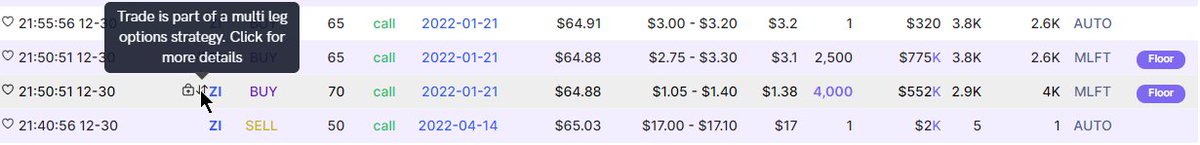

Folks sometimes will look at the @unusual_whales flow and point to some of the tags as being indicators to take an entry, make an exit, or to outright avoid a trade altogether.

For instance, sometimes there are trades that come through marked as "floor". What is a "floor" trade?

For instance, sometimes there are trades that come through marked as "floor". What is a "floor" trade?

Floor traders work on the floor of an exchange.

When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

That's it.

Well...

When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

That's it.

Well...

...Except for the fact they might be initiating a trade on behalf of a client for any other reason or with knowledge from said client(s).

But that's hearsay (literally?).

This is a pretty cool video showing off floor traders from a couple of decades ago:

But that's hearsay (literally?).

This is a pretty cool video showing off floor traders from a couple of decades ago:

Working off 50% salary and 50% commission, one would be motivated to perform as many trades as possible, and to work as hard as possible.

Also, in no way are floor traders operating a racket or pyramid scheme, as per the lady and gentleman in that video.

Also, in no way are floor traders operating a racket or pyramid scheme, as per the lady and gentleman in that video.

Whatever information they trade with, we have access, too.

Right?

...Right?

Right?

...Right?

On the Unusual Whales blog is a report on floor traders' performance.

I'm leaning on this heavily to understand if floor traders do in fact have an edge on the market: unusualwhales.com/blog/floor-tra…

I'm leaning on this heavily to understand if floor traders do in fact have an edge on the market: unusualwhales.com/blog/floor-tra…

Here is a snippet:

"More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit."

"More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit."

"And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above."

To repeat:

Most trades made are ~10% ITM--and of OTM calls, nearly 50% are profitable and a third of them are hitting 50% gains or more.

To repeat:

Most trades made are ~10% ITM--and of OTM calls, nearly 50% are profitable and a third of them are hitting 50% gains or more.

So maybe there is something more to floor trades? At least when it comes to ITM positions, and sometimes (a lot of the time!) when it comes to the shorter-dated OTM ones, too.

Let me know your thoughts on this article and if you use floor trades as an indicator for your strategy!

And make sure to go check out the full article! unusualwhales.com/blog/floor-tra…

And make sure to go check out the full article! unusualwhales.com/blog/floor-tra…

• • •

Missing some Tweet in this thread? You can try to

force a refresh