Financial History: Sunday Reads

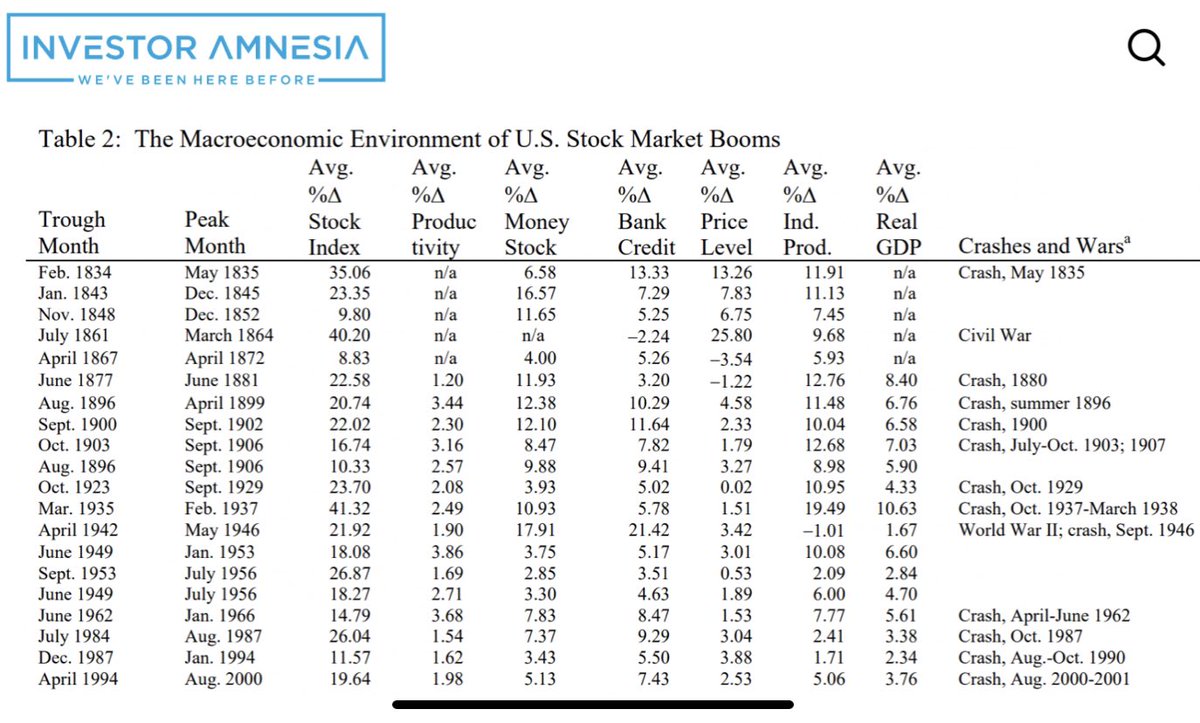

• The Benefits of Bucket Shops

• Embracing Speculative Frenzies

• Manias & Democratization

• Liberty Bonds & Stock Ownership

• Where Common People Can Speculate

investoramnesia.com/2022/01/09/tha…

• The Benefits of Bucket Shops

• Embracing Speculative Frenzies

• Manias & Democratization

• Liberty Bonds & Stock Ownership

• Where Common People Can Speculate

investoramnesia.com/2022/01/09/tha…

"One particularly ironic aspect of this whole saga was that the most vocal critics of bucket shops were also those responsible for their creation. Bucket shops started because smaller investors were priced out of traditional stock exchanges and financial services industry."

Bucket shops survived off their customers' rampant speculation, but were also the medium through which many smaller investors could first participate in the stock market.

One may have been drawn in by getting rich quick and speculating but then developed into a serious investor.

One may have been drawn in by getting rich quick and speculating but then developed into a serious investor.

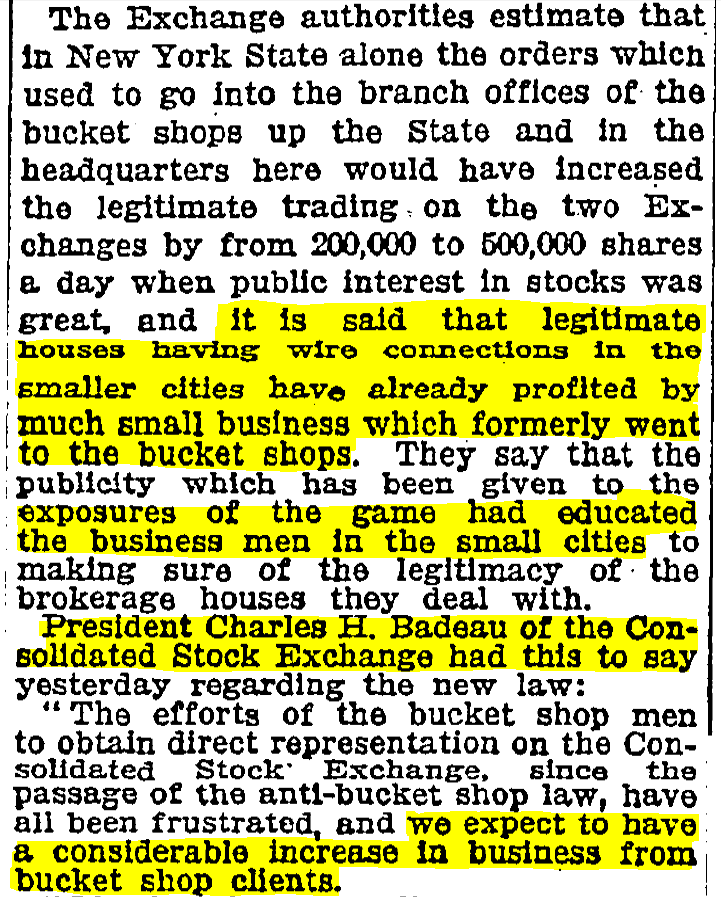

We can see evidence of this from reports at the time discussing trading volume after bucket shops were forced out of business...

The Consolidated Stock Exchange President:

"We expect to have a considerable increase in business from bucket shop clients."

(New York Times, 1908)

The Consolidated Stock Exchange President:

"We expect to have a considerable increase in business from bucket shop clients."

(New York Times, 1908)

Another NYT article:

"Thousands of customers of these [bucket shop] houses, practically all of who were small speculators, have opened accounts with branches of Stock Exchange houses and that their purchasing orders now are executed on the Stock Exchange"

"Thousands of customers of these [bucket shop] houses, practically all of who were small speculators, have opened accounts with branches of Stock Exchange houses and that their purchasing orders now are executed on the Stock Exchange"

While not an example of speculation, around the same time as the bucket shops were rising and falling...

Liberty Loan drives to finance WWI showed regions with higher subscription rates to Liberty Bonds had greater levels of stock ownership in the years after.

Liberty Loan drives to finance WWI showed regions with higher subscription rates to Liberty Bonds had greater levels of stock ownership in the years after.

"The American effort in World War I introduced millions of households to bond ownership [and] contributed to the expansion of securities investing in the 1920s that likely helped fuel the large-scale expansion in American industry of the mid-twentieth century."

"Investing should not be restricted to those of wealthier means, and if it requires speculating on NFTs for a smaller investor to become interested in investing then by all means buy that JPEG."

• • •

Missing some Tweet in this thread? You can try to

force a refresh