When Steve Jobs unveiled the iPhone in Jan 2007, the maker of BlackBerry — Research in Motion (RIM) — had a market cap near Apple's ($60B vs. $75B).

Now, it’s $5B vs. ~$3T.

While Jobs positioned iPhone perfectly, RIM made 5 decisions that led to its fall.

Here's a breakdown🧵

Now, it’s $5B vs. ~$3T.

While Jobs positioned iPhone perfectly, RIM made 5 decisions that led to its fall.

Here's a breakdown🧵

1/ The BlackBerry vs. iPhone story is not as clean as it seems in hindsight. When iPhone officially hit markets in June 2007, many thought it would fail.

Former Microsoft CEO Steve Ballmer famously balked at the price ($500) and design ("no keyboard").

Tech media was skeptical:

Former Microsoft CEO Steve Ballmer famously balked at the price ($500) and design ("no keyboard").

Tech media was skeptical:

2/ Blackberry sales actually grew for many years after iPhone's launch.

In 2007, RIM moved <10m BlackBerry units.

In 2011, RIM moved more than 5x the units, selling 50m+ handsets for the year.

In 2007, RIM moved <10m BlackBerry units.

In 2011, RIM moved more than 5x the units, selling 50m+ handsets for the year.

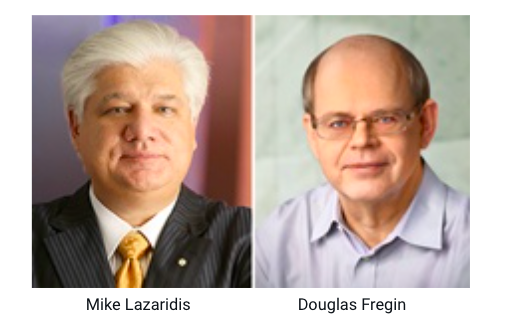

3/ The Research in Motion (RIM) story begins in 1984 in Waterloo, Ontario.

Founded by two engineering students -- Mike Lazaridis and Douglas Fregin -- RIM started as a consultancy.

But after a contract with Canadian telecom firm Rogers, it started making wireless technology.

Founded by two engineering students -- Mike Lazaridis and Douglas Fregin -- RIM started as a consultancy.

But after a contract with Canadian telecom firm Rogers, it started making wireless technology.

4/ RIM launched its first successful device in 1997: Inter@ctive Pager.

The device was a 2-way pager that could send text messages. Priced at $675 with a compact keyboard, corporate exces loved it.

RIM IPO'd in 1998 with sales at $20m+. It raised $100m to expand its device biz.

The device was a 2-way pager that could send text messages. Priced at $675 with a compact keyboard, corporate exces loved it.

RIM IPO'd in 1998 with sales at $20m+. It raised $100m to expand its device biz.

5/ Blackberry made 2 big leaps in the following years:

◻️1999: Inter@ctive Pager 850 supported email from Microsoft exchange server (email on-the-go was a killer app)

◻️ 2000: Blackberry 957 was the first familiar phone form factor (w/ calendar, email, contacts)

◻️1999: Inter@ctive Pager 850 supported email from Microsoft exchange server (email on-the-go was a killer app)

◻️ 2000: Blackberry 957 was the first familiar phone form factor (w/ calendar, email, contacts)

6/ The first voice-enabled BlackBerry smartphone was in 2002 (but -- absurdly -- you had to use earphones to talk).

From there, BlackBerry released new models w/ additional functionality: *actual* voice, track wheel, camera, Bluetooth + more.

RIM crossed $1B sales in FY 2005.

From there, BlackBerry released new models w/ additional functionality: *actual* voice, track wheel, camera, Bluetooth + more.

RIM crossed $1B sales in FY 2005.

7/ By 2008, BlackBerry was ubiquitous. Sales doubled to $6B vs. prior year.

Its addictiveness -- especially Blackberry Messenger (BBM) feature -- earned it the name "Crackberry".

Large corps and govn’t orgs relied on it (incoming President Obama was a huge fan).

What happened?

Its addictiveness -- especially Blackberry Messenger (BBM) feature -- earned it the name "Crackberry".

Large corps and govn’t orgs relied on it (incoming President Obama was a huge fan).

What happened?

8/ Decision #1: Keyboard

Blackberry pioneered mobile typing. The keyboard was its brand and RIM was slow to embrace touchscreen.

Steve Jobs focused his iPhone reveal on Apple’s superior touch experience:

Blackberry pioneered mobile typing. The keyboard was its brand and RIM was slow to embrace touchscreen.

Steve Jobs focused his iPhone reveal on Apple’s superior touch experience:

9/ Decision #2: Software

Blackberry made some very bad decisions with its mobile OS:

◻️It was slow to develop an app store ecosystem (developers flocked to Apple, Android)

◻️It believed — like Adobe — that Flash was the future of mobile (very wrong)

Blackberry made some very bad decisions with its mobile OS:

◻️It was slow to develop an app store ecosystem (developers flocked to Apple, Android)

◻️It believed — like Adobe — that Flash was the future of mobile (very wrong)

10/ Decision #3: Lack of consumer focus

Corporates and governments relied on Blackberry for its security and email.

Serving this market helped build RIM into a $60B+ firm. But by being satisfied with its 10s of millions of Enterprise users, it lost out on billions of consumers.

Corporates and governments relied on Blackberry for its security and email.

Serving this market helped build RIM into a $60B+ firm. But by being satisfied with its 10s of millions of Enterprise users, it lost out on billions of consumers.

11/ Decision #4: BBM

A big consumer fumble was locking the uber-popular Blackberry Messenger (BBM) to RIM hardware.

Younger consumer (eg KimK) were huge BBM boosters. Cross-platform messaging was a huge opportunity (read: FB’s $19B WhatsApp acquisition in 2014) that RIM missed.

A big consumer fumble was locking the uber-popular Blackberry Messenger (BBM) to RIM hardware.

Younger consumer (eg KimK) were huge BBM boosters. Cross-platform messaging was a huge opportunity (read: FB’s $19B WhatsApp acquisition in 2014) that RIM missed.

12/ Decision #5: Carrier

In 2006, neither Android or Apple had a carrier relationship. And when iPhone first launched, it did so exclusive to AT&T.

RIM had an opportunity to win millions of Verizon customers that wanted a touchscreen phone…but totally flopped w/ the Storm.

In 2006, neither Android or Apple had a carrier relationship. And when iPhone first launched, it did so exclusive to AT&T.

RIM had an opportunity to win millions of Verizon customers that wanted a touchscreen phone…but totally flopped w/ the Storm.

13/ While RIM peaked at 50m+ units sold in 2011 ($19B sales), that was the first full year iPhone outsold BlackBerry.

Blackberry share of the exploding smartphones fell from 21% in 2009 to 2% in 2013 (same year RIM renamed to Blackberry).

It stopped making phones in 2016.

Blackberry share of the exploding smartphones fell from 21% in 2009 to 2% in 2013 (same year RIM renamed to Blackberry).

It stopped making phones in 2016.

14/ Blackberry is now a $5B firm that mainly sells cybersecurity software.

On Jan 4, it shuts down text, call and data for legacy phones.

Blackberry’s success — combined w/ complacency — locked it into a losing hand. Its sales chart captures the post-iPhone story arc perfectly:

On Jan 4, it shuts down text, call and data for legacy phones.

Blackberry’s success — combined w/ complacency — locked it into a losing hand. Its sales chart captures the post-iPhone story arc perfectly:

15/ If you enjoyed that, I write interesting threads 1-2x a week.

Def follow @TrungTPhan to catch them in your feed.

Here's one you might like:

Def follow @TrungTPhan to catch them in your feed.

Here's one you might like:

https://twitter.com/trungtphan/status/1453396116012089347?s=21

16/ PS. I also write a weekly newsletter that rounds up hilarious memes and tweets on trending tech, business and internet topics

trungphan.substack.com

trungphan.substack.com

17/ Sources

Company Man:

MakeUseOf: makeuseof.com/the-reasons-bl…

Pocket Lint: pocket-lint.com/phones/news/13…

Investopedia: investopedia.com/articles/inves…

The Verge: theverge.com/platform/amp/2…

Company Man:

MakeUseOf: makeuseof.com/the-reasons-bl…

Pocket Lint: pocket-lint.com/phones/news/13…

Investopedia: investopedia.com/articles/inves…

The Verge: theverge.com/platform/amp/2…

18/ Here's another slide from Steve Jobs iPhone reveal in Jan 2007. It shows a 2x2 matrix with these axes:

◻️”smart” / “not so smart”

◻️ “hard to use” / “easy to use”

Apple has since sold more than $1 trillion worth of iPhones.

LESSON: Always be in the top right quadrant.

◻️”smart” / “not so smart”

◻️ “hard to use” / “easy to use”

Apple has since sold more than $1 trillion worth of iPhones.

LESSON: Always be in the top right quadrant.

19/ Here is a great insight on BlackBerry vs. Apple missing from the thread.

via: libertyrpf.com/p/223-blackber…

via: libertyrpf.com/p/223-blackber…

20/ The good people at BBC asked your boy to hop on to discuss BlackBerry vs. Apple

• • •

Missing some Tweet in this thread? You can try to

force a refresh