Richer, Wiser, Happier by @williamgreen72 is a cracker of a book which distills investment and life wisdom from many of the world's most iconic investors, as well as some lesser known ones

Below are some of my notes with my favourite quotes and lessons, organised by investor

Below are some of my notes with my favourite quotes and lessons, organised by investor

@williamgreen72 1⃣ Nick Sleep and Qais Zakaria - my favourite chapter of the book, profiling their focus on the long game, destination analysis and what they believe is the most powerful business model of all - scale economies shared

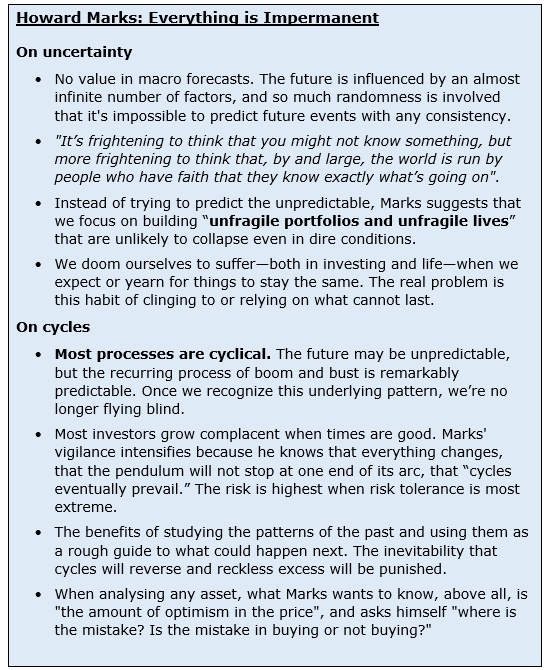

2⃣ Howard Marks - Everything is impermanent, and the future is highly unpredictable. Thus we must act with conservatism and vigilance, and be honest with ourselves about our limitations and vulnerabilities

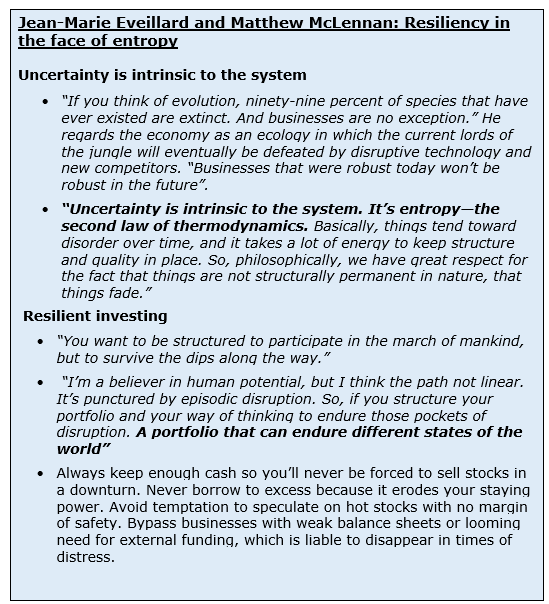

3⃣ Jean-Marie Eveillard and Matthew McLennan (First Eagle Global Fund) - returned 12.49% a year since 1979 (vs 9.35% for MSCI World). Two brilliant but little known investors who blend in science and history into their thinking. This chapter was a hidden gem

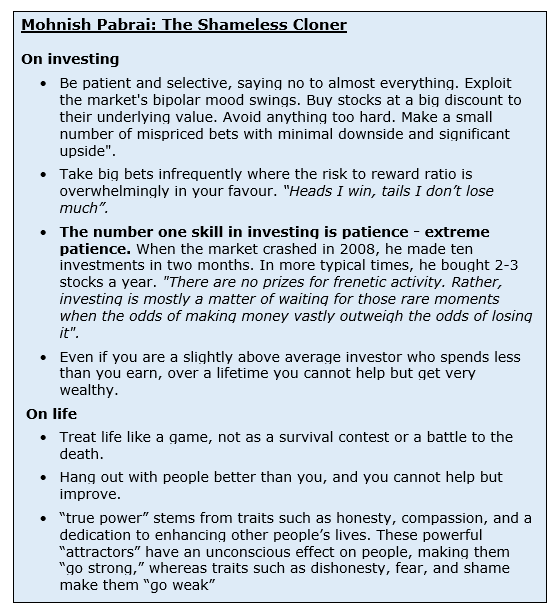

4⃣ Mohnish Pabrai - one of the most successful value investors who cloned Buffett's philosophy on investing and life almost perfectly

There are lots of other investors and insights covered in this book, which makes it well worth reading. Highly recommend.

• • •

Missing some Tweet in this thread? You can try to

force a refresh