Making your Trading System.

A Thread.

Most fail because they don't have a trading system OR

Because they fail to make a system.

Here is how to make a system.

A Thread.

Most fail because they don't have a trading system OR

Because they fail to make a system.

Here is how to make a system.

Prelude-

Not going to lecture you with non-sense like:

"You must meditate. You must have good trading psychology. Must have patience. It's about mindset."

Above phrases are often a bait by course sellers to attract unsuspecting noobs.

Trading system has nothing to do with it

Not going to lecture you with non-sense like:

"You must meditate. You must have good trading psychology. Must have patience. It's about mindset."

Above phrases are often a bait by course sellers to attract unsuspecting noobs.

Trading system has nothing to do with it

1. What is a system?

All of the profitable traders use an entry trigger and there's almost zero analysis.

The process of making a trading system is difficult but once formed, it makes entries and exits an ON/OFF phenomena.

An established system leaves no room for analysis.

All of the profitable traders use an entry trigger and there's almost zero analysis.

The process of making a trading system is difficult but once formed, it makes entries and exits an ON/OFF phenomena.

An established system leaves no room for analysis.

Example.

You cook pasta and your sauce is salty, you add water.

Sauce is less salty, you add salt.

It's an established system. You are not going to research it all the time. Simple triggers for action.

So system = This will be done if this happened, all pre-determined.

You cook pasta and your sauce is salty, you add water.

Sauce is less salty, you add salt.

It's an established system. You are not going to research it all the time. Simple triggers for action.

So system = This will be done if this happened, all pre-determined.

2. Finding a system.

There's a billion strategies available online and non would work for as it is.

i. If the strategy is already public, the edge will deplete over-time.

ii. Pattern strategies gets picked up by MMs and get used as liquidity pools. E.g. t.me/EmperorbtcTA/5…

There's a billion strategies available online and non would work for as it is.

i. If the strategy is already public, the edge will deplete over-time.

ii. Pattern strategies gets picked up by MMs and get used as liquidity pools. E.g. t.me/EmperorbtcTA/5…

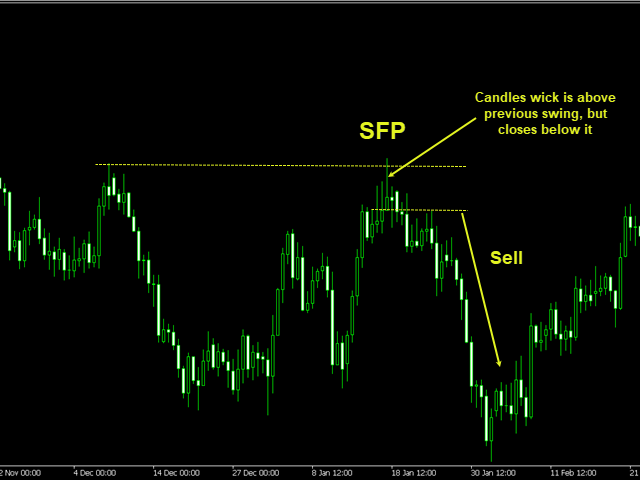

Example- Lets say you learn about Swing Failure Pattern and use to trade with it.

It's a good pattern but will you succeed? No.

The filters you add to your basic technique is the system.

So rather than Trading SFP, you should be trading SFP if X and Y and Z happen.

It's a good pattern but will you succeed? No.

The filters you add to your basic technique is the system.

So rather than Trading SFP, you should be trading SFP if X and Y and Z happen.

So to explain further,

A strategy could be:-

I will trade a SFP only if confirmed by the ATR, RSI Divergence is directional and FIBS show a S/R.

The above filters can ONLY be added with live screen-time, back-testing and LOTS of real trading.

A strategy could be:-

I will trade a SFP only if confirmed by the ATR, RSI Divergence is directional and FIBS show a S/R.

