Learnings from one of my favorite Trader & Youtuber Mr. Subasish Pani @subasish_pani of 𝗣𝗼𝘄𝗲𝗿 𝗼𝗳 𝗦𝘁𝗼𝗰𝗸𝘀 fame from the F2F interview conducted by @Vivbajaj Sir of @elearnmarkets fame

Time for a thread 🧵

Time for a thread 🧵

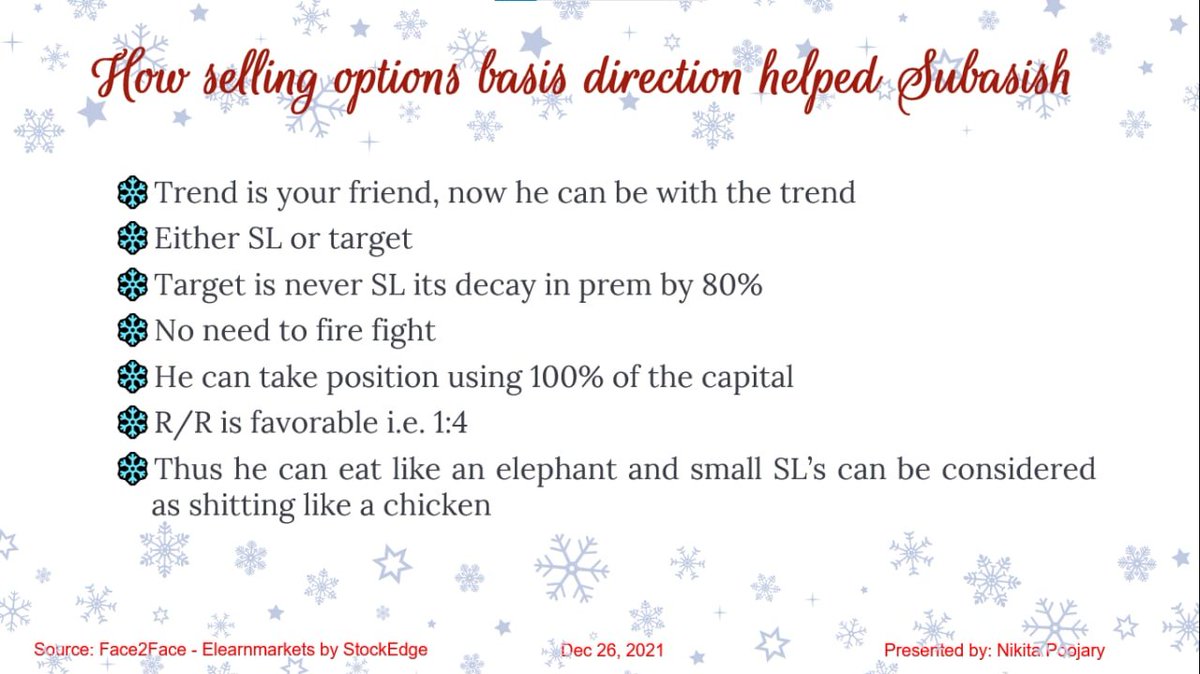

• After being a successful in cash, futures & option buying in intraday Subasish is currently a Positional Option Seller

• Logic for strike selection i.e. Deep ITM strike

• When he senses that the downtrend will start he will pull the trigger with a small SL

• He'll choose the strike of the immediate support (for a downtrend)

• When he senses that the downtrend will start he will pull the trigger with a small SL

• He'll choose the strike of the immediate support (for a downtrend)

• How SL is determined for the trade

• He understands the market moves pretty, so usually captures at the start of a trend and that benefits him as can take that trade placing a small SL

• Even if the SL gets hit, its always small

• He understands the market moves pretty, so usually captures at the start of a trend and that benefits him as can take that trade placing a small SL

• Even if the SL gets hit, its always small

• Why he prefers deep ITM instead of OTM

• He places his entry like a scalper and once it is in his favor he'll convert that trade into positional

• He places his entry like a scalper and once it is in his favor he'll convert that trade into positional

• He doesn't play for just theta decay he plays for the direction or delta

• He wanted to build a system in option selling, wherein he can deploy not just 100% of his capital but can also avail leverage

• Prefers to use leverage given his conviction in the trend

• He wanted to build a system in option selling, wherein he can deploy not just 100% of his capital but can also avail leverage

• Prefers to use leverage given his conviction in the trend

• He carefully observed how market moves

• He doesn't believe in fire fighting, he would rather take a small SL and get out of the trade rather than fighting with the market

• He utilized his strengths to build a system, his strength is to capture the trend

• He doesn't believe in fire fighting, he would rather take a small SL and get out of the trade rather than fighting with the market

• He utilized his strengths to build a system, his strength is to capture the trend

• Upmoves are usually slow whereas falls are always ferocious

• Subasish has made a major chunk of his fortune in the downtrend (Covid Crash) and plays aggressively on the downside

• Current correction has also proved the same, he made a Rs. 1cr. in a week (positional)

• Subasish has made a major chunk of his fortune in the downtrend (Covid Crash) and plays aggressively on the downside

• Current correction has also proved the same, he made a Rs. 1cr. in a week (positional)

• Identify the weaker leg and simply short it

• On the day of expiry never to wait for the options to go to 0, as usually the move post 2.30-3pm can convert a deep OTM into ATM

• On the day of expiry never to wait for the options to go to 0, as usually the move post 2.30-3pm can convert a deep OTM into ATM

• Pure intraday set up only to be applied on an expiry, it can screw you if you try the same in positional

• A mature trader is a one who refines his setup after merging his experiences with his personal forte

• Despite a Drawdown, he hasnt given up yet, as he realizes that for anything to work it takes time as one needs to work on its nuances as well

• Key takeaway, if he doesn't give up despite having so many other tricks under his hat, we also shouldn't give up that easily

• Key takeaway, if he doesn't give up despite having so many other tricks under his hat, we also shouldn't give up that easily

• Always check the broader trend of the market

• Amateurs open the market, and the professionals close it, so focus on BO & BD's post 12.30 pm

• Amateurs open the market, and the professionals close it, so focus on BO & BD's post 12.30 pm

• Never buy in first pullback

• Focus on the larger trend, usually first pullbacks will be an opportunity for the sellers

• Focus on the larger trend, usually first pullbacks will be an opportunity for the sellers

• Understand the psychology from the perspective of buyers & sellers instead of mere candlestick

• Try to analyse who gets rewarded and who gets trapped and what will they do, and accordingly take action

• Try to analyse who gets rewarded and who gets trapped and what will they do, and accordingly take action

• Shoutout to @subasish_pani @Vivbajaj Sir & @elearnmarkets for helping out so many budding traders

• Do follow their YouTube channel:

𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐒𝐭𝐨𝐜𝐤𝐬: youtube.com/c/POWEROFSTOCK…

𝗘𝗹𝗲𝗮𝗿𝗻 𝗠𝗮𝗿𝗸𝗲𝘁𝘀 𝗯𝘆 𝗦𝘁𝗼𝗰𝗸𝗘𝗱𝗴𝗲: youtube.com/channel/UCMec1…

• Do follow their YouTube channel:

𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐒𝐭𝐨𝐜𝐤𝐬: youtube.com/c/POWEROFSTOCK…

𝗘𝗹𝗲𝗮𝗿𝗻 𝗠𝗮𝗿𝗸𝗲𝘁𝘀 𝗯𝘆 𝗦𝘁𝗼𝗰𝗸𝗘𝗱𝗴𝗲: youtube.com/channel/UCMec1…

• This was a 🧵on the F2F interview by @Vivbajaj Sir with @subasish_pani

• Source of this presentation & Link for this interview: shorturl.at/eAILY

• If you❤️this, why not share?

• Retweet the first tweet and help others find this🧵

• Happy learning 🤓 to everyone!

• Source of this presentation & Link for this interview: shorturl.at/eAILY

• If you❤️this, why not share?

• Retweet the first tweet and help others find this🧵

• Happy learning 🤓 to everyone!

• Hope you 👍 this thread 🧵

• I curate threads on trading & finance

• You can check out other threads 📌 on my profile😃✌️

• I curate threads on trading & finance

• You can check out other threads 📌 on my profile😃✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh