✦ INCOMING TRANSMISSION ✦

RE: Deployment of $xASTRO, $vxASTRO and the Astral Assembly

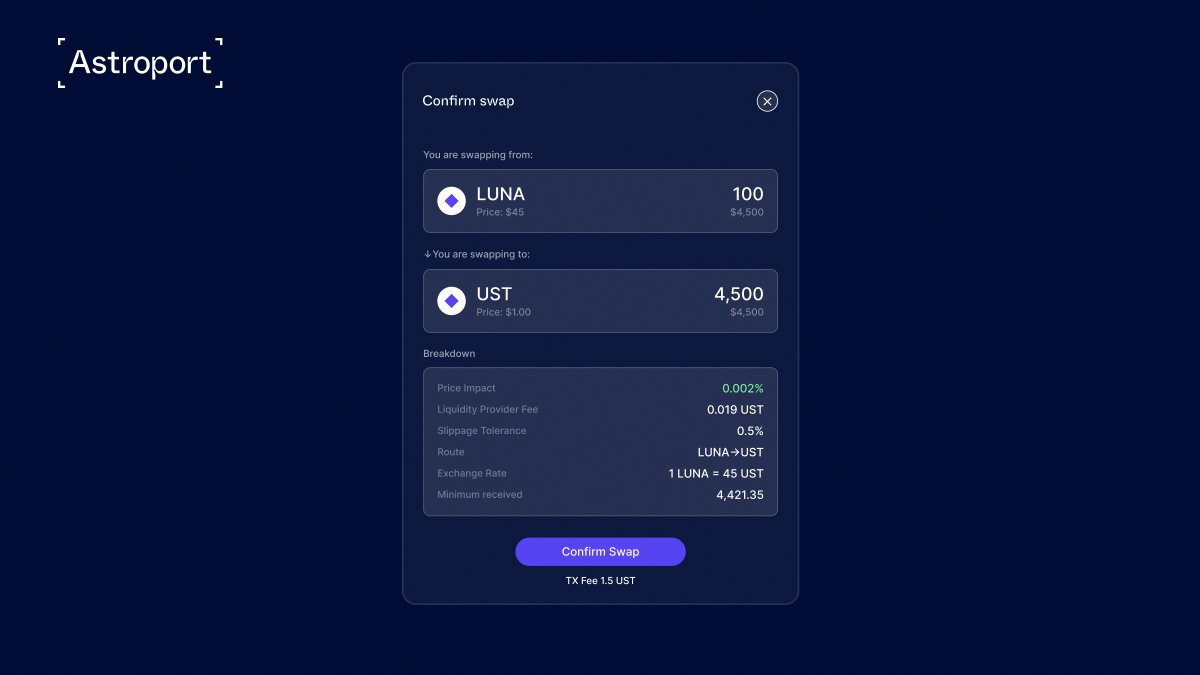

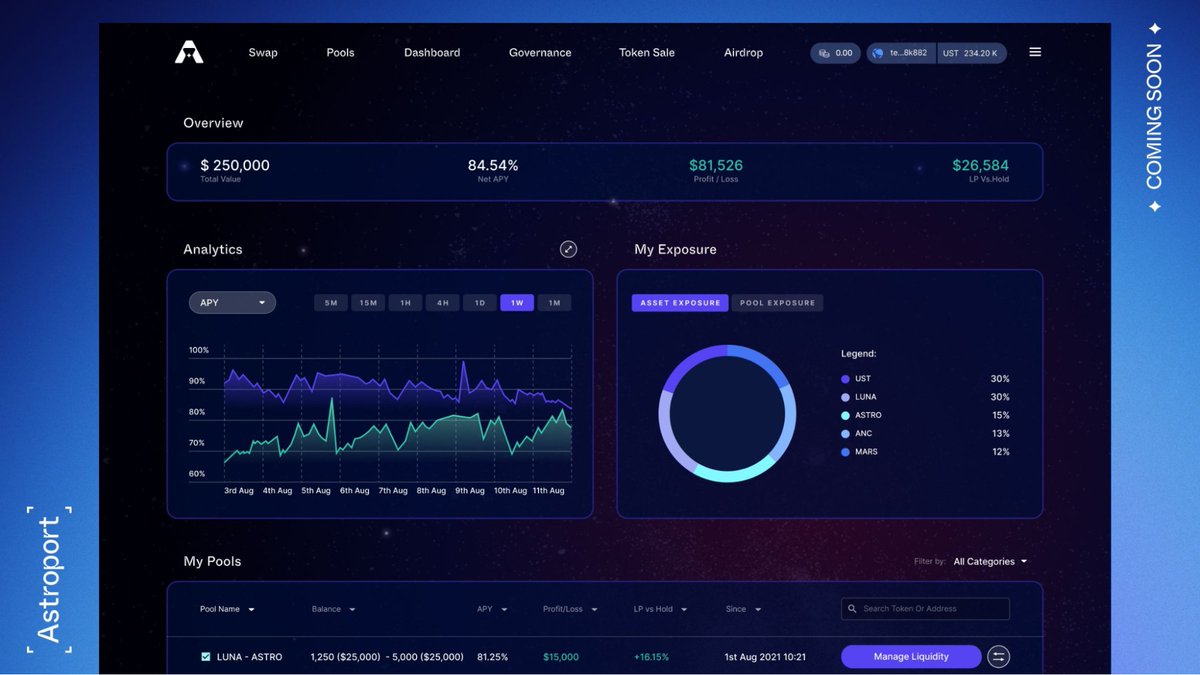

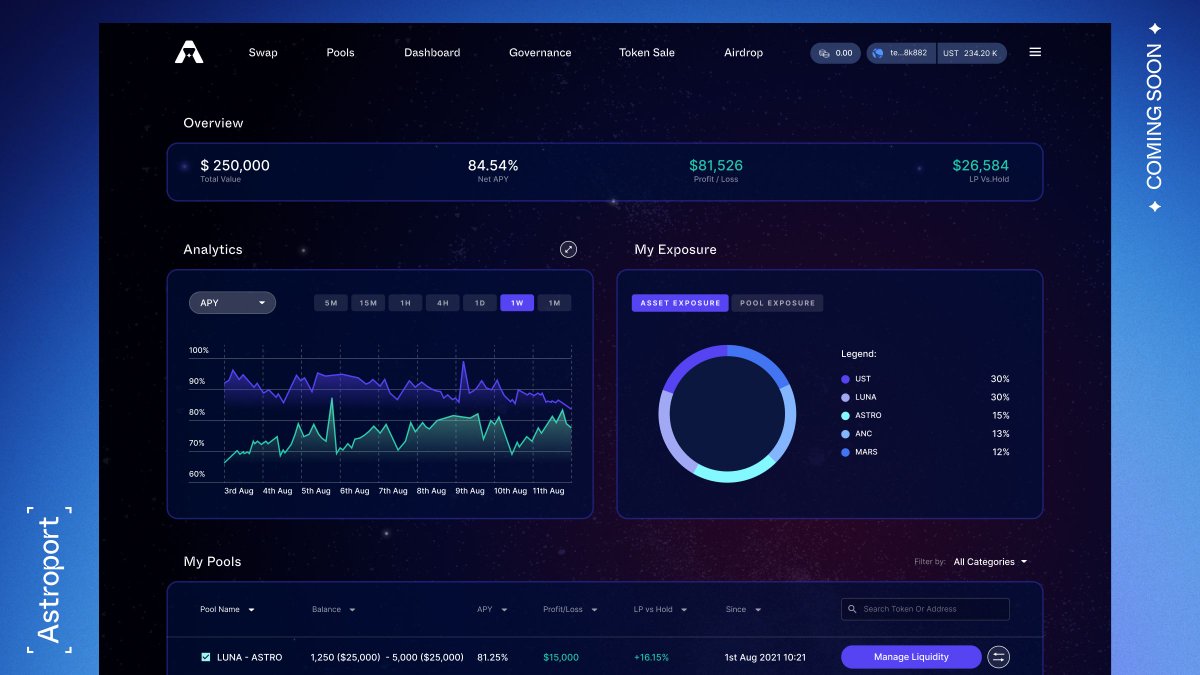

Now that the Astroport AMM has launched, focus shifts to activation of $ASTRO staking ($xASTRO), locking ($vxASTRO) and governance (via the Astral Assembly).

🧵👇

RE: Deployment of $xASTRO, $vxASTRO and the Astral Assembly

Now that the Astroport AMM has launched, focus shifts to activation of $ASTRO staking ($xASTRO), locking ($vxASTRO) and governance (via the Astral Assembly).

🧵👇

B/w the launch of the Astroport AMM and activation of the Astral Assembly a grace period was planned for important security-oriented reasons including:

(1) no matter how carefully engineered or audited, code always needs a trial period "in production" before it should be considered fully secure;

(2) while code is being battle-tested in prod, agile multisignature-based security incident response and parameter-setting by the developers is a better source of protection than slower-moving token-based governance;

(3) token-based governance cannot be secure until there is widespread distribution and market stability for the governance token; and

(4) there is not yet a robust equivalent of Snapshot-style voting on Terra, so it was not even feasible for us to provide an interim 'signal voting' style governance functionality for $ASTRO.

