How did a secretive German family (with a complicated Nazi past) build a global coffee and food empire?

Actually, it was three creative managers who turned the family business into a unique hybrid investment firm.

Today, JAB controls 50+ billion in assets and many iconic brands

Actually, it was three creative managers who turned the family business into a unique hybrid investment firm.

Today, JAB controls 50+ billion in assets and many iconic brands

JAB is a combination of family holding and private equity firm with investments across coffee (Keurig, Peet's, Caribous), food (Krispy Kreme), restaurants (Panera Bread, Pret), beverages (Dr. Pepper Snapple), and perfumes (Coty).

It all started in 1823 in Southern Germany...

It all started in 1823 in Southern Germany...

JAB = Johann Adam Beckinser who acquired a chemical lab in Pforzheim. He hired a young chemist named Karl Ludwig Reimann (first to extract nicotine from tobacco) who took over the firm after B's death. It became a top producer of citric acids, the sour ingredient for soda & candy

The 1930s and 40s are the family's darkest chapter: Albert Reimann Sr. and his son Albert Reimann Jr. were enthusiastic supporters of the Nazi regime and employed forced laborers who were subjected to abuse at their company and home.

In 1937, Reimann Jr. wrote to Heinrich Himmler: “We are a purely Aryan family business that is over 100 years old. The owners are unconditional followers of the race theory.”

In a wild twist Reimann Jr. had an affair with Emilie

Landecker, a young employee at his company.

Landecker's father Alfred was Jewish, her mother Catholic. Seeing the storm, Landecker made sure his children were baptized.

He was deported and murdered in 1942.

Landecker, a young employee at his company.

Landecker's father Alfred was Jewish, her mother Catholic. Seeing the storm, Landecker made sure his children were baptized.

He was deported and murdered in 1942.

This remained a secret for years but Reimann, who had no children with his wife, eventually "adopted" the 3 children he had with Landecker.

He adopted 9 children - each inherited 11.1% of the firm and was forbidden from selling to anyone outside the family.

He adopted 9 children - each inherited 11.1% of the firm and was forbidden from selling to anyone outside the family.

But the company lacked scale and some of the heirs wanted out.

A Harvard MBA named Peter Harf was tasked with the rescue.

"We had a lot of marginal pieces in our portfolio. I'm not afraid of taking risks. I'm not afraid of losing. I'm not afraid of buying something."

A Harvard MBA named Peter Harf was tasked with the rescue.

"We had a lot of marginal pieces in our portfolio. I'm not afraid of taking risks. I'm not afraid of losing. I'm not afraid of buying something."

Harf acquired some 25 companies (Coty from Pfizer) and moved into consumer goods. In 1997, he took the core business public, then merged it into Reckitt-Beckinser.

In 2002, he joined the board of Interbrew (later became chairman) and watched the beer industry consolidate.

In 2002, he joined the board of Interbrew (later became chairman) and watched the beer industry consolidate.

Harf wanted to use JAB as a platform to enter other industries. In 2010, he brought on Reckitt-B's Dutch CEO Bart Becht and the French Olivier Goudet from Mars.

The three would own 10% of JAB, the family the rest. Their interests were fully aligned.

The three would own 10% of JAB, the family the rest. Their interests were fully aligned.

He wanted secular growth, strong brands, industries ripe for consolidation in which acquirers "win almost automatically."

