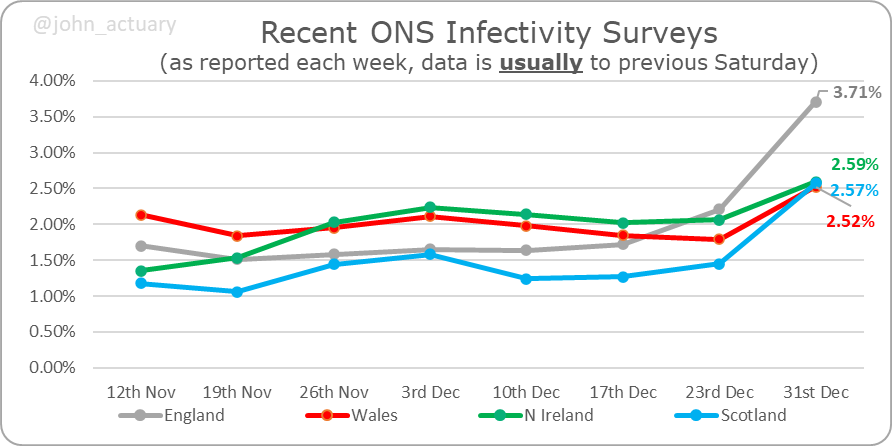

ONS has released its infection survey results early this week, and they show a big, y-axis changing, jump for the week ending 31st Dec.

E ⏫from 3.7% to 6.0%

W⏫from 2.5% to 5.2%

NI⏫from 2.6% to 4.0%

S⏫from 2.6% to 4.5%

In E, 3.3m are estimated to have been infected.

1/

E ⏫from 3.7% to 6.0%

W⏫from 2.5% to 5.2%

NI⏫from 2.6% to 4.0%

S⏫from 2.6% to 4.5%

In E, 3.3m are estimated to have been infected.

1/

In London the modelling estimates that prevalence peaked on Xmas Day and is now falling back, albeit more slowly than it rose. That's good news, but...

...we also need to look at the age profile of London though.

2/

...we also need to look at the age profile of London though.

2/

Here we see a slightly less optimistic picture, with infections at older ages continuing to rise towards the year end, although even the oldest ages appear to peak by the 31st, so hopefully it's downhill across all ages in the new year.

3/

3/

By region we can see that London was still the highest last week, but the NW was not far behind. It's likely that has reversed by now though.

4/

4/

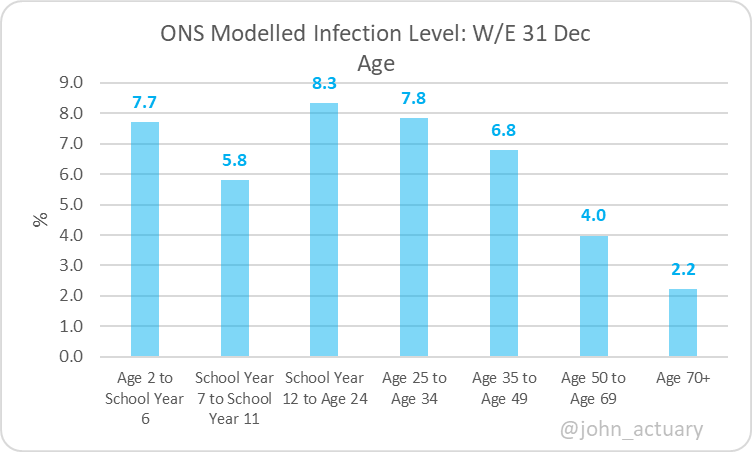

By age it's noticeable that Yr 7-11 has a lower prevalence than the bands either side. Other than that, it's a familiar picture, with prevalence falling as age increases.

5/

5/

We see here how Omicron has usurped Delta rapidly in the space of around 3 weeks, amounting to close to 90% of the cases in England.

6/

6/

Although these data are to the 31st, the single figures quoted are the average for the week (28th), and so if rates are continuing to increase then they are likely to underestimate the position by the 31st (the converse is true during a falling period).

7/

7/

A reminder that these are randomly sampled PCR tested data, and issues around testing availability, delays in obtaining results etc will not influence the results.

Report here:

8/8

ons.gov.uk/peoplepopulati…

Report here:

8/8

ons.gov.uk/peoplepopulati…

• • •

Missing some Tweet in this thread? You can try to

force a refresh