How to get URL link on X (Twitter) App

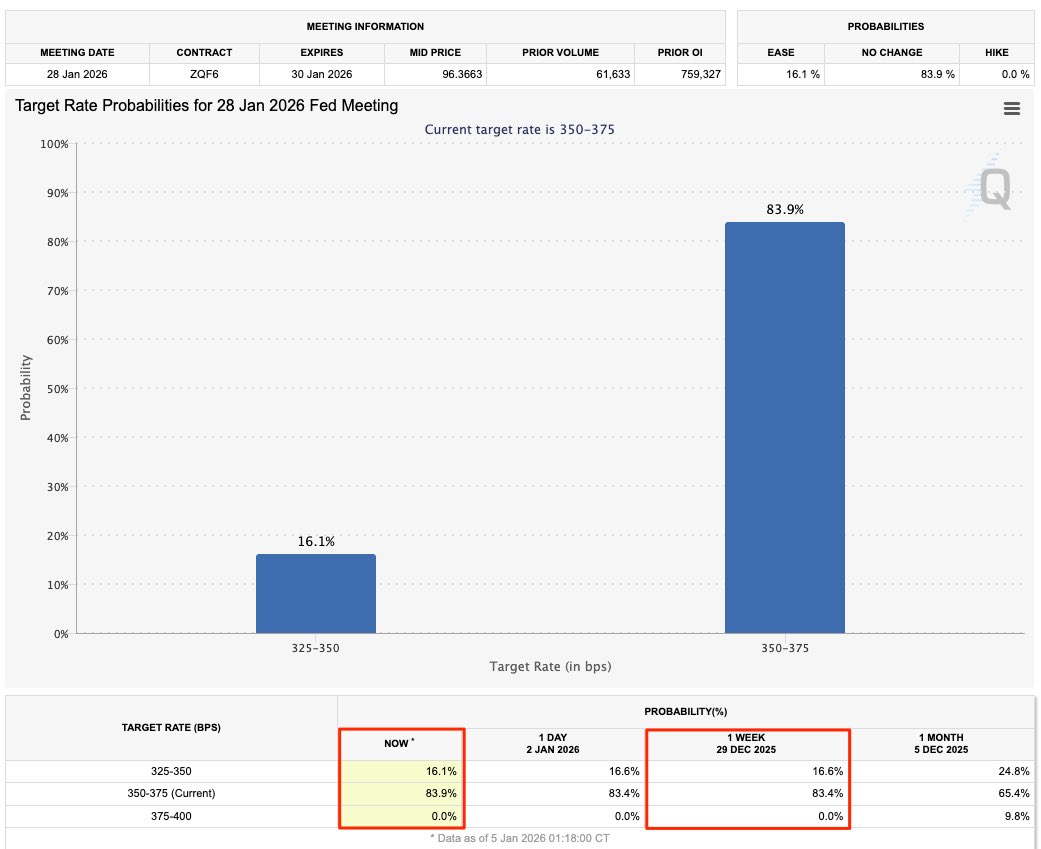

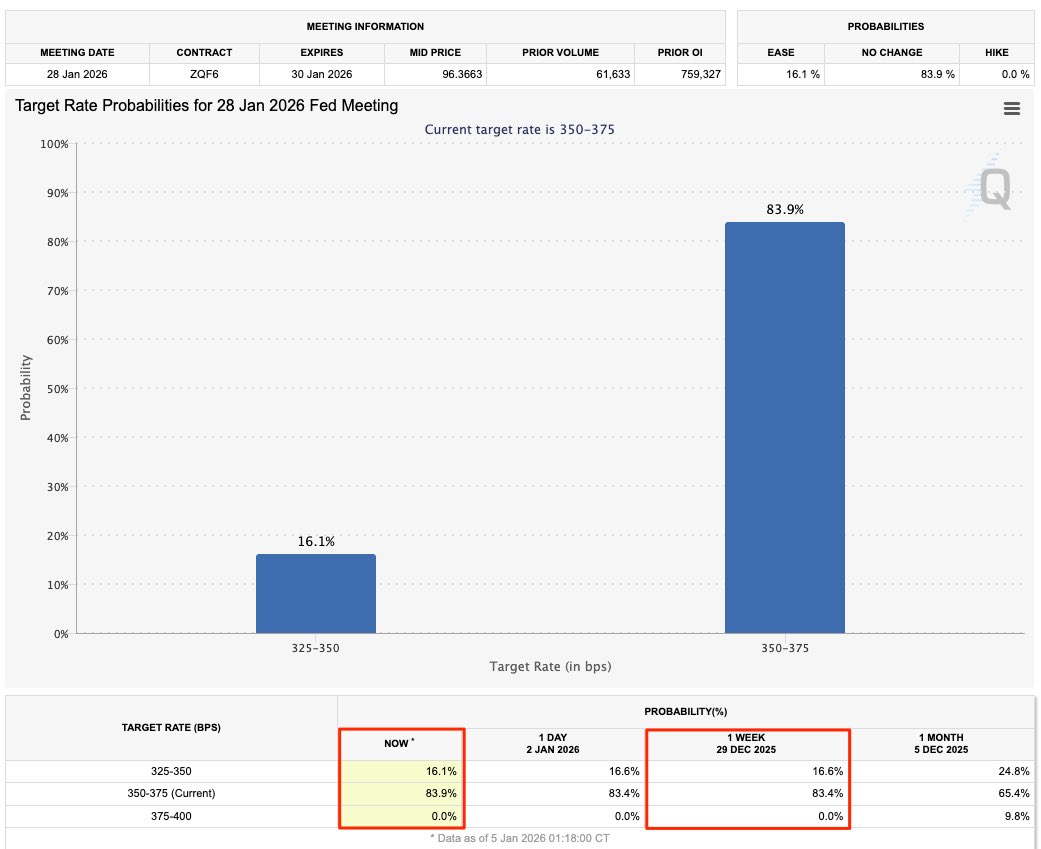

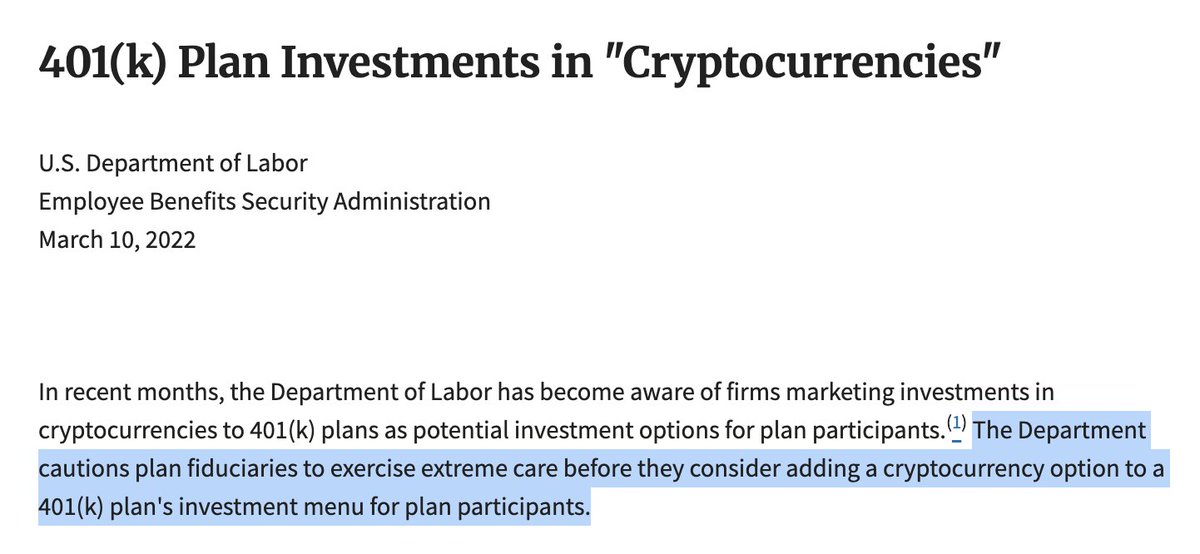

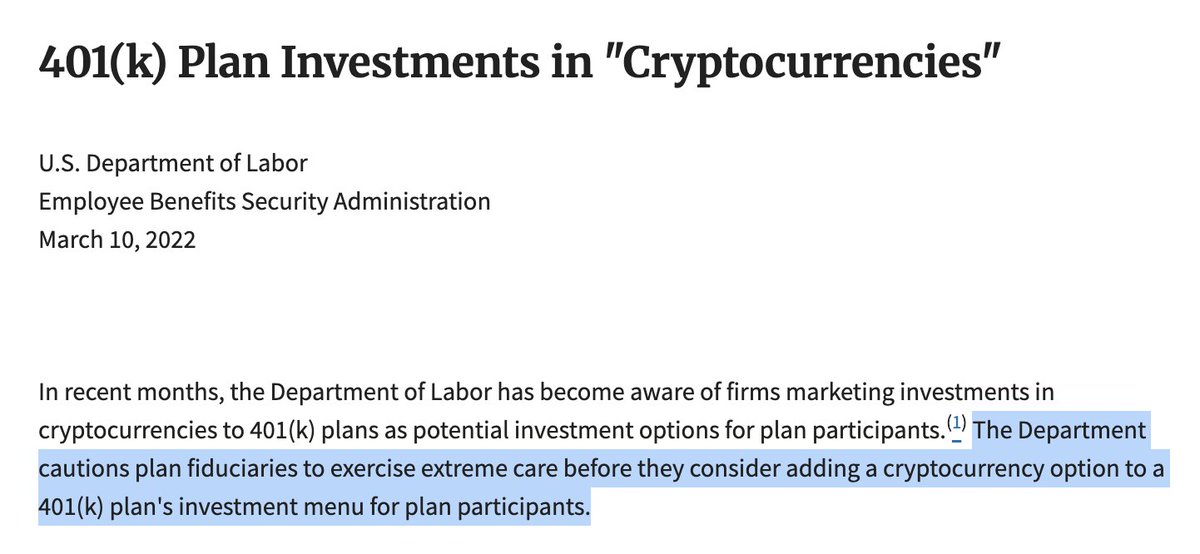

https://twitter.com/RasterlyRock/status/19534775965761498352/ In 2022, the U.S. Department of Labor issued an unprecedented warning to retirement plan providers:

50% of NFT trading volume on Uniswap has gone through OpenSea:

50% of NFT trading volume on Uniswap has gone through OpenSea:

2/25

2/25https://twitter.com/koeppelmann/status/15704368824835235852/9 First, it makes sense that the largest staking service providers have the advantage early on, particularly in the hours & days following Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS)...

https://twitter.com/chainlinkgod/status/15563531638206423042/ Smart contracts & crypto applications need real-world data to function.

https://twitter.com/rasterlyrock/status/1461406902466883593

https://twitter.com/makerdao/status/15439988017860689922/ The proposal?

(2/4) Even more impressive, the number of web3 developers grew by 77% in 2021.

(2/4) Even more impressive, the number of web3 developers grew by 77% in 2021.

Floor Market Cap = Floor Price X Total Collection Supply

Floor Market Cap = Floor Price X Total Collection Supply

https://twitter.com/Blockworks_/status/1489014905697153024About an hour ago, the Wormhole team indicated "ETH will be added over the next hours to ensure wETH is backed 1:1. More details to come shortly."

https://twitter.com/wormholecrypto/status/1489001949881978883?s=20&t=QJAT-98B7ZFu7a2kWE3Glg