Flare Network Protocol Analysis: Will Flare ($FLR) ignite in 2022?

This is a condensed twitter thread of my full essay altcoinevolution.substack.com/p/flare-networ…

Video version:

TL;DR below in 3️⃣ tweets, full🧵 in 56 tweets

This is a condensed twitter thread of my full essay altcoinevolution.substack.com/p/flare-networ…

Video version:

TL;DR below in 3️⃣ tweets, full🧵 in 56 tweets

a) The promise: Flare Network has a simple vision; bring smart contracts (SCs) to chains without Turing Completeness e.g. XRP, LTC, DOGE and more.

SCs are required for dApps which is why Flare presents a massive unlock allowing communities to build use cases for their tokens

SCs are required for dApps which is why Flare presents a massive unlock allowing communities to build use cases for their tokens

b) The reality: The team launched their canary/test network "Songbird" in September. It has shown some traction with some great projects already building on it and engagement from their loyal community.

For some stats check out the following thread

For some stats check out the following thread

https://twitter.com/FlareNetworks/status/1476926918754807808?s=20

c) The rub: It's early days but can Flare withstand the heat competition from others that are already ahead and carve out a piece of the "multichainverse" for themselves?

Let's find out...

Let's find out...

1/56 Protocol: Flare is a distributed network that can be used to create two-way bridges between networks.

It integrates the Ethereum Virtual Machine which enables the network to run Turing Complete SCs.

Flare is a contestant in the Great Alt EVM wars

It integrates the Ethereum Virtual Machine which enables the network to run Turing Complete SCs.

Flare is a contestant in the Great Alt EVM wars

https://twitter.com/j0hnwang/status/1478479236541616130

2/56 Flare's vision is to unlock the assets that are held in non-Turing Complete chains.

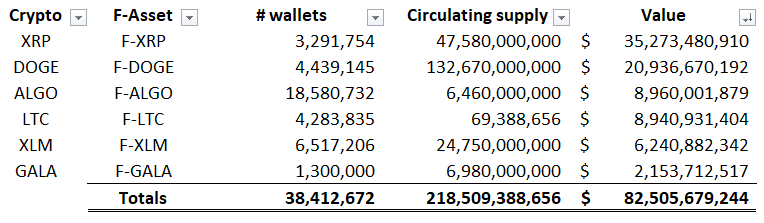

On launch the F-Assets that will be listed are as follows: $XRP, $DOGE, $ALGO, $LTC, $XLM and $GALA

Is this the dawn of Blockchain Composability?!

On launch the F-Assets that will be listed are as follows: $XRP, $DOGE, $ALGO, $LTC, $XLM and $GALA

Is this the dawn of Blockchain Composability?!

https://twitter.com/FlareNetworks/status/1479588075453960202?s=20

3/56 According to my calcs, on release Flare would have an immediate market of 38m wallets, 218b coins representing $82b worth of value.

When the network launches the biggest determinate of Flare's success (imo) will be how many of the available coins get turned into F-Assets.

When the network launches the biggest determinate of Flare's success (imo) will be how many of the available coins get turned into F-Assets.

4/56 Proof of Stake has become one of the dominant security methods in crypto, however the Flare team point to two issues with this approach which required them to develop an innovative new method:

5/56 The first issue is shorter term whereby if an "economically rational" staker saw that their tokens would yield greater returns elsewhere then they would remove their stake and divert the tokens.

This has the effect of reducing the network security. cryptoeconomicsystems.pubpub.org/pub/chitra-sta…

This has the effect of reducing the network security. cryptoeconomicsystems.pubpub.org/pub/chitra-sta…

6/56 The second issues longer term with the Flare team stating:

“As a Proof of Stake network gains usage and the value built on top of it increases, the value of the staking token must increase or the network will become unsafe. This requires a constant inflow of...

“As a Proof of Stake network gains usage and the value built on top of it increases, the value of the staking token must increase or the network will become unsafe. This requires a constant inflow of...

7/56 ...capital if proof of stake were to become the ubiquitous method of doing business, the scale of diversion of capital required from other endeavors, just to secure the value built on these networks, would make the cost of commerce unfeasibly high.”

8/56 While I can see the logic of the first argument, I find the second reason a bit of a stretch as I believe that PoS networks would innovate and find alternatives before ever reaching this point.

~~ Interested to hear from #cryptotwitter on this one.

~~ Interested to hear from #cryptotwitter on this one.

9/56 So how does Flare solve these issues?

The Spark Token is the native token of Flare. It helps prevent spam attacks and can be used as collateral within DApps, providing data to an on-chain oracle, and participate in protocol governance.

The Spark Token is the native token of Flare. It helps prevent spam attacks and can be used as collateral within DApps, providing data to an on-chain oracle, and participate in protocol governance.

https://twitter.com/stedas/status/1470731783125749762?s=20

10/56 Importantly Spark isn’t required to secure the network!

Flare is the world’s first Turing complete Federated Byzantine Agreement (FBA) network. Nodes run the Avalanche protocol with a key adaptation to the FBA topology.

Avalanche Deep Dive medium.com/avalanche-hub/…

Flare is the world’s first Turing complete Federated Byzantine Agreement (FBA) network. Nodes run the Avalanche protocol with a key adaptation to the FBA topology.

Avalanche Deep Dive medium.com/avalanche-hub/…

11/56

A key property of FBA is that it is unique as a consensus topology in that it achieves safety without relying on economic incentives that can interfere with high-value and high-risk use cases.

A key property of FBA is that it is unique as a consensus topology in that it achieves safety without relying on economic incentives that can interfere with high-value and high-risk use cases.

12/56 Read this excellent full article on Consensus Protocols + part 2 by @kozak_timothy here:

blockchain.intellectsoft.net/blog/consensus…

blockchain.intellectsoft.net/blog/consensus…

13/56 I heard Flare's FBA & UNL were centralised!

Fear not Flare have a cunning plan for this...

Fear not Flare have a cunning plan for this...

https://twitter.com/FlareNetworks/status/1365074898222264321?s=20

14/56 In terms of Transactions per second (TPS) we don’t have real readings yet but Avalanche (the blockchain) is fast with up to 7k quoted in some instances but a baseline of:

https://twitter.com/CryptoSeq/status/1381702047519682566?s=20

15/56 More important than TPS is Time to Finality, which should be very quick due to the FBA topology. The Songbird (Flare’s canary network as mentioned in the introduction) explorer does seem very fast with a block time of ~350ms.

See it for yourself songbird-explorer.flare.network

See it for yourself songbird-explorer.flare.network

16/56 I mentioned the opportunity with F-Assets earlier and the technology itself is revolutionary.

I’ll not go into too much detail here but the following diagrams are a high level overview of the flow and you can read more about it here: alphaoracle.io/flare-network/…

I’ll not go into too much detail here but the following diagrams are a high level overview of the flow and you can read more about it here: alphaoracle.io/flare-network/…

17/56 The investors in Flare came in two rounds:

2019 - Unknown amount by Xpring (RippleX) - Press Release: ripple.com/insights/inves…

June 8, 2021 - $11.3m seed backed by big names inc Cardano’s C-Fund (although F-Asset not yet announced)

bitcoinist.com/flare-network-…

2019 - Unknown amount by Xpring (RippleX) - Press Release: ripple.com/insights/inves…

June 8, 2021 - $11.3m seed backed by big names inc Cardano’s C-Fund (although F-Asset not yet announced)

bitcoinist.com/flare-network-…

18/56 We don’t have a break down of what token allocation the investors got for this investment although we know “Flare Networks Ltd” got 25m spark tokens allocated which we will come back to in the team/governance section further down.

19/56 Tokenomics (Supply)

Both FLR and SGB tokens are inflationary as they are geared up for utility rather than token value. There are two ways in which inflation works:

FTSO payout for participation is in newly minted tokens. The inflation rate is set at 10% per year.

Both FLR and SGB tokens are inflationary as they are geared up for utility rather than token value. There are two ways in which inflation works:

FTSO payout for participation is in newly minted tokens. The inflation rate is set at 10% per year.

20/56 F-Asset & FXRP Incentive Pool (which we discussed earlier): Flare tokens are progressively unlocked for the holders at a rate of 3% a month. These tokens can be inflationary until all the 100 billion FLR tokens are released to the market.

21/56 Tokenomics (Demand)

The demand for tokens will come from two areas:

FTSO contribution: lock up/delegation of tokens to data providers

Collateral: FLR can be used as collateral within applications

@Stedas put together this infographic:

The demand for tokens will come from two areas:

FTSO contribution: lock up/delegation of tokens to data providers

Collateral: FLR can be used as collateral within applications

@Stedas put together this infographic:

https://twitter.com/stedas/status/1368641851612401666?lang=en-GB

22/56 From work by @AlphaOracle1 in summary:

- The FTSO is a critical component of the network

- It is responsible for collecting and forming accurate estimates of data to the network for Spark (FLR) holders and applications

It is the brain of the network.

- The FTSO is a critical component of the network

- It is responsible for collecting and forming accurate estimates of data to the network for Spark (FLR) holders and applications

It is the brain of the network.

23/56 FTSO Stats

By the end of last year there were some impressive stats on the Songbird FTSO usage:

By the end of last year there were some impressive stats on the Songbird FTSO usage:

https://twitter.com/HugoPhilion/status/1471918294332579851

24/56 Tracking public FTSO providers can be done on @flaremetrics flaremetrics.io

25/56 Just a note here: if the protocol was PoS the 63 FTSO public providers list seems too short to provide a good enough attack resistance but as Flare uses other methods there is no issue with Nakamoto co-efficient.

26/56 Collateralization works via F-Asset Agents if you want to understand more about the ins and outs of this there is no place better than @MrFreshTime & @theREALpattyxrp's comprehensive site:

thedefistandard.com/flare-network/…

thedefistandard.com/flare-network/…

27/56 Developer Experience

One key area that is in urgent need of attention is the developer experience. Two things stand out: developer resources e.g. support, tooling etc, and (the big one) developer grants.

One key area that is in urgent need of attention is the developer experience. Two things stand out: developer resources e.g. support, tooling etc, and (the big one) developer grants.

28/56 Only basic support is available right now. This is unsurprising and should be expected as Flare is a new chain so it will take time to create tools and build the knowledge base for developers to really make the most of the network.

28b) While they are doing a good job with the resources they have I think we would need to see this whole area be lifted to another level.

Enter their new hire @dommoore as Head of Ecosystem. He was previously at @OVioHQ, a very well respected crypto VC and Web3 accelerator.

Enter their new hire @dommoore as Head of Ecosystem. He was previously at @OVioHQ, a very well respected crypto VC and Web3 accelerator.

29/56 The need to develop grant program is critical as other L1s have massive funds to support a rapid acceleration of development across their ecosystems.

Flare are very much behind in this regard, having raised a relatively small (compared to other L1s) $11.3m in 2021.

Flare are very much behind in this regard, having raised a relatively small (compared to other L1s) $11.3m in 2021.

30/56 Without an initial (Coin/Dex/Protocol?) offering to boost finances I expect we will see much larger raises coming and the release of the $FLR to generate further funds (if structure as IxO).

31/56 Near, for example, have a massive warchest of an estimated ~$1.2b for their grant program, so for Flare to compete we will need to see a $1b step up 💰

32/56 Is there a precedent for this? Potentially as Oasis $ROSE just announced that @BinanceLabs will be contributing to the Oasis Ecosystem Fund, growing the fund up to 200M $USD.

https://twitter.com/OasisProtocol/status/1480913232261005319?s=20

33/56 Time will tell if Flare will be able to repeat this success but hiring is in progress as we can see from the Flare Careers page, so watch this space!

