West Ham publish financials for year ended 31 May 2021: Key numbers

Revenue up 38% to a record £193m despite Covid.

Wages little change

Day to day losses down from £80m to £26m

Net transfer spend minus £3m

Borrowings down £11m to £109m

#WHUFC

Revenue up 38% to a record £193m despite Covid.

Wages little change

Day to day losses down from £80m to £26m

Net transfer spend minus £3m

Borrowings down £11m to £109m

#WHUFC

Total revenue up as broadcast increase due to more matches in period 1 June 2020-31 May 2021 than previous year. This offset decrease in matchday income. Gap to the Sneaky Six still huge though. #WHUFC

Broadcast income almost doubled due to more matches being played so be cautious when comparing to 2019/20 as many matches postponed due to Covid. Good by standards of 'Other 14' but still some catching up to do on you know who.

Matchday revenue just £508k due to Covid compared to nearly £26m previous season. Should bounce back in 2021/22 due to matches in front of paying audience, increased capacity and participation in Europe. #WHUFC

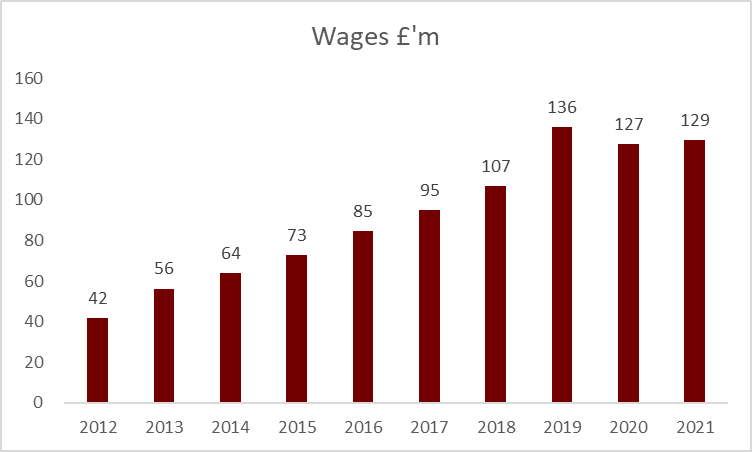

Wages cost up slightly (2020 figures included compo for Pelligrini so stripped out here) #WHUFC still below the wage level of a small club such as Crystal Palace although Palace's covered 13 months. Average weekly wage just over £60k

West Ham paid £67 in wages for every £100 of income, below UEFA's red line of £70 and a big fall from previous season. #WHUFC

Highest paid director at #WHUFC had a £300k pay rise. I wonder who was the lucky recipient?

Other main player cost is transfer fee amortisation (fee divided by contract period) has been broadly static for the past three years. Mid table by PL standards

West Ham had transfer fee impairments (writing down transfer value having signed someone a bit bobbins) of £9.9 million in 2020/21.

As a result of all the above West Ham had a day to day loss of £26m in 2020/21, down from £80m previous season. Losses of £1/2m a week turn out to be quite low by PL standards. #WHUFC

Losses can be offset by player sales and owner investments. West Ham made profits of £18m in 2020/21 #WHUFC

West Ham owners earned £1.87m from loans to the club in 2020/21 taking the total to £22.5 million in the last decade #WHUFC

West Ham had player signings of £54m in 2020/21 offset by sales of £57m. The squad cost fell to £259m

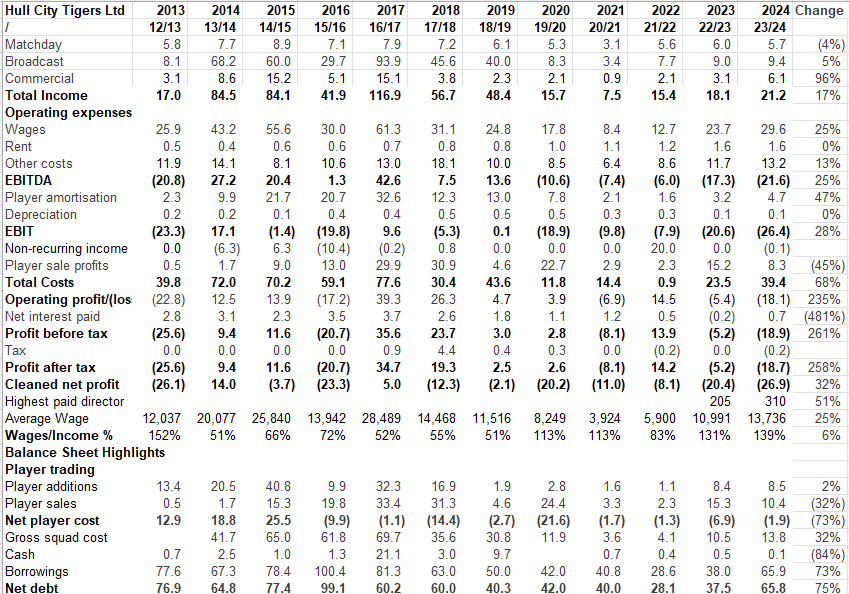

Spreadsheet summary for last decade #WHUFC

• • •

Missing some Tweet in this thread? You can try to

force a refresh