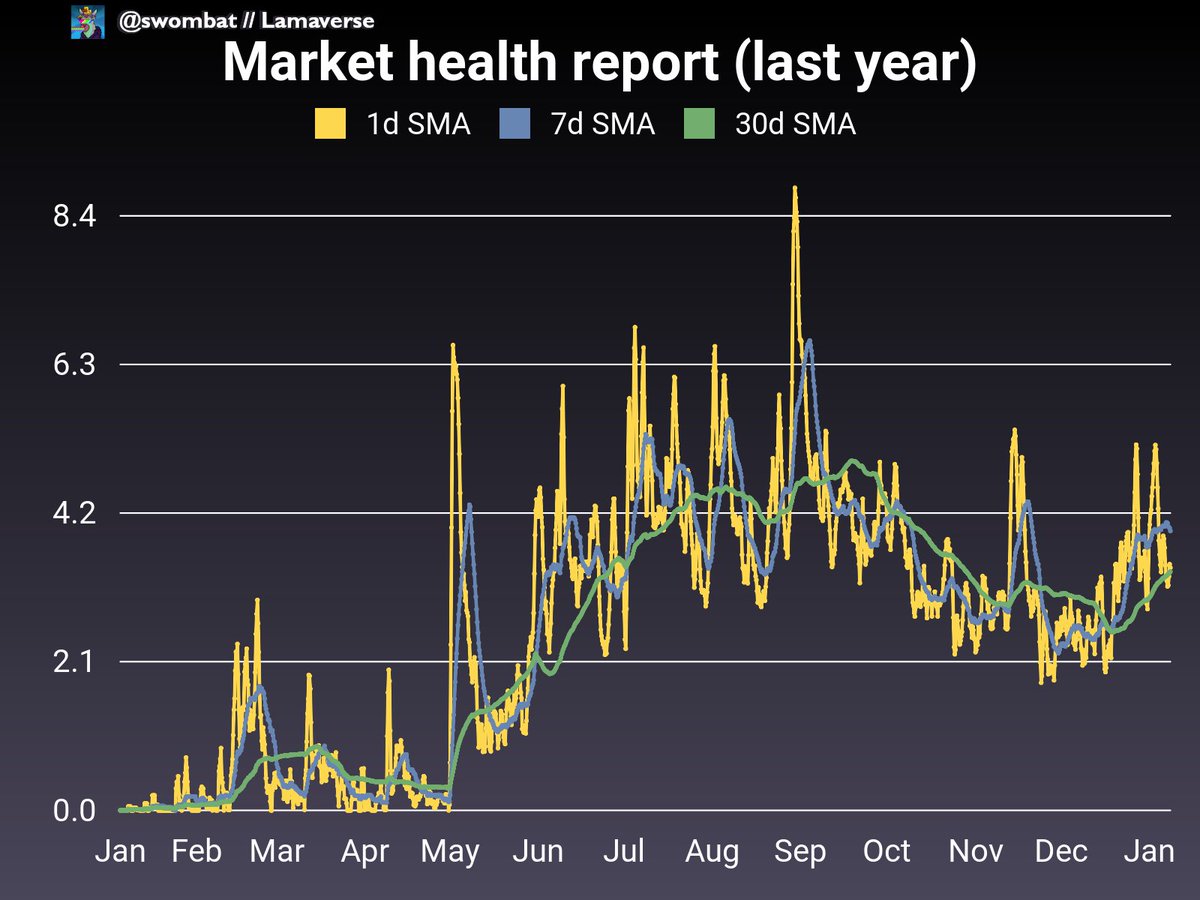

Market health stats time!

Let's start with the end: things are *not* looking good momentum-wise.

The early indicators did work, I think. Volumes are generally down. As volumes go down, the market turns more red. Did you pull out of your more risky bets?

Let's start with the end: things are *not* looking good momentum-wise.

The early indicators did work, I think. Volumes are generally down. As volumes go down, the market turns more red. Did you pull out of your more risky bets?

Yesterday there was uncertainty as to whether to keep including Pudgies in the ranking given their "artificial" volume. The Pudgy saga continues, but even including them, the original "top ten" volume is down. Here's with and without Pudgies:

It looks better if you include Pudgies of course, because they still have some volume going through, which makes sense since they just (insanely imho) got bought for 750 eth:

Let's stick with the top 9 for now. Pudgies is on probation and probably will be dropped in favour of another project. Zooming into the report, what do we see? To me that looks like a volume that's not rebounding. So the momentum alarm bell is definitely ringing.

What if we swap in another project instead of Pudgies? A good up-and-coming project worth maybe considering is Doodles. They seem well on their way to becoming a bluechip. And they were pumping at the same time as the Pudgies.

Ironically, if we include Doodles, then we see a third recent spike appear on the graph... and then an even more disastrous collapse. Here's with and without Doodles...

This makes sense if we remember that Doodles is still more in the "second tier" category, so they will pump later than the market leaders like MAYC. If we use projects like this as part of the market health, we get delayed signals. So I'll keep them out for now.

It's always good to have more than one data source, and I like to check @Zeneca_33's daily floor stats update. He hasn't posted one for yesterday, but the spreadsheet is up to date and... it does show a lot more red than before. docs.google.com/spreadsheets/d…

If we look at the broader picture, we are still above the deep bear market levels we were at back in Q4 2021, so things are not _that_ bad, but I would definitely not call the last few days a bull run at all, and the momentum graphs gave us a good early signal of this.

The final graph to look at is the 6-hour volume stacked bars for the top 9. This gives us a very sensitive, immediate picture of where things are at at right now (well, an hour ago). This is the graph of the raw data that creates the moving averages you see in the other graphs:

This tells us that yeah, there was a little bounce for 12 hours or so but we're still trending downwards.

As a reminder, the question these graphs are meant to answer is: Is the bull market still on or should I be cautious?

TL;DR: be cautious.

As a reminder, the question these graphs are meant to answer is: Is the bull market still on or should I be cautious?

TL;DR: be cautious.

As a reminder, here's the thread describing how these graphs are calculated.

https://twitter.com/swombat/status/1478794518745001984

I will be posting daily updates to these on my twitter, and more frequent updates on some select few Discords like @Llamaverse_ . So follow me to get these daily, and find me on Discord if you want these in your group.

gm & gl

gm & gl

PS: I am also starting work on another index graph that would look at how the average prices are swinging across all those projects. I suspect that will be a lagging rather than leading indicator, but it's still useful to have.

• • •

Missing some Tweet in this thread? You can try to

force a refresh