Some takeaways from Morgan Stanley's Q4 CIO survey

- Software has the highest growth expectations in IT

- Strong demand in software persisting (not simply pull forward in 2021)

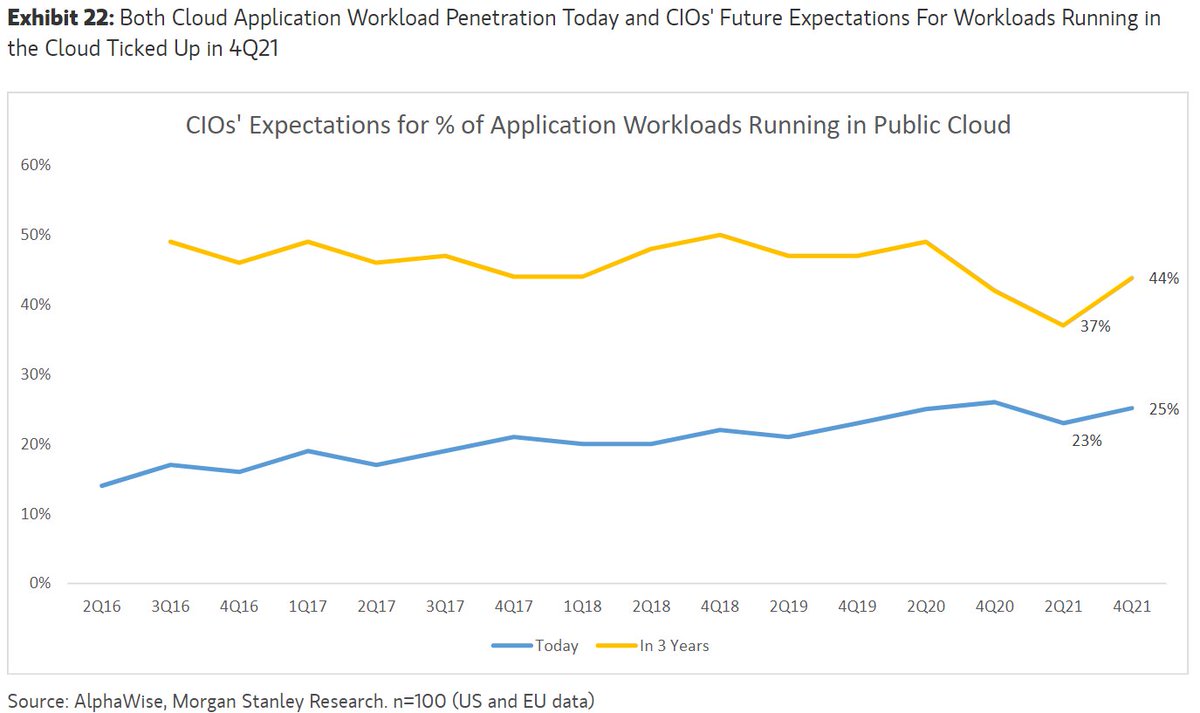

- Cloud computing remains CIO's top priorities

- Security software most defensible

More graphs below

- Software has the highest growth expectations in IT

- Strong demand in software persisting (not simply pull forward in 2021)

- Cloud computing remains CIO's top priorities

- Security software most defensible

More graphs below

"Survey data suggests 25% of application workloads are running in the public cloud today, up from 23%... in 2Q21. The multi-year trend in the migration of applications to the cloud remains intact, with CIOs expecting 44% of workloads to reside in public cloud by 2024"

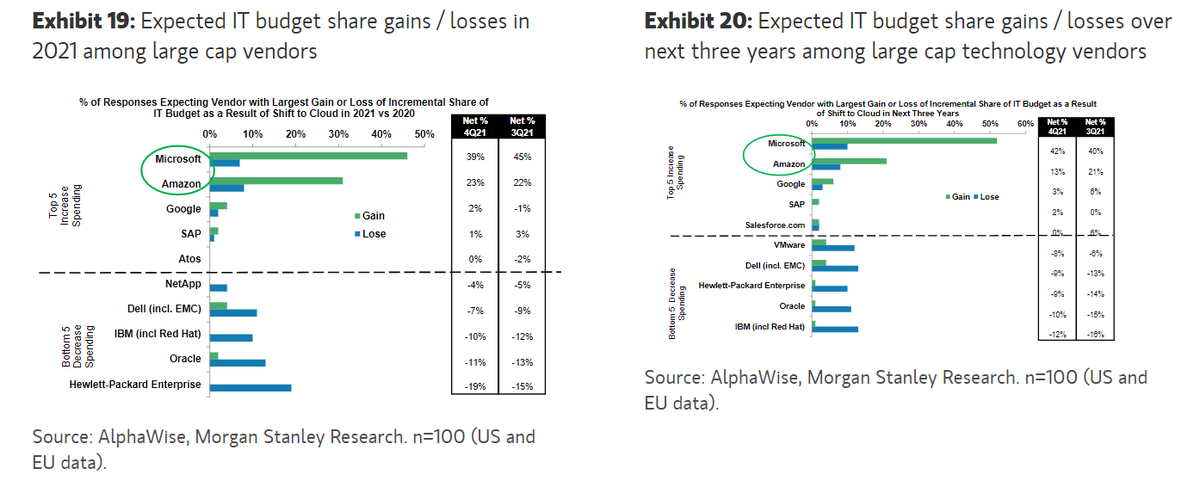

"As workloads continue to shift from on-premise to the cloud, Microsoft and Amazon remain the largest beneficiaries , both in 2021, as well as over the next three years"

"Snowflake screens as the vendor with the highest weighted average growth expectations in 2022 at +7.1%...30% of CIOs surveyed expecting spend to increase in 2022, vs. 0% of CIOs expecting spend to decrease."

Microsoft has the highest up-to-down ratio of 70%

Microsoft has the highest up-to-down ratio of 70%

Maybe most importantly:

"Expectations for software spending growth in 2022 remain ahead of historical levels, refuting the notion of a pull forward in demand in CY21"

"Expectations for software spending growth in 2022 remain ahead of historical levels, refuting the notion of a pull forward in demand in CY21"

• • •

Missing some Tweet in this thread? You can try to

force a refresh