A Picture can speak a thousand words if you are willing to observe.

#Brightcomgroup

Keeping it Simple.

Imagining the Possible.

Applying Patience

#Brightcomgroup

Keeping it Simple.

Imagining the Possible.

Applying Patience

With METAVERSE a completely new Segment for AdTech is emerging and this will create a parallel virtual market.

I had made a note a month ago which is still valid and I am sharing below.

Globally Ad-Tech business is expected to grow at above 30% CAGR for next 5 years. The overall PE itself is growing

Globally Ad-Tech business is expected to grow at above 30% CAGR for next 5 years. The overall PE itself is growing

In the meantime, after inclusion in MSCI, around 12 renowned FPI have entered and 3-4 very large fund houses have also entered.

Within another 2-3 months especially with Q3 results a month away. BCG fundamentally has a lag in valuation and based on yearly guidance a level of EPS range og 8.3 to 9.2 the gap in valuation is obvious.

PE is something you decide

PE is something you decide

1) EPS guidance for year in range of 8.36 to 9.24.

Apply your own PE to say a yearly EPS on lower side 8.

Can the market give it a PE of 35 or may be 50/60 who knows.

Apply your own PE to say a yearly EPS on lower side 8.

Can the market give it a PE of 35 or may be 50/60 who knows.

2) They have also now given guidance on Free Cash Flow of minimum 500 crores up to June 2022 and minimum of 250 crores for current FY

3) They delivered above Q2 guidance and Q3-Oct- December is their biggest quarter as Ad revenue maximum in US and Europe

They have maintained guidance for Q3 in conference call hence TTM EPS will jump.

They have maintained guidance for Q3 in conference call hence TTM EPS will jump.

4) Along with Free Cash Flow now there is RoE which is currently at 16 and is expected to go to 25 in this FY.

5) From pure fundamentals of business and financial ratios plus with massive growth in revenues and profits the stock is currently grossly undervalued as compared to peer cos in India and US.

6) Company is also debt free.

7) Now with the above what happens when it's added to MSCI, Foreign portfolio investors find it lucrative and start coming on board.

8) A few good FPI names and then the domestic institutions and MF get interested.

9) In the meanwhile we do an acquisition and resolve pending litigation with Daum

10) We check ✔️ all boxes for a Blue Chip company and Voila the sky opens up as the market starts noticing.

Point 9. Addressed in release to exchanges regarding acquisition of an Audio focussed AdTech platform company.

Spotify, Podcasts, Music streaming are getting more and more Ear Drums.

Newer and very large market that has emerged and growing rapidly.

Growth is here and now.

Spotify, Podcasts, Music streaming are getting more and more Ear Drums.

Newer and very large market that has emerged and growing rapidly.

Growth is here and now.

First MSCI...then BSE S&P500 getting added from Friday.

Indices are getting it slowly ....Blue Screen Analysts have not even begun.

Imagining possibilities...... Nifty Digital/IT...Nifty 100. What say?

Indices are getting it slowly ....Blue Screen Analysts have not even begun.

Imagining possibilities...... Nifty Digital/IT...Nifty 100. What say?

Recently 100% acquisition of Media Mint was announced.

It provides services to some of the top Global Brands.

AdTech Platform business when combined with providing AdResponse Analytics can further propel the entire offering into a premium space....Extremely exciting move.

It provides services to some of the top Global Brands.

AdTech Platform business when combined with providing AdResponse Analytics can further propel the entire offering into a premium space....Extremely exciting move.

Outsourced ad ops partners should have experience with your channels, tools, and platforms. MediaMint teams are platform-agnostic; we understand your expectations, adapt your existing tools and processes, and work to become fully integrated with your team. ow.ly/Zi5z50GCE4K

Core AdTech Platform + AI/ML Analytics based services + Audio segment + METAVERSE ....

Hmmm....now the parts seem to be connecting together like the Transformers....

Hmmm....now the parts seem to be connecting together like the Transformers....

#BrightcomGroup #mediamint

will provide BCG a robust services capability that will Pivot the Platform business to offer a 360 range of offers.

Will make it easier to LAND - ADOPT-EXPAND-RENEW.

will provide BCG a robust services capability that will Pivot the Platform business to offer a 360 range of offers.

Will make it easier to LAND - ADOPT-EXPAND-RENEW.

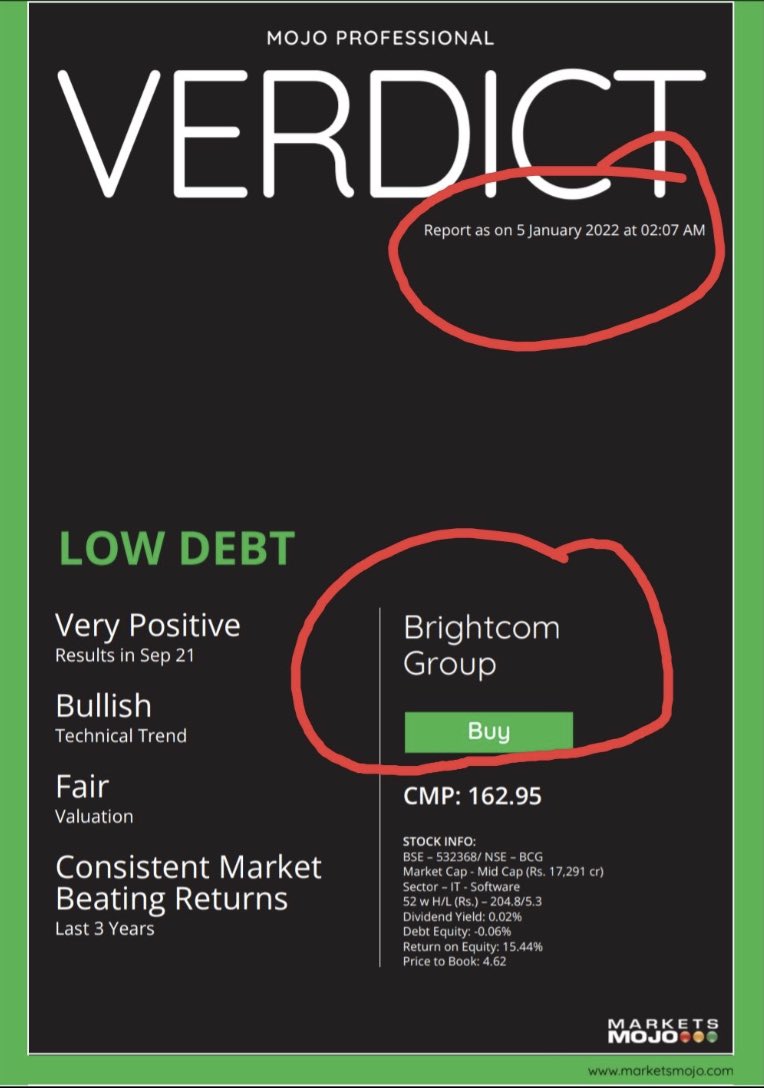

Based on the factors mentioned plus other financial ratios ....and their own Algorithm of finding value.

Below is what @Marketsmojo feels...

Below is what @Marketsmojo feels...

The Offerings of Brightcom are geared towards the emerging Business opportunities and combined with acquisitions of Audio AdTech and Analytics services will stand apart.

• • •

Missing some Tweet in this thread? You can try to

force a refresh