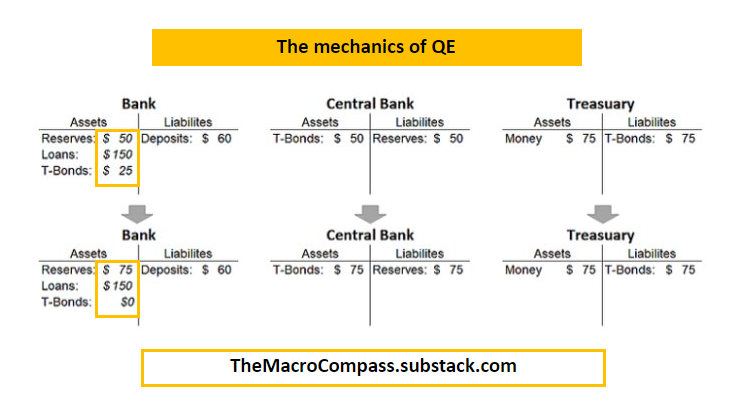

To understand QT, you need to understand QE first.

QE happens when Central Banks create bank reserves out of thin air, and purchase bonds from the private sector with them.

The pvt sector asset composition is forcefully swapped from bonds to inert reserves/deposits.

2/10

QE happens when Central Banks create bank reserves out of thin air, and purchase bonds from the private sector with them.

The pvt sector asset composition is forcefully swapped from bonds to inert reserves/deposits.

2/10

The private sector does not have more net worth.

Its asset side's composition has just been swapped: less duration intensive & coupon bearing bonds, more zero duration & low-yielding reserves or deposits.

Now, QT is the exact opposite of this.

But before we go there...

3/10

Its asset side's composition has just been swapped: less duration intensive & coupon bearing bonds, more zero duration & low-yielding reserves or deposits.

Now, QT is the exact opposite of this.

But before we go there...

3/10

QE drains collateral (bonds) from the system and adds inert reserves/deposits (allow me to call them ''cash'' here)

It creates a cash/collateral imbalance: a lot of short-term cash-like assets (inert reserves/deposits) chasing less & less collateral

Now, QT!

4/10

It creates a cash/collateral imbalance: a lot of short-term cash-like assets (inert reserves/deposits) chasing less & less collateral

Now, QT!

4/10

There are two ways for the Fed to run QT: let Treasury holdings mature & not reinvest them, or (on top) sell them outright in the market.

The Fed will start with the first option.

But it's already a tough one to digest for markets, and here is why.

5/10

The Fed will start with the first option.

But it's already a tough one to digest for markets, and here is why.

5/10

QT reverses the cash/collateral imbalance by draining reserves (reducing Fed balance sheet).

Do you know who's the most important victim here?

The repo market.

The Fed shrank their B/S from $4.5 trn to $3.8 trn in '18-19 and the repo market exploded.

A crucial event.

6/10

Do you know who's the most important victim here?

The repo market.

The Fed shrank their B/S from $4.5 trn to $3.8 trn in '18-19 and the repo market exploded.

A crucial event.

6/10

The chart below shows short-term repo levels for USTs against Fed Funds rates.

Repos are short-term secured loans collateralized by USTs - in a ''normal'' world, they should be as safe as parking cash at the Fed.

The spread should be close to 0.

It went to 3% in Sep 2019.

7/10

Repos are short-term secured loans collateralized by USTs - in a ''normal'' world, they should be as safe as parking cash at the Fed.

The spread should be close to 0.

It went to 3% in Sep 2019.

7/10

Repos are used by primary dealers and hedge funds to fund their positions. They facilitate leveraged position: as long as repo levels remain tight, with a small amount of capital you can put on large ''relative value'' trades.

If repos explode, it's mayhem unwind time.

8/10

If repos explode, it's mayhem unwind time.

8/10

Reversing the cash/collateral imbalance puts pressure on repo levels: less people willing to give away excess ''cash'' in the system = repo levels tend to widen

More punitive repo levels = leverage is more expensive = risk appetite gets marginally hit

It all starts there

9/10

More punitive repo levels = leverage is more expensive = risk appetite gets marginally hit

It all starts there

9/10

Tapering, QT, hikes: yes, but what's the end game?

I am very excited about tomorrow's article, which will cover exactly that: The Macro End Game.

If you like my macro insights and want to hear my answer, subscribe to TheMacroCompass.substack.com and you'll get it tomorrow!

10/10

I am very excited about tomorrow's article, which will cover exactly that: The Macro End Game.

If you like my macro insights and want to hear my answer, subscribe to TheMacroCompass.substack.com and you'll get it tomorrow!

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh