How to get URL link on X (Twitter) App

Multiples are a shorthand for valuation, not the valuation itself. Valuation should be driven by earnings and CFs

Multiples are a shorthand for valuation, not the valuation itself. Valuation should be driven by earnings and CFs

ROIC is a key indicator of a company's ability to create value, its competitive advantages and capital efficiency. What's important is:

ROIC is a key indicator of a company's ability to create value, its competitive advantages and capital efficiency. What's important is:

Nvidia unsurprisingly dominates accelerator instances with over 80% share across all cloud providers, however interesting how much AWS is pushing its inferentia chip for inferencing workloads

Nvidia unsurprisingly dominates accelerator instances with over 80% share across all cloud providers, however interesting how much AWS is pushing its inferentia chip for inferencing workloads

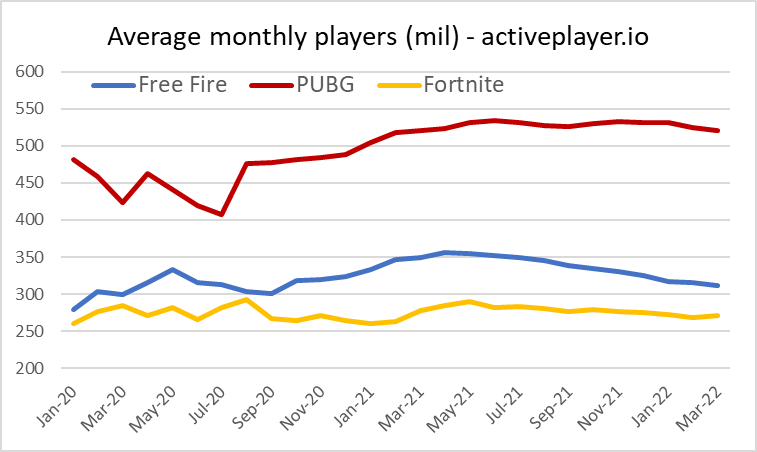

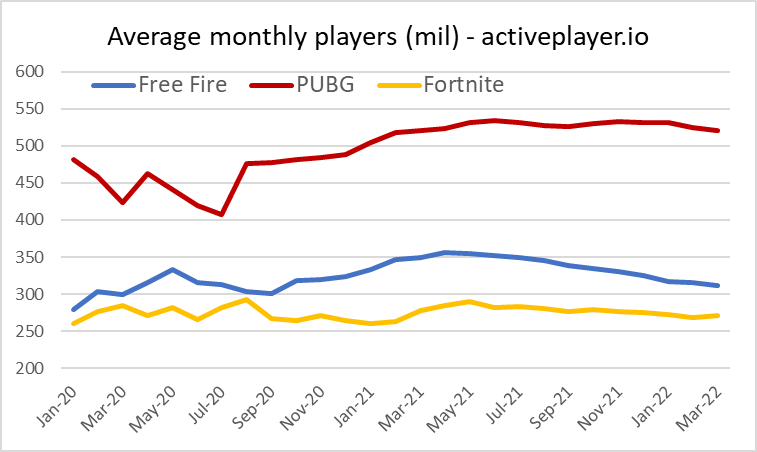

Active players generally grew well over 1H'21 and then started falling, which ties to the slowdown/decline in bookings we saw in the Q3/Q4 results. Player numbers kept falling in the first 3m of this yr. PUBG and Fortnite are also down from their peaks but not to the same extent

Active players generally grew well over 1H'21 and then started falling, which ties to the slowdown/decline in bookings we saw in the Q3/Q4 results. Player numbers kept falling in the first 3m of this yr. PUBG and Fortnite are also down from their peaks but not to the same extent

@rorysutherland Most of the biggest, most successful business ideas in the world initially defied conventional logic.

@rorysutherland Most of the biggest, most successful business ideas in the world initially defied conventional logic.

@williamgreen72 1⃣ Nick Sleep and Qais Zakaria - my favourite chapter of the book, profiling their focus on the long game, destination analysis and what they believe is the most powerful business model of all - scale economies shared

@williamgreen72 1⃣ Nick Sleep and Qais Zakaria - my favourite chapter of the book, profiling their focus on the long game, destination analysis and what they believe is the most powerful business model of all - scale economies shared

Slowdown in Garena is somewhat concerning - broadly flat q-on-q. Something ill need to look into. Free Fire Max will hopefully lift Q4 results

Slowdown in Garena is somewhat concerning - broadly flat q-on-q. Something ill need to look into. Free Fire Max will hopefully lift Q4 results

Its evolution was a classic fintech playbook: begin as a closed loop network serving only the MELI marketplace, open up to off-platform merchants, introduced mPOS devices for offline transactions, launch credit lending, e-wallets, bill payments and asset mgmt most recently

Its evolution was a classic fintech playbook: begin as a closed loop network serving only the MELI marketplace, open up to off-platform merchants, introduced mPOS devices for offline transactions, launch credit lending, e-wallets, bill payments and asset mgmt most recently

2/this is interesting to me as one of the common criticisms of $GRVY is that it has poor capital allocation/hoards cash etc, but despite its huge unused cash pile it's still more efficient than any of its peers. A large part of that is to do with the fact that other companies

2/this is interesting to me as one of the common criticisms of $GRVY is that it has poor capital allocation/hoards cash etc, but despite its huge unused cash pile it's still more efficient than any of its peers. A large part of that is to do with the fact that other companies