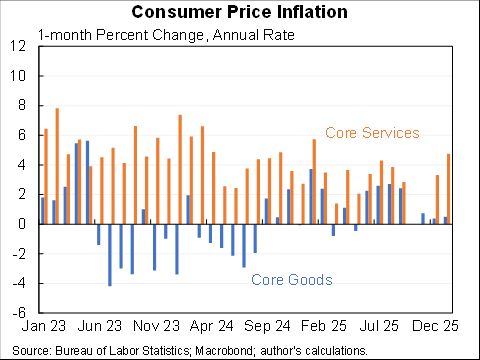

A closer look at inflation in services excluding energy, this accounts for about 60% of the CPI and 75% of the core CPI.

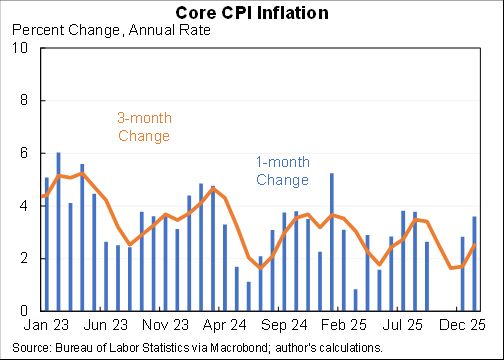

Over the last three months up at a 4.6% annual rate compared to 2.9% annual rate pre-pandemic.

That excess is adding ~1.2pp to annualized core CPI.

Over the last three months up at a 4.6% annual rate compared to 2.9% annual rate pre-pandemic.

That excess is adding ~1.2pp to annualized core CPI.

Overall core services are still below trend--but is moving up more quickly so converging towards/above trend. You could look at that and say that our only inflation problem is goods. Or you could look at that and say we have another shoe yet to drop.

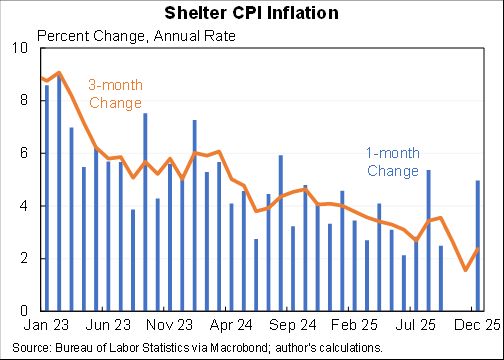

Leading candidate for yet-to-drop shoe #1 is housing prices. These are still up relatively slowly for *all* housing as compared to the large increases we're seeing for new leases. All should catch up to new.

Potential yet-to-drop shoe #2: pandemic-related prices. We're still in a pandemic. It has been constraining services demand and service prices. If we return to more normal then expect higher prices for airfare, hotels, events, etc.

Potential yet-to-drop shoe #3: there is some evidence from @jimstockmetrics and Mark Watson that service prices are more sensitive to labor market slack than overall prices. And labor markets much tighter now than they were a year ago. nber.org/papers/w25987

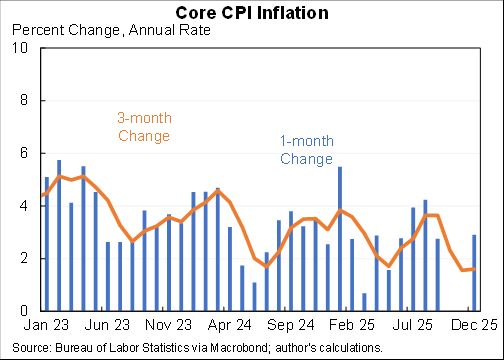

But who knows. I expect an undoing of the abnormal rotation to reduce inflation the question is how much--is it enough to get us to 2%? Does it leave us at 3%? And if it leaves us at 3% is the Fed OK with that (as I think they should be) or do they feel they need to fight it?

BTW, here is the same multiple period picture for durable goods that I showed you for core services.

And repeating the durable goods vs. services comparison over the last 24 months that started this discussion in the first place.

• • •

Missing some Tweet in this thread? You can try to

force a refresh