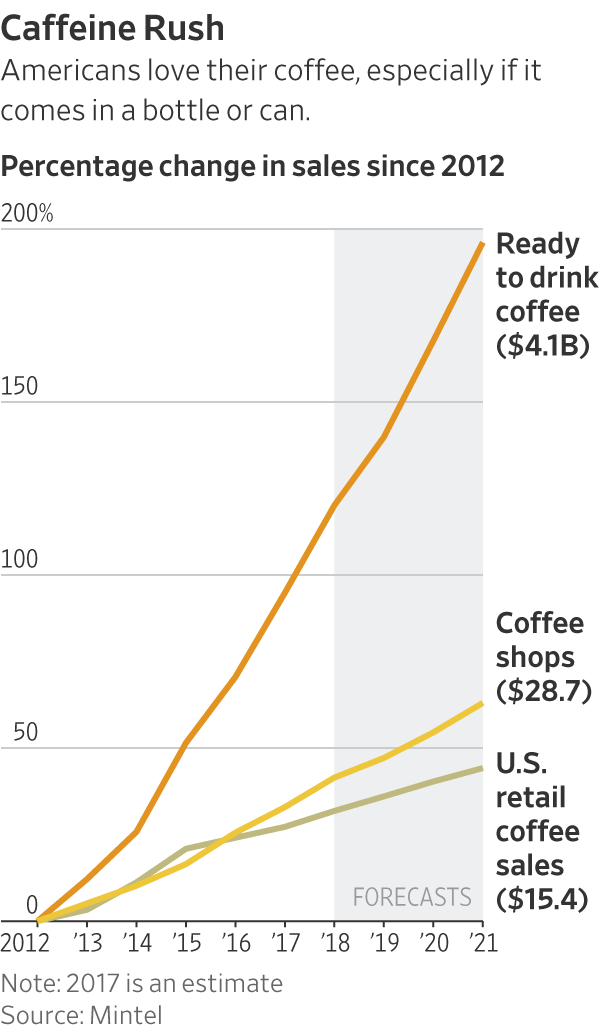

He started with coffee which, unlike beer and chocolate, hadn't consolidated.

"Coffee only had Nestlé, the industry was fragmented."

He started with coffee which, unlike beer and chocolate, hadn't consolidated.

"Coffee only had Nestlé, the industry was fragmented."

Millennials provided secular growth, "the best coffee drinkers ever."

JAB bought companies up and down the value chain: “The consumer wants choice, both in terms of beverage and location. We’re simply going to where the consumer is or wants to be.”

JAB bought companies up and down the value chain: “The consumer wants choice, both in terms of beverage and location. We’re simply going to where the consumer is or wants to be.”

Their playbook focused on generating cash and an ownership mindset. Once taken private: "focus less on quarterly earnings, more on generating cash.. reduce inventory, extend payment periods to suppliers.. give customers discounts for paying early"

Resilient cash flows allowed JAB to use leverage and take advantage of favorable credit markets.

And growing market share allowed them to extend payment terms to up to 300 days, three times as long as Nestle typically demands

And growing market share allowed them to extend payment terms to up to 300 days, three times as long as Nestle typically demands

Today, many of their acquisitions are public again:

-Keurig was merged with Dr. Pepper Snapple - $KDP

-Krispy Kreme - $DNUT

-Peet's merged with D.E Master Blenders and Mondelez's coffee business - now JDE (Jacobs Douwe Egberts)

-Panera is going public via SPAC

-Keurig was merged with Dr. Pepper Snapple - $KDP

-Krispy Kreme - $DNUT

-Peet's merged with D.E Master Blenders and Mondelez's coffee business - now JDE (Jacobs Douwe Egberts)

-Panera is going public via SPAC

"We're not really looking to sell out of businesses. Our time horizon can be anywhere from 10 years to—there is no maximum."

"We're active investors ... with a long-term view and close personal contact with management that views itself as owners"

"We're active investors ... with a long-term view and close personal contact with management that views itself as owners"

Four Reimann family members own most of JAB: Renate, Wolfang, Stefan, and Matthias.

There are no pictures, no interviews.

Reportedly Harf makes any family members who want to know about the business swear an oath of secrecy on their 18th birthday!

There are no pictures, no interviews.

Reportedly Harf makes any family members who want to know about the business swear an oath of secrecy on their 18th birthday!

And JAB has become a unique investment firm with partners and offices around the world.

It's private equity fund includes investors like Stanford, Singapore's GIC, and European family offices.

It's private equity fund includes investors like Stanford, Singapore's GIC, and European family offices.

When Harf's wife died of leukemia she told him: "Put your business smarts to work. There is more to life than making money."

Harf launched DKMS, a bone marrow donor bank. He calls it "a high-performance, nonprofit company driven by an impossible dream and a strong culture."

Harf launched DKMS, a bone marrow donor bank. He calls it "a high-performance, nonprofit company driven by an impossible dream and a strong culture."

Sources:

jabholco.com

wsj.com/articles/the-s…

bloomberg.com/news/articles/…

handelsblatt.com/unternehmen/ha…

alumni.hbs.edu/stories/Pages/…

wiwo.de/unternehmen/ha…

nytimes.com/2019/06/14/bus…

jabholco.com

wsj.com/articles/the-s…

bloomberg.com/news/articles/…

handelsblatt.com/unternehmen/ha…

alumni.hbs.edu/stories/Pages/…

wiwo.de/unternehmen/ha…

nytimes.com/2019/06/14/bus…

• • •

Missing some Tweet in this thread? You can try to

force a refresh