The above filters can ONLY be added with live screen-time, back-testing and LOTS of real trading.

Many People use simple EMA/SMA Cross overs to enter.

We know such a strategies will just be used as liquidity events unless accompanied by other occurrences, Example- S/R Flip, accumulation etc.

Here is an EMA strategy for HTF

t.me/EmperorbtcTA/4…

We know such a strategies will just be used as liquidity events unless accompanied by other occurrences, Example- S/R Flip, accumulation etc.

Here is an EMA strategy for HTF

t.me/EmperorbtcTA/4…

3. Constituents.

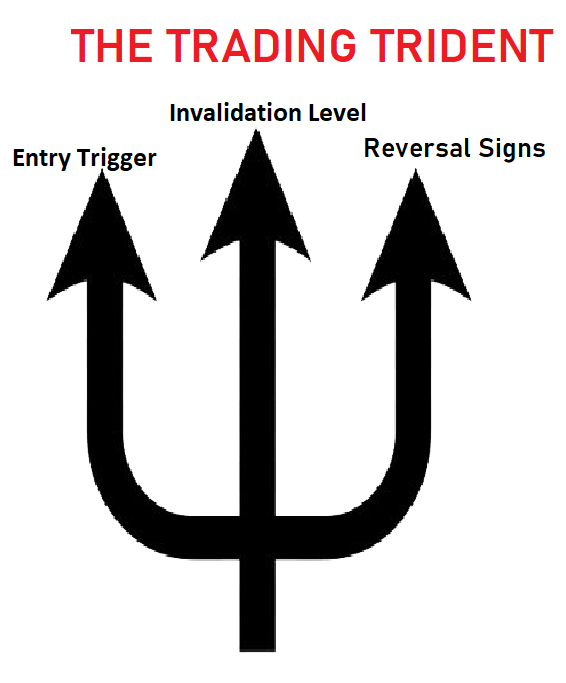

A system should clearly define the trading Trident.

A Phenomena which initiates the entry.

The levels at which the trade gets invalidated.

The Sings of price reversal

(To be used for taking profits TP)

A system should clearly define the trading Trident.

A Phenomena which initiates the entry.

The levels at which the trade gets invalidated.

The Sings of price reversal

(To be used for taking profits TP)

4. Rekt-Proof

Following the common sense principle and also the most important one, risk management.

People lose because

-Bet too much in one trade.

-Have too small capital and want a lot of profit soon.

-Think they need to make it in one trade.

Link- t.me/EmperorbtcTA/3…

Following the common sense principle and also the most important one, risk management.

People lose because

-Bet too much in one trade.

-Have too small capital and want a lot of profit soon.

-Think they need to make it in one trade.

Link- t.me/EmperorbtcTA/3…

Conclusion.

1. Planning and research is to be done to MAKE the system, to make the recipe. Once the recipe is made, it's mechanical. If you don't yet have such a recipe, make one slowly.

2. Add filters through screen time to common-sense approaches. THIS IS YOUR SYSTEM.

1. Planning and research is to be done to MAKE the system, to make the recipe. Once the recipe is made, it's mechanical. If you don't yet have such a recipe, make one slowly.

2. Add filters through screen time to common-sense approaches. THIS IS YOUR SYSTEM.

3. Your strategy should automatically give you the constituents of the trading trident. It should be all mechanical, don't research AFTER entering.

4. Risk Management will make you survive, survival will make you island buying money. 99% fail here.

4. Risk Management will make you survive, survival will make you island buying money. 99% fail here.

We'll discuss the strategies that work in crypto for Holding and Day trading next.

Share if you liked it.

I am working with Delta to make the best Trading tutorials cost-free for all traders.

You can support for Free by Trading at

👉delta.exchange/EmperorBTC

Share if you liked it.

I am working with Delta to make the best Trading tutorials cost-free for all traders.

You can support for Free by Trading at

👉delta.exchange/EmperorBTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh