Not surprising that Ethereum leads total Web3 developers by a long shot with ~4,000 developers.

Somewhat surprising to see Polkadot ranking second with ~1,400.

Source: @ElectricCapital Web3 Developer Report

Somewhat surprising to see Polkadot ranking second with ~1,400.

Source: @ElectricCapital Web3 Developer Report

2/ Looking at monthly active developers since launch, Etheruem again leads the pack.

But the Polkadot ecosystem is clearly showing impressive developer traction.

There is also a noticeable spike in monthly active developers working on Cosmos in 2021 versus prior years.

But the Polkadot ecosystem is clearly showing impressive developer traction.

There is also a noticeable spike in monthly active developers working on Cosmos in 2021 versus prior years.

3/ Full-time developers on Near skyrocketed in 2021, surpassing Cardano and Tezos.

Avalanche and Terra appear to be following a similar trajectory.

Avalanche and Terra appear to be following a similar trajectory.

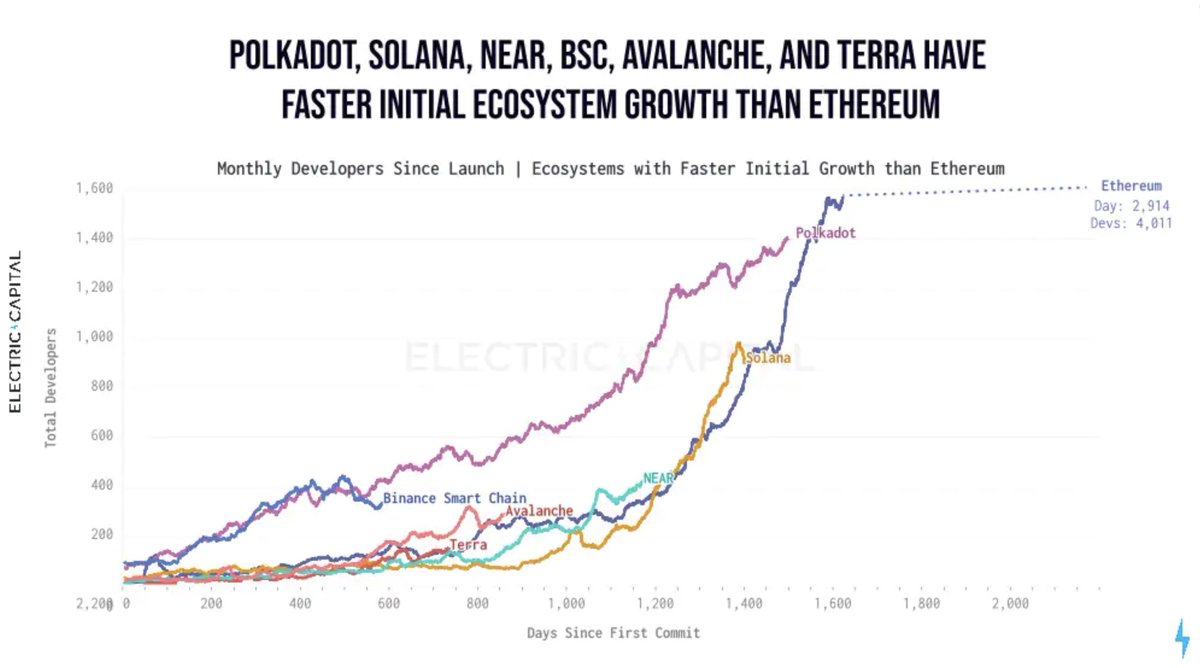

4/ The @ElectricCapital team found that Polkadot, Solana, Near, Binance Smart Chain, Avalanche, and Terra have faster initial ecosystem growth than Etheruem.

Not surprising given the explosion in Web3 adoption over the past year.

Note that some of these are EVM-compatible.

Not surprising given the explosion in Web3 adoption over the past year.

Note that some of these are EVM-compatible.

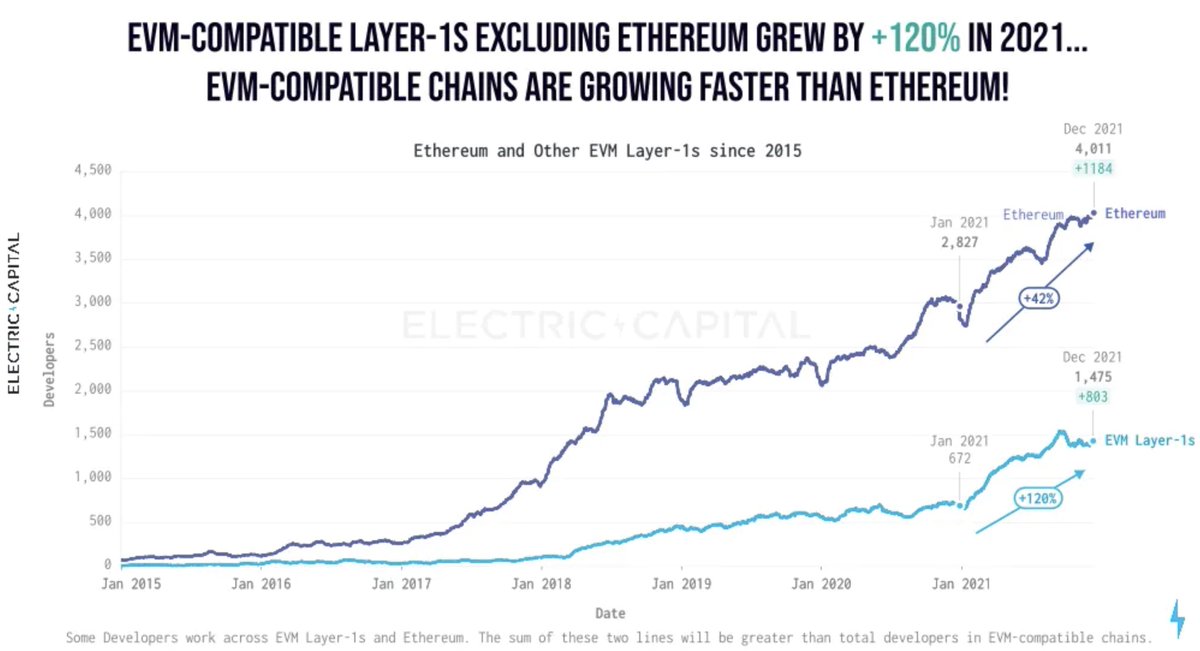

5/ Why does being EVM-compatible matter?

The EVM-compatible layer 1s are growing faster than Etheruem.

Network effects in action.

The EVM-compatible layer 1s are growing faster than Etheruem.

Network effects in action.

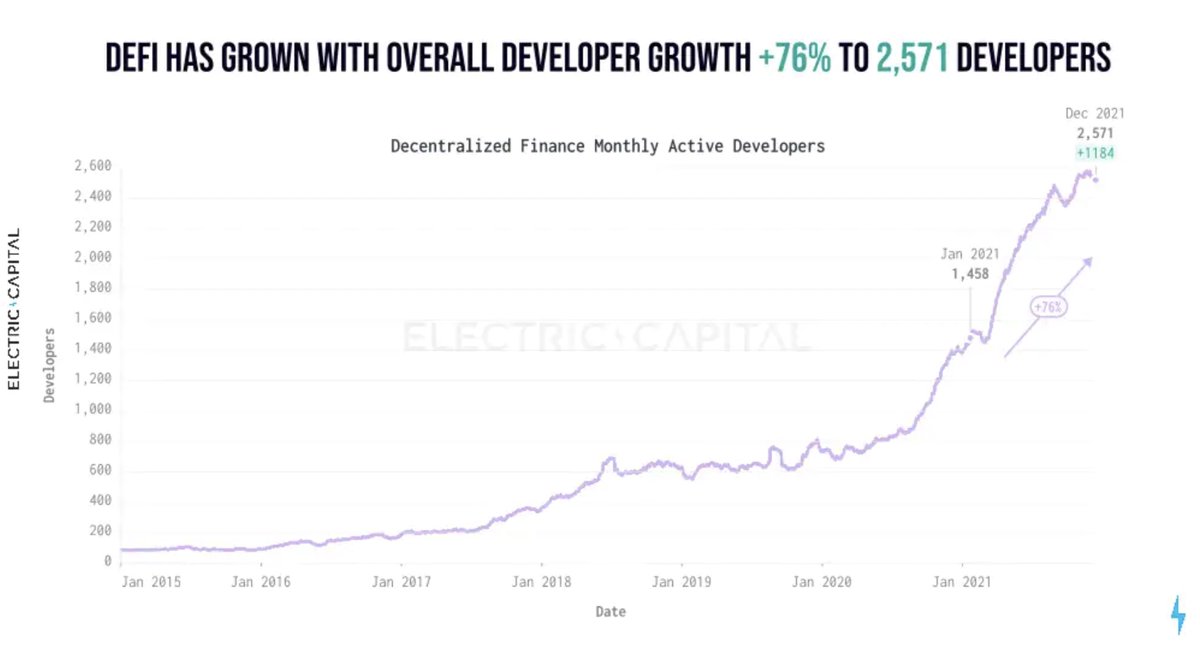

6/ DeFi developers nearly doubled in 2021, growing to ~2,600 from 1,500.

Roughly ~1,000 of those are full-time developers.

Remarkable given the current $260 billion of TVL in DeFi (Source: @DefiLlama)

Roughly ~1,000 of those are full-time developers.

Remarkable given the current $260 billion of TVL in DeFi (Source: @DefiLlama)

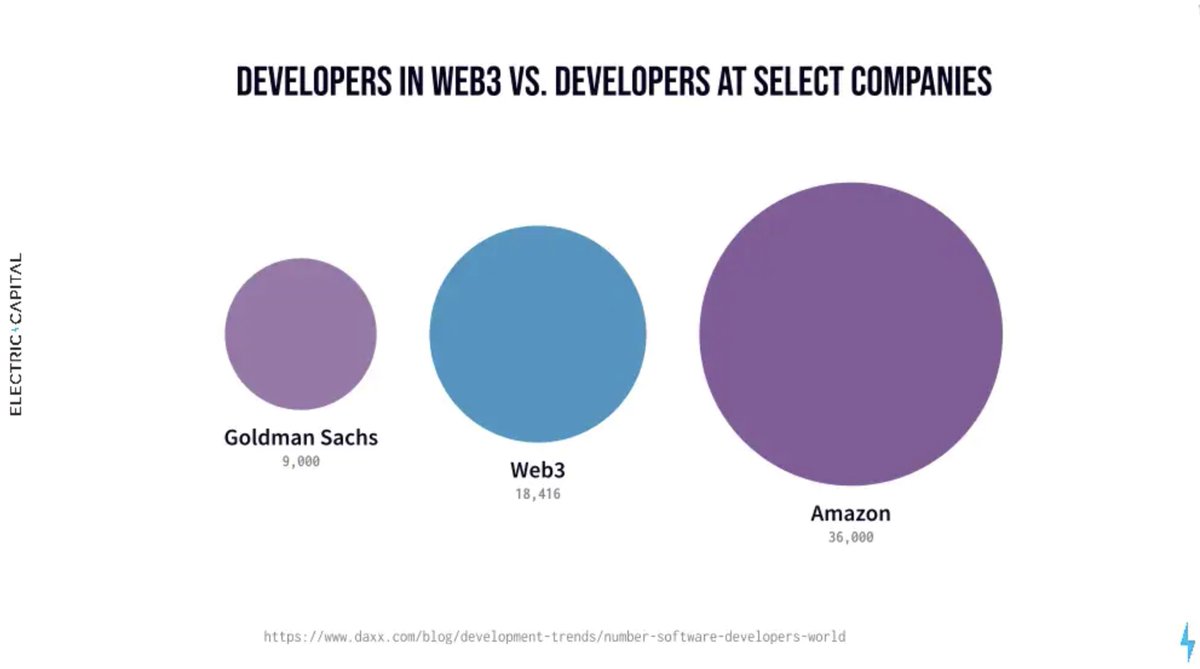

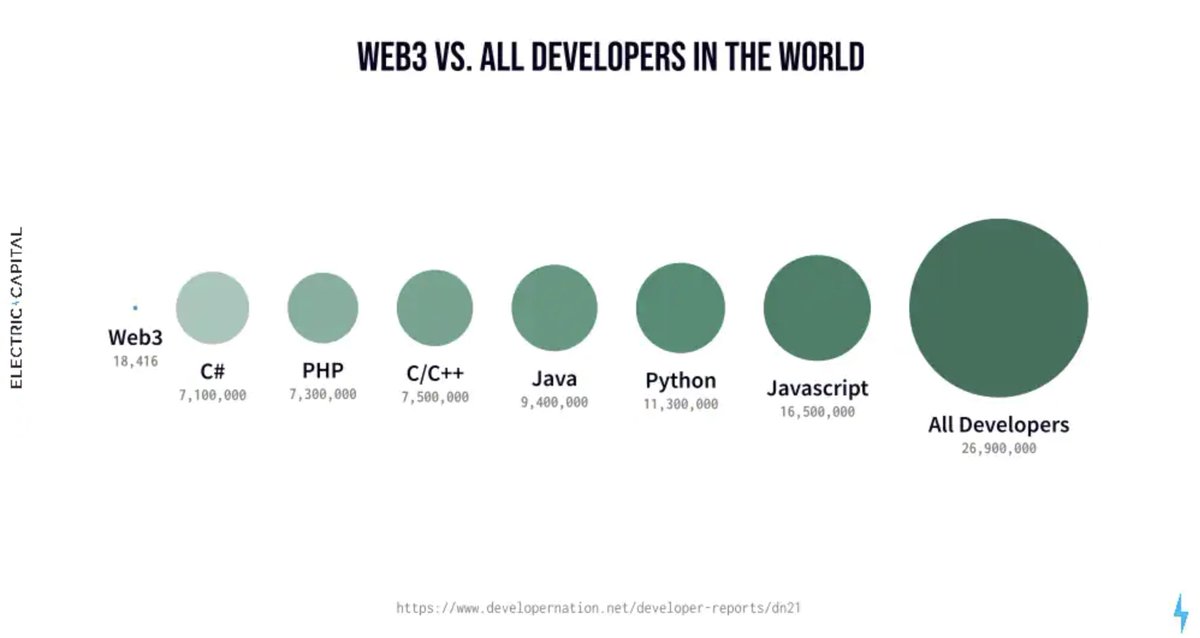

7/ Overall, 2021 was an incredible year for Web3.

In total, the industry now has more than 18,000 active developers building the future of the internet.

Still, that’s only 50% of the developers employed by Amazon and a small fraction of the 26.9 million developers worldwide.

In total, the industry now has more than 18,000 active developers building the future of the internet.

Still, that’s only 50% of the developers employed by Amazon and a small fraction of the 26.9 million developers worldwide.

8/ Massive kudos to the team at @ElectricCapital for publishing the 2021 Annual Web3 Developer Report.

📑👇 Check out the link below for the full report and a great breakdown by Electric Capital’s @MariaShen.

medium.com/electric-capit…

📑👇 Check out the link below for the full report and a great breakdown by Electric Capital’s @MariaShen.

medium.com/electric-capit…

• • •

Missing some Tweet in this thread? You can try to

force a refresh