1/ Its been a while since I last posted🧵

But when your mentor asks you to read a business you oblige. Thanks @ishmohit1, please add your insights if you find any gaps.

#Taskus 🇺🇸 $TASK

"Outsourcing reimagined for the innovation age"

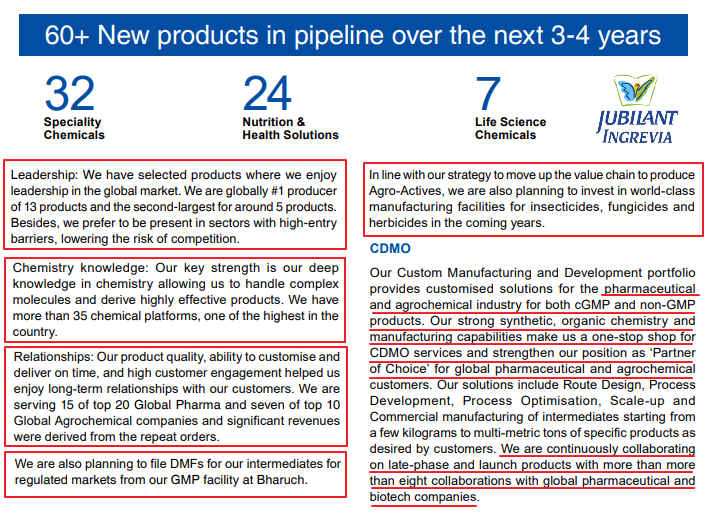

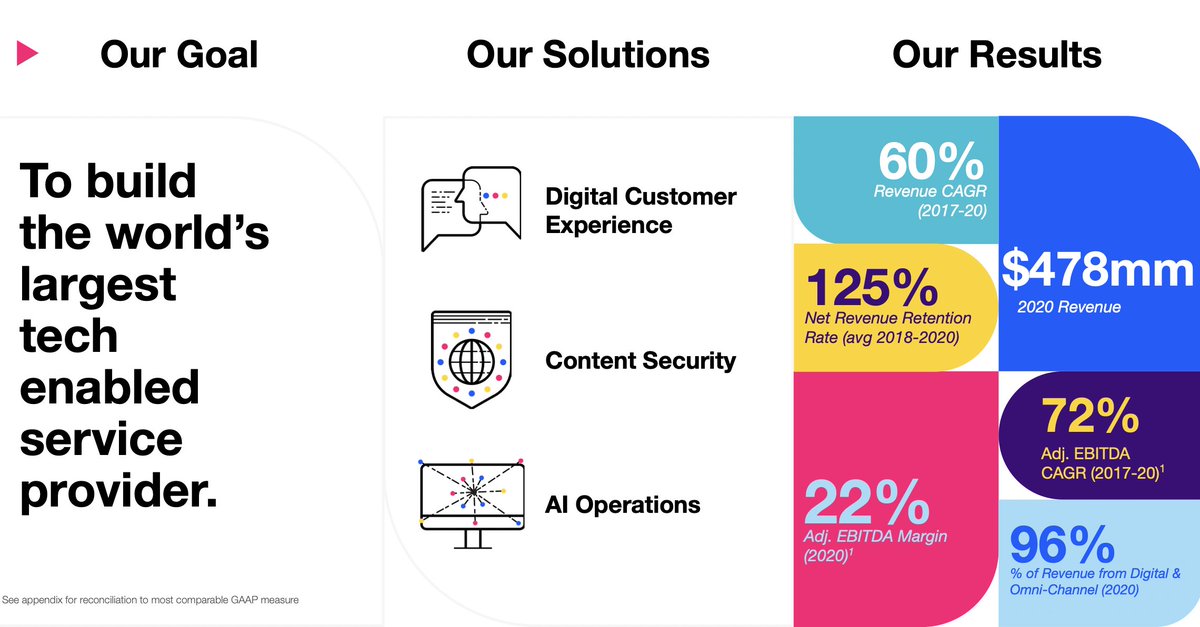

🔥60% Revenue CAGR over past 4 years

But when your mentor asks you to read a business you oblige. Thanks @ishmohit1, please add your insights if you find any gaps.