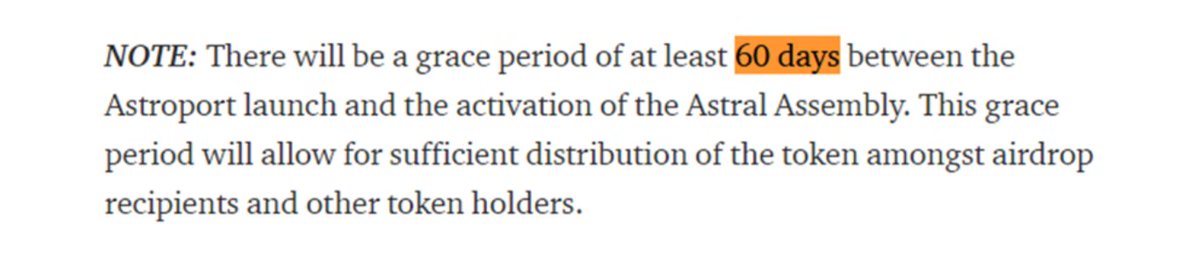

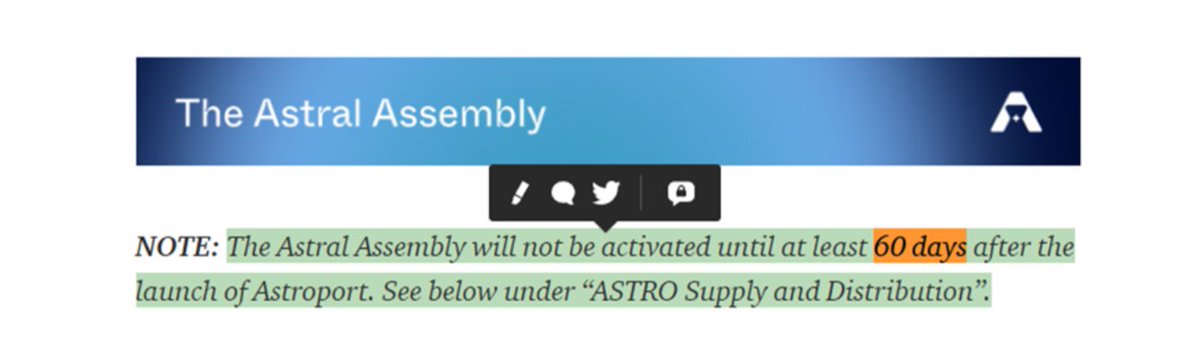

The Astroport Litepaper (astroport.medium.com/astroport-lite…) published on September 10th noted the grace period at the very start of the "The Astral Assembly" section and featured another reminder later in the "ASTRO Supply and Distribution" section.

Nonetheless, some community members have pointed to the following sentence which appears in the Litepaper in between the two notes about the grace period as having been confusing:

In context (considering the preceding and following notes about the delay), "Upon launch" was meant to mean "Upon launch [of the Astral Assembly]".

To try to be as clear as possible, we have revised the litepaper sentence to read "Upon activation of the Astral Assembly 60-90 days following the Astroport AMM launch, ASTRO holders will be able to join…."

Additionally, since the $xASTRO code is complete and audited, we are working on a potentially faster roll-out (approximately 2-3 weeks from now).

This launch will precede full activation of the Astral Assembly; $xASTRO will not have binding governance powers until Astral Assembly activation. However, $ASTRO holders will be able to stake their $ASTRO for $xASTRO and its associated fee-capture mechanism 🦾

Tl;dr

✦ Litepaper updated for clarity

✦ $ASTRO staking for $xASTRO could launch within 2-3 weeks

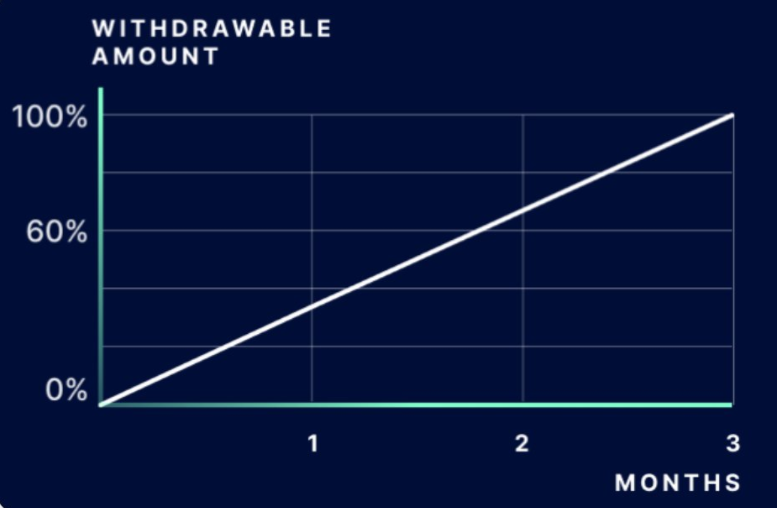

✦ $ASTRO locking for $vxASTRO and full activation of the Astral Assembly expected within 60-90 days

Onwards and upwards!

✦ Litepaper updated for clarity

✦ $ASTRO staking for $xASTRO could launch within 2-3 weeks

✦ $ASTRO locking for $vxASTRO and full activation of the Astral Assembly expected within 60-90 days

Onwards and upwards!

• • •

Missing some Tweet in this thread? You can try to

force a refresh