There are a LOT of things on sale right now, $AML.LN is in our top 5 & agnostic to market rotations occurring. What other co. profit warns & goes up (yesterday) because it's so washed out? Let’s take a (fast) lap 🏎🏁

Aston Martin mini-thesis🧵

Aston Martin mini-thesis🧵

1/ It's not easy to revive a brand, but it helps if you have a century of performance & global awareness. But after an epic channel stuffing IPO collapsed shortly after, too many 🇬🇧 investors have been burned by 007's preferred wheels.

2/ Step 1 was a recapitalization to save it from an... 8th (‼️) lifetime bankruptcy. Now with ~£0.5B cash on the BS at YE21, w/ cash burn inflecting close to breakeven, the co. has plenty of room to deliver the turnaround. But still... the history has created a LOT of skeptics.

3/ now it's largely backstopped by Lawrence Stroll, who's not only great at brand revitalizations, but also great at timing his major capital allocation entries and exits. He & the excellent under-followed CEO have been buying stock in recent weeks.

4/ To restore the luxury-cache, $AML.LN reverted to a demand-driven model which has reduced the dealer inventory headwind. This is the most important part - in 2021, "Retail has outstripped Wholesale by a few hundred deliveries." This comes after a major de-stocking in 2020.

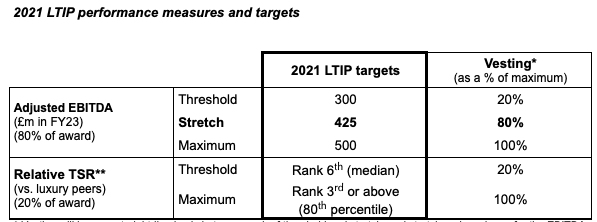

5/ CEO Moers' German engineering efficiency plan is driving sustainable 30-35% operating savings through 'Project Horizon' leading to improved margins and achieving FCF stability by 2023.

6/ $AML.LN CEO Tobias Moers is new to the stock market, but as CEO and CTO of Mercedes AMG, he grew volumes almost 5x and profits to over $2 billion. He was responsible for one of Daimler's largest profit drivers over that period.

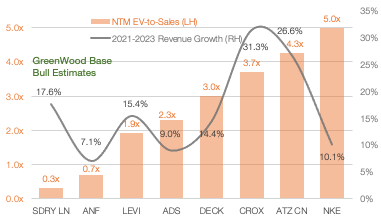

7/ AML has put out a 2024/2025 target of £2b revenues and £500m EBITDA, w/ CEP compensation aligned with this plan. We think he'll deliver ahead of schedule given his recent comments and positioning. Meanwhile consensus for 2023 EBITDA sits at £344m. Yawn, nothing to see here.🤭

8/ Introduction of the DBX SUV was a game changer for the co. Now ~50% mix of $AML.LN volumes w/ at least 5 derivative models yet to come. Paired w/ a full 2023 front-engine refresh coupled with the Mid-engine program (Valhalla & Vanquish) regular/fresh product debuts are back..

9/ While we love $RACE with a passion, and we know this isn't, nor will ever be the prancing 🐴, the new $AML.LN team is following the same playbook to undersell to demand, raise prices, restore a regular launch cadence, raise ASPs, & bring EBITDA margins closer to luxury peers.

10/ To drive brand awareness, $AML.LN's return to the F1 grid creates a global marketing platform at a fraction of the cost. >90% of races are in countries with an AML dealership, creating a natural cross-selling event & lifestyle presence.

https://twitter.com/McIlroyRory/status/1452404840764674052

11/ Thanks to Liberty, & the $NFLX series #DrivetoSurvive, F1 viewership in '21 has surged 39% versus '19 levels, creating incalculable brand awareness for AML. In '20, F1 saw a 99% increase in global engagement across social media- the largest jump for any professional sport

12/ And while everyone is so focused on EV, and how AML will compete, its partnership with Mercedes isn't the only solution - F1 tech transfer will bring sustainable carbon-neutral fuel/engines by 2025 formula1.com/en/latest/arti…

13/ '22 will be a big year of P&L lift before a product onslaught in '23. Now with it being run by a German engineer challenging the inefficient British heritage, & an aggressive owner operator as chairman, well versed in luxury strategy, the recent stock pull back is a 🎁.

• • •

Missing some Tweet in this thread? You can try to

force a refresh