#Taskus 🇺🇸 $TASK

"Outsourcing reimagined for the innovation age"

🔥60% Revenue CAGR over past 4 years

2/ Background: Founded in 2008 during recession by 2 high school best friends, Jasper Weir & Bryce Maddock

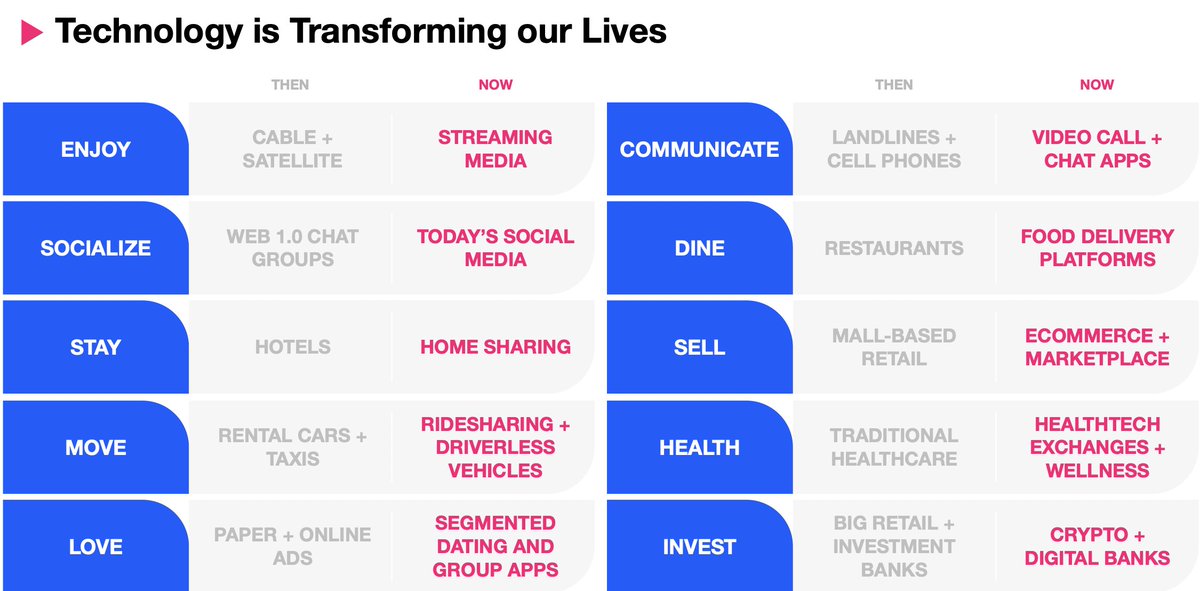

3/ While all major competitors in the industry were occupied serving traditional telco clients, they focused efforts on the emerging digital economy. Most clients have 3 things in common: they are truly customer obsessed, they've grown faster than nearly every other company

4/ in history and their success has led to massive operational challenges that can put their customer experience at risk. That's where TaskUs comes in.

5/ It provides specialized services that companies rely on to scale their business and deliver for their customers. Currently into 3 domains with Digital CX, Content Security & AI

8/ One example to understand why content security is needed is the instance of Peloton, its an internet connected exercise equipment company. And so one might think why would they need content security? Turns out people were weaponizing their user names.

futurism.com/the-byte/pelot…

futurism.com/the-byte/pelot…

9/ There was all sorts of hateful memes that were showing up in user names. And so they had to moderate user names. So that shows the extent that anywhere where user-generated content is being created and shared publicly, there's going to be a need for content security services.

10/ Companies like Meta (Facebook), Youtube and TikTok are currently the biggest driver of demand for these services today. However, 3-5 years down this could change drastically.

11/ Focused on becoming one of the largest Content security service provider in the world

12/ AI operations:

EV – most exciting contract win, where their AI team is supporting to enable future of self-driving cars.

EV – most exciting contract win, where their AI team is supporting to enable future of self-driving cars.

13/ Demand within AI is expanding where in the beginning a lot of work was done towards autonomous vehicle space but has now expanded into other interesting verticals like social media space etc., who are looking to train their own models in various situations.

14/ As application of AI expands the demand for training data will too expand

16/ Five focus areas:

(1) Current clients who are growing extremely fast & accelerating outsourcing spend,

(2) Adding new specialized service offerings,

(3) Expand globally,

(1) Current clients who are growing extremely fast & accelerating outsourcing spend,

(2) Adding new specialized service offerings,

(3) Expand globally,

17/

(4) Add more clients, apart from High-growth disruptors, add Big tech & support digital transformation of Fortune 500 companies,

(5) M&A to expand geographically & capabilities (100% organic growth so far)

(4) Add more clients, apart from High-growth disruptors, add Big tech & support digital transformation of Fortune 500 companies,

(5) M&A to expand geographically & capabilities (100% organic growth so far)

