How to get URL link on X (Twitter) App

2/6

2/6

2/ Huge Deleveraging:

2/ Huge Deleveraging:

There are 2 models that business generally follow:

There are 2 models that business generally follow:

2/

2/

Powertrain vertical (Cylinder Heads is part of this segment) - 52% of total revenue

Powertrain vertical (Cylinder Heads is part of this segment) - 52% of total revenue

2/ Background: Founded in 2008 during recession by 2 high school best friends, Jasper Weir & Bryce Maddock

2/ Background: Founded in 2008 during recession by 2 high school best friends, Jasper Weir & Bryce Maddock

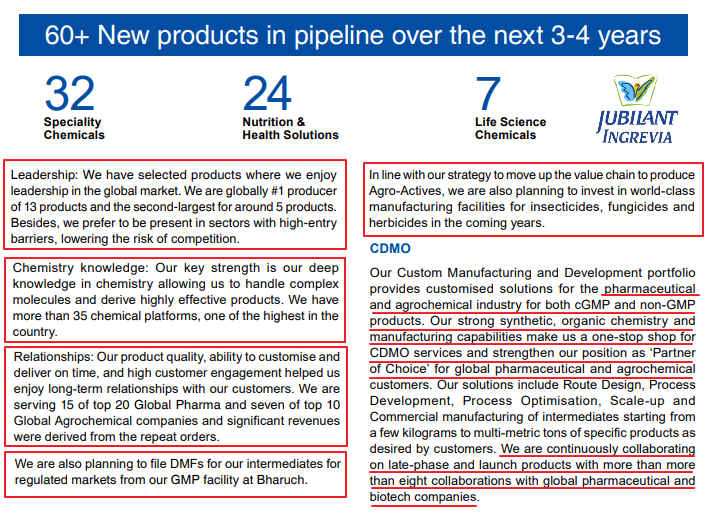

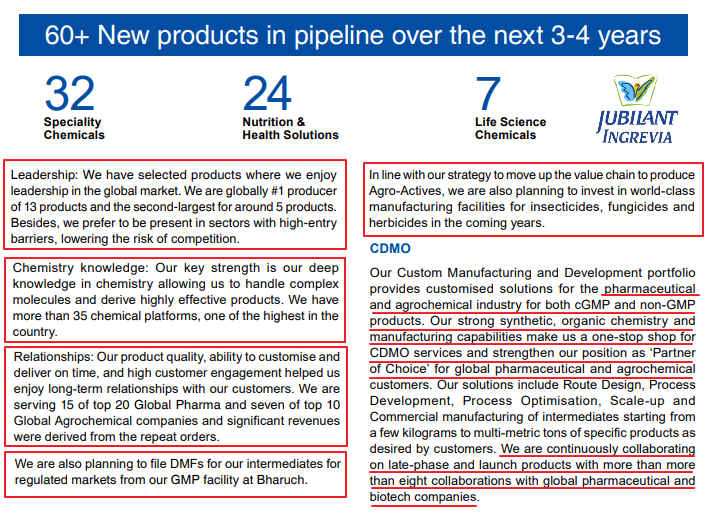

2/ About the co. - Great export biz - almost 50% Revenue from sales in 60+ countries (Exports). No client concentration risk with top 10 making 23% sales only.

2/ About the co. - Great export biz - almost 50% Revenue from sales in 60+ countries (Exports). No client concentration risk with top 10 making 23% sales only.

https://twitter.com/mmali09/status/1376864451874365440?s=20

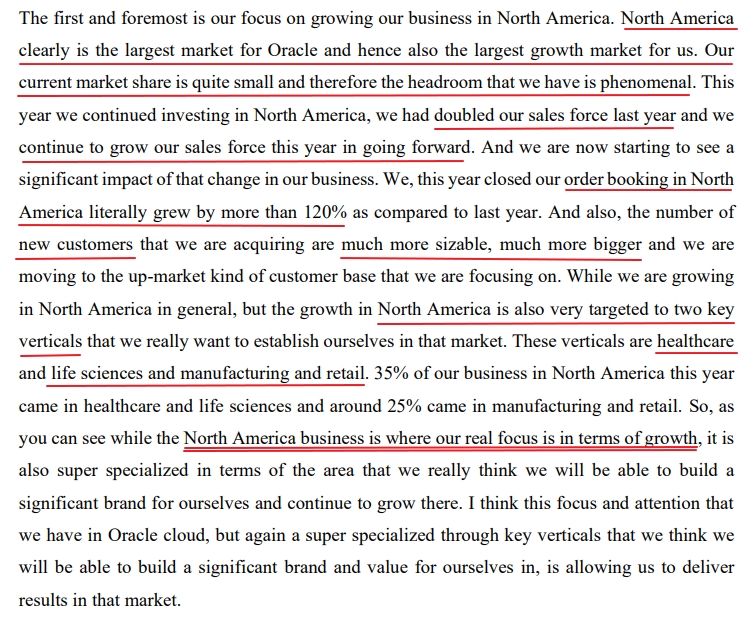

2/ 2nd area of focus is competing with SAP and gaining more market share. Already closed 5 marquee customers who were using SAP as their legacy application. Will give opp. to significantly move in the UK & Europe region (stronghold of SAP).

2/ 2nd area of focus is competing with SAP and gaining more market share. Already closed 5 marquee customers who were using SAP as their legacy application. Will give opp. to significantly move in the UK & Europe region (stronghold of SAP).

2/ However, the sustainability of these moats needs closer look. Mold-Tek has a state of the art “IN HOUSE TOOL ROOM” with sophisticated Swiss and German machinery to design & produce complex molds and distinction of developing IML decorated packaging for the first time in India.

2/ However, the sustainability of these moats needs closer look. Mold-Tek has a state of the art “IN HOUSE TOOL ROOM” with sophisticated Swiss and German machinery to design & produce complex molds and distinction of developing IML decorated packaging for the first time in India.