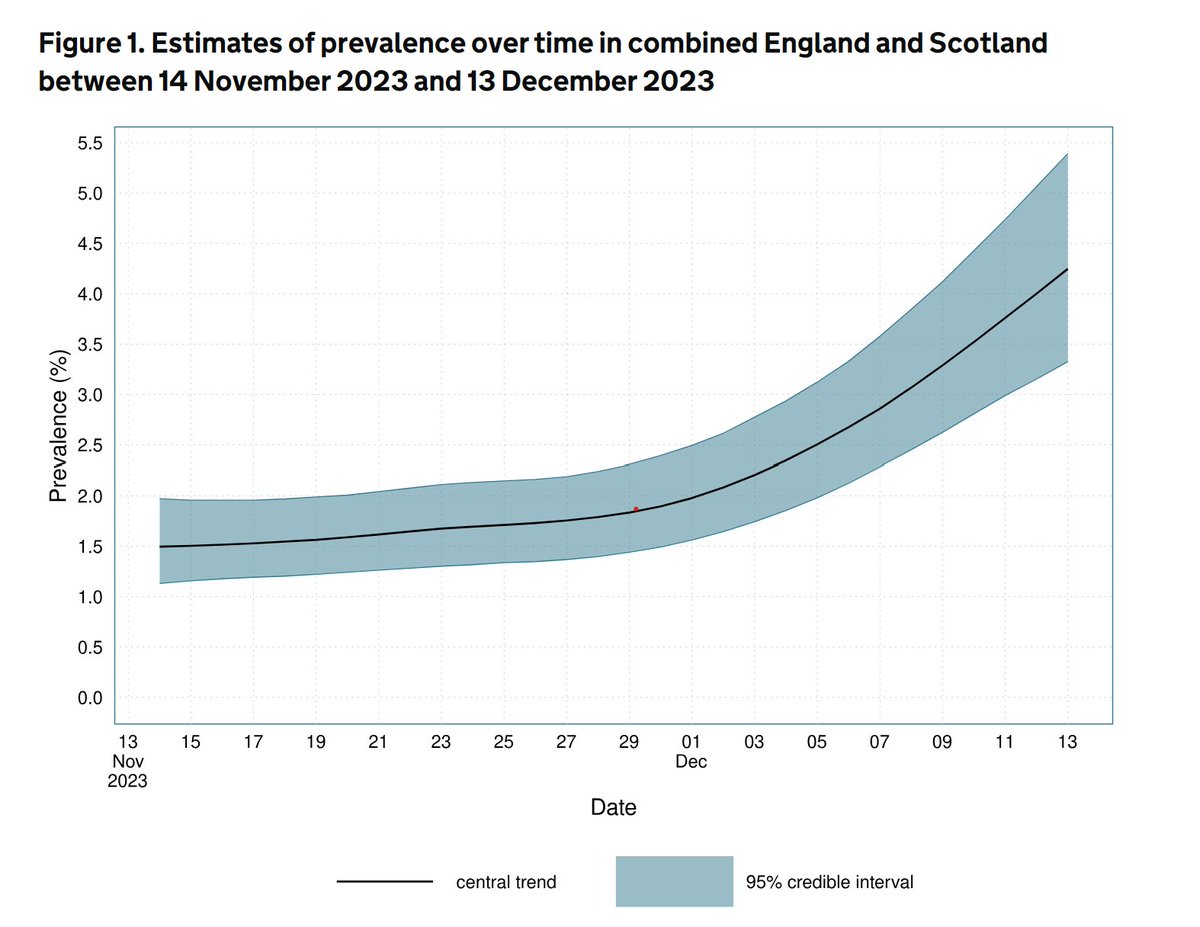

With 6 full-ish jabbing days left, that's no longer likely, especially as many will be infected and not able to come forward anyway.

3/

With 6 full-ish jabbing days left, that's no longer likely, especially as many will be infected and not able to come forward anyway.

3/

Importantly though, we have very good take-up over age 50 - now at 87.5% above that age, which will be very helpful in minimising any surge in admissions.

4/

4/

And finally for the graphs, here's progress over the last month. We've still a lot we can do under 50, with only just over a third of the under 30s boosted yet.

5/

5/

And finally, to all who've followed these threads, and indeed any of my output this year, can I wish you all a safe, relaxing and enjoyable Xmas. And for those on duty, particularly in the health and emergency sectors, I hope you manage to catch some family time too.

Happy Xmas!

Happy Xmas!

• • •

Missing some Tweet in this thread? You can try to

force a refresh