18/ 🔥Seeing explosive🔥 (Growth 300% YoY) demand from Fintech (especially in anti-money laundering & KYC areas) who are challenging the traditional global financial institutions

19/ Plan to further expand European delivery footprint in 2022 to develop additional language capabilities. Seeing significant growth in EU in coming years

20/ Entered India in October 2019. As of September of 2021, just 2 years after launching, have nearly 5,000 employees, making India the fastest-growing region in TaskUs history (Margin accretive growth – due to lower operating cost)

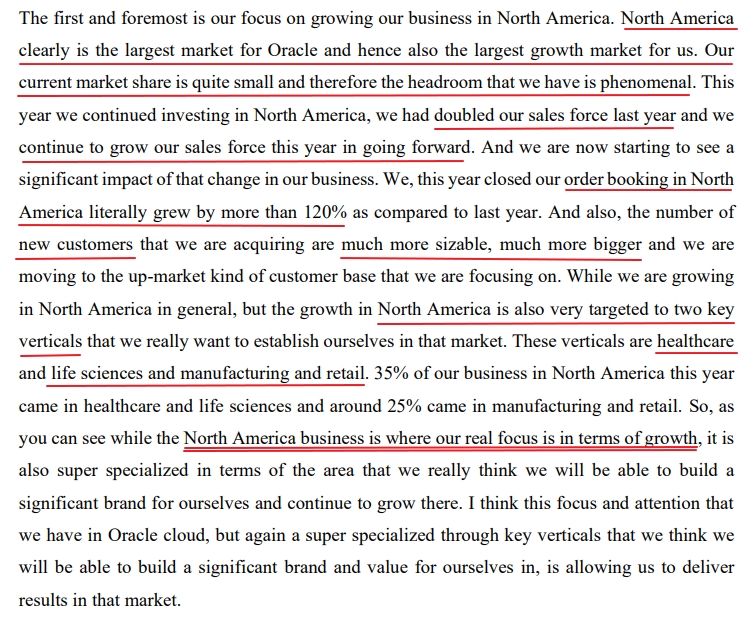

21/ Lets talk about company USP:

TaskUs business is largely dependent on the quality of its team, as the satisfaction level of clients is largely correlated with the quality of service. Therefore, it is important for the company to establish high employee satisfaction level

TaskUs business is largely dependent on the quality of its team, as the satisfaction level of clients is largely correlated with the quality of service. Therefore, it is important for the company to establish high employee satisfaction level

22/ Their “culture” really sets them apart from competition which is evident from their investment into various employee benefit programs. Highly rated on Glassdoor – 4.7 (best among peers)

23/ Something I found interesting, instead of saying “employees” they refer to the workforce as “teammates”

24/ Able to Attract & retain quality “talented” specialized workforce due to their “world-class” culture & above market pay

25/ If a client walks into any of their offices be it India, Mexico, Philippines or any other, they will feel like walking into their San Francisco office both in terms of office culture and physical environment

****Not the end, adding more tweets below****

****Not the end, adding more tweets below****

26/ Record of 99% on-time hiring SLA (Service Level Agreement). Avg. time from contract signing to having an employee trained and deployed was 15 days only (3x faster than competition)

27/ Unlike bigger players with legacy infrastructure, they are 100% cloud based and connect via API into client systems

28/ Their focus is industry specialized and classified into various verticals like fintech, food delivery, health tech, media streaming etc., whereas large players place them all into the bucket of Mega tech bucket without specialized focus

29/ Their “World class” tech enables them to deliver solutions to fastest growing biggest innovators in the world. They have a broad no. of tech disruptor Clients in High growth sectors

30/ Focus on early-stage high growth start-ups and often they are first choice disruptive outsourcing service provider by leveraging its relationships with fast growing tech companies

31/ TaskUs was Uber’s first outsourced partner and in many ways grew up with Uber. Similar was the case with Zoom.

32/ Increasingly seeing a no. of its clients growing well and becoming public

33/ Going public themselves evidences their intention to remain independent from being bought by traditional players which is in turn helping them win business from some newly public companies

34/ Covid accelerating the digital trend leading to growth across all client base. Additionally, emergence of Metaverse is providing excellent opportunity.

35/ Staying one step ahead of the trend - Being proactive they launched probably world’s first content security services for non-fungible tokens or NFTs by securing the marketplaces where such digital assets are traded.

36/ This leverages their existing capabilities and brings an adjacent offering to the market

37/ Signed 1st customer in Q4 2021 for nonfungible tokens content security services

38/ Begun building a platform to expand the reach of AI Operations services where they intend to deliver rapid results by leveraging a combination of TaskUs employees and globally distributed freelance experts

39/ They closely watch trends in the start-up and venture capital space, working with founders and investors to develop custom service offerings. This approach has earned them the opportunity to support the fastest-growing companies in history well before anyone else

40/ Recently we saw the scrutiny social media giant Meta (Facebook) faced with increasing regulatory pressure in US. However, most advanced regulatory policies exists in EU region. And with that there is an increased demand for essential services like Content Security and

41/ AI operations. Their reputation of best-in-class provider of these services puts them in the right spot to benefit

42/ Customer stickiness – Able to identify areas of needs for the customers and with the sophistication and customization in the platforms that they deliver they are able to obtain more and more outsourced services from clients and retain them

43/ More focused on technical investments and not on building ERP or CRM like intense systems, rather they are building lightweight browser-based extensions that can be easily integrated with client’s system (e.g., chatbots, workflow automation tools etc.)

44/ Risk:

TaskUs success is tied to the success of the overall digital economy

TaskUs success is tied to the success of the overall digital economy

45/ Customer concentration – Top 2 clients contributed 39% revenues in Q2 FY21. Each contributing 27% (Meta – Facebook) and 12% respectively

46/ This business was started with a capital of just $20K in 2008 therefore – Low barriers to entry. However, barriers to scale in this industry are high which requires building global footprint, robust technical & secure infrastructure, large investments into technology.

47/ Inflation - They are able to pass on only a certain % of costs to customers. Good - Majority of our contracts on an account basis have cost-of-living adjustments baked into them, where they can increase customers' rates and pass on wage increase.

48/ Bad - But some of the largest contracts, which are signed on a 2 or 3-year terms, have fixed pricing. They could see a gross margin impact as a result of that.

49/ Financials:

Took a hit due to cash bonus/equity awards to every employee post IPO

Took a hit due to cash bonus/equity awards to every employee post IPO

50/ In Q2 2021, SG&A expenses were $177.8 million, which included $129.4 million onetime expenses of phantom shares bonus made in connection with the IPO, a $6.8 million for nonrecurring teammate IPO bonus, and other IPO-related expenses.

51/ Started to accrue for stock compensation expenses in the current quarter of $5.8 million, which was prorated for the period from the IPO date to the end of the quarter.

52/ Net income was a loss of $105.9 million or a loss per share of $1.14. This result included the onetime expense as mentioned above. By comparison, in the prior year, net income was at $8 million and EPS of $0.09.

53/ Geographies are Key Triggers for Margins: total cost of services is tied to increases in head count as more people are hired to deliver specialized services to clients.

54/ The cost of service as a % of revenues is not heavily influenced by the service offering mix. Instead, it is primarily influenced by the geographic location from which services are provided. Expecting geographic mix to be stable in the near term

55/ Q1 2021 saw a few massive wins that helped scale into Q2. Need to go and replicate that success going forward

56/ Coming to year end, Q4 typically has slightly higher seasonal operating costs due to the number of holidays in the quarter

57/ H1 of this year saw 60% sales from existing clients, evidence of their ability to mine existing customer base

58/ Inflationary environment is expected to result in increased offshore outsourcing solutions particularly to countries like India and Philippines (High Gross margins)

59/ Although even these countries are facing high wage pressure they are still able to absorb those without significant impact on margins since those are still better than they are in the US

60/ Guidance:

- Expect to maintain EBITDA margin of 25% plus in medium term (around 23% for 2022)

- Full year 2021 total revenues in the range of $705 million to $709 million, representing YoY growth of 47.9%

- Expect to maintain EBITDA margin of 25% plus in medium term (around 23% for 2022)

- Full year 2021 total revenues in the range of $705 million to $709 million, representing YoY growth of 47.9%

61/ Heading into 2022, expect to deliver sustainable revenue growth and world-class margins and remain confident to grow at or about 25% in the medium term.

62/ Company seems to be on track to achieve its hyper growth targets and sustain momentum in medium term. This is a really interesting opportunity. The recent correction in US market is offering a great entry point.

63/ Wow !! that was really long, unlike Indian market stocks I didn't find any research report on this US company so had to do all the dirty stuff myself. But this was a very enlightening process.

Thank you for reading, if you liked it then kindly retweet and share🧵♻️

Thank you for reading, if you liked it then kindly retweet and share🧵♻️

• • •

Missing some Tweet in this thread? You can try to

force a refresh