34/56 Flare made good progress in 2021 with the launch of their canary network Songbird; which is already exhibiting high levels of use and functionality with the following statistics from Dec 13th last year.

https://twitter.com/stedas/status/1470332006223523841?s=20

35/56 The 240k wallets rivals that of Polkadot’s canary network Kasuma whcih can be seen here

kusama.subscan.io

kusama.subscan.io

36/56 Also as of 11th Jan 22 we confirmed 10M transactions have taken place

https://twitter.com/FlareNetworks/status/1480894980545826817

37/56 Projects being built on Flare

There are already a small batch of projects building in the ecosystem:

DeFi: @FlareFinance @TrustlineInc

FTSO: @FTSO @ftso_au @BestFtso @lightFTSO @ftso_eu @AlphaOracle1 @ftso_uk @AureusOx @scandinodesFTSO

Data: @flaremetrics

There are already a small batch of projects building in the ecosystem:

DeFi: @FlareFinance @TrustlineInc

FTSO: @FTSO @ftso_au @BestFtso @lightFTSO @ftso_eu @AlphaOracle1 @ftso_uk @AureusOx @scandinodesFTSO

Data: @flaremetrics

38/56

NFTs: @GoGalaGames @crypto888crypto @GE_Federation @fcflio @BoredApesXRP

@SparklesNFT @SGBPunks @BabySongbirds

Wallets: @BifrostWallet @UpholdInc @Ledger @Trezor @MetaMask @DCENTwallets

NFTs: @GoGalaGames @crypto888crypto @GE_Federation @fcflio @BoredApesXRP

@SparklesNFT @SGBPunks @BabySongbirds

Wallets: @BifrostWallet @UpholdInc @Ledger @Trezor @MetaMask @DCENTwallets

39/56 In my recent video & tweet thread I gave a fair amount of detail on the traction statistics for Flare and various projects.

https://twitter.com/0xGregH/status/1474004915651444739?s=20

40/56 dApp Highlight: @FlareFinance is an anonymous team of developers building out critical DeFi infrastructure on the Flare Network. It offers a suite of 6 unique decentralized finance products dedicated to bootstrapping the Flare Network with a single suite DeFi solutions.

41/56 This team is delivering… Flare Finance's Experimental Finance (ExFi) platform V2 is live on the Songbird Network and already has over $20 million in TVL with only 3 products live on the platform.

42/56 Even in the last 7 days we have seen some impressive stuff from Flare Finance’s on demand liquidity product FlareX:

https://twitter.com/hc_capital/status/1480118968912588802?s=20

43/56 And the Flare Loans product isn’t doing too badly either despite a recent sell off… defillama.com/protocol/flare…

44/56 Airdrops... It hasn’t all been easy sailing though with the ExFi airdrops not holding value particularly well, delays, reworking of distributions and more… This has left some in the community frustrated:

https://twitter.com/KIN4theWIN/status/1480806841554808833?s=20

45/56 yes there have been issues, but I believe that the Flare Team has done it's upmost to rectify issues where they have had the option to do so

https://twitter.com/FlareNetworks/status/1477636459540713475?s=20

46/56 Other projects are launching with a recent announcement from @fcflio about joining Flare

https://twitter.com/FlareNetworks/status/1473307326463582227

47/56 Team; Flare have a strong team:

@HugoPhilion Co-Founder and CEO

@sprwn Sean Rowan Co-Founder, and CTO

@NairiUsher is the Chief Scientist

@JoshuaGEdwards VP Engineering

@dommoore Head of Ecosystem

++ Eight advisors have been appointed to the project

@HugoPhilion Co-Founder and CEO

@sprwn Sean Rowan Co-Founder, and CTO

@NairiUsher is the Chief Scientist

@JoshuaGEdwards VP Engineering

@dommoore Head of Ecosystem

++ Eight advisors have been appointed to the project

48/56 Governance: Flare Networks will retain 35% of voting power to start.

Ideally I would love to see a plan for the Flare Networks Ltd part of voting power get gradually handed over to the community but this will likely come with time.

Ideally I would love to see a plan for the Flare Networks Ltd part of voting power get gradually handed over to the community but this will likely come with time.

49/56 The remaining share (65%) of the votes goes to the community so it does have a large say in the future direction of the network.

@ftso_uk broke down the decision categories into this nice infographic showing the different thresholds to pass:

@ftso_uk broke down the decision categories into this nice infographic showing the different thresholds to pass:

https://twitter.com/ftso_uk/status/1373537935396593667?lang=bg

50/56 This brings us to the end of our analysis part now we put it all together for the Bear and the Bull Cases for Flare.

51/56 🐂 Bull Case

- The users of NTC chains convert assets to Flare in search of yields

- Continued additions to F-Asset roster pulling in more communities, as more specialised tokens launch more F-Assets come online

...

- The users of NTC chains convert assets to Flare in search of yields

- Continued additions to F-Asset roster pulling in more communities, as more specialised tokens launch more F-Assets come online

...

52/56 ...Cont

- PoS shown to be less secure, and more users convert

- Achieves scale without issues and carves out a piece of the L1 pie

- PoS shown to be less secure, and more users convert

- Achieves scale without issues and carves out a piece of the L1 pie

53/56 What happens if F-Assets are better than the originals…

As discussed in the thread below; Flare doesn't impact the underlying networks, they will just become more Stores of Value.

xrpchat.com/topic/37844-fl…

As discussed in the thread below; Flare doesn't impact the underlying networks, they will just become more Stores of Value.

xrpchat.com/topic/37844-fl…

54/56 🐻 case / headwinds:

- Technology becomes outdated quickly, will Flare be so nimble when it is live?

- Still not live, other L1s have a headstart with massive funding behind them

- Demand for assets? wBTC (~1.4% of circulating supply) no change since June really…

- Technology becomes outdated quickly, will Flare be so nimble when it is live?

- Still not live, other L1s have a headstart with massive funding behind them

- Demand for assets? wBTC (~1.4% of circulating supply) no change since June really…

55/56 ... cont.

- Spark Dependent Applications (SDAs) rely on third-party networks to keep growing and gain adoption.

- Wild swings supported currencies/tokens could potentially cause collateral issues for Spark holders

- Spark Dependent Applications (SDAs) rely on third-party networks to keep growing and gain adoption.

- Wild swings supported currencies/tokens could potentially cause collateral issues for Spark holders

56/56 Overall, Flare has a huge amount going for it but faces challenges. The team are approaching the task with deliberate care and is also executing well on their plans.

TL;DR Definitely one to watch.

TL;DR Definitely one to watch.

Legendary accounts to follow: @FlareNetworks @HugoPhilion @dommoore @JeenLolkema @timrowley_au @stedas @CommunityFlare @SongbirdComm @theREALpattyxrp @MrFreshTime @HigherManas @NftRiddler @Flarepedia

And more that I will have no doubt missed and will comment below!

And more that I will have no doubt missed and will comment below!

Disclaimer: As always I am not an investment advisor, this thread is for educational purposes only, always DYOR.

Also crypto is complicated and rapidly evolving so information may be inaccurate or out of date when you see this. So always DYOFR.

Also crypto is complicated and rapidly evolving so information may be inaccurate or out of date when you see this. So always DYOFR.

You can read the unrolled version of this thread here:

typefully.com/u/0xGregH/t/j0…

typefully.com/u/0xGregH/t/j0…

• • •

Missing some Tweet in this thread? You can try to

force a refresh