Altimeter Partner working with software businesses at the earliest stages of product market fit. Dad to 4 amazing kids. No investment advice, all views personal

8 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/buccocapital/status/1505250453130461184

As a venture capitalist we take bets that companies will be worth more in the future, despite a "premium" multiple paid in the early days.

As a venture capitalist we take bets that companies will be worth more in the future, despite a "premium" multiple paid in the early days.

Here's the scatter plot without the circles

Here's the scatter plot without the circles

Datadog has grown much faster (by a wide margin) than they were expected to at IPO

Datadog has grown much faster (by a wide margin) than they were expected to at IPO

To try and explain this further - RPO measures the aggregate total unrecognized contract value from all customers. Let's say a company had one customer that signed a $100k one year deal. After 6 months, the RPO would be $50k. this represents the remainder of the deal, or 6 months

To try and explain this further - RPO measures the aggregate total unrecognized contract value from all customers. Let's say a company had one customer that signed a $100k one year deal. After 6 months, the RPO would be $50k. this represents the remainder of the deal, or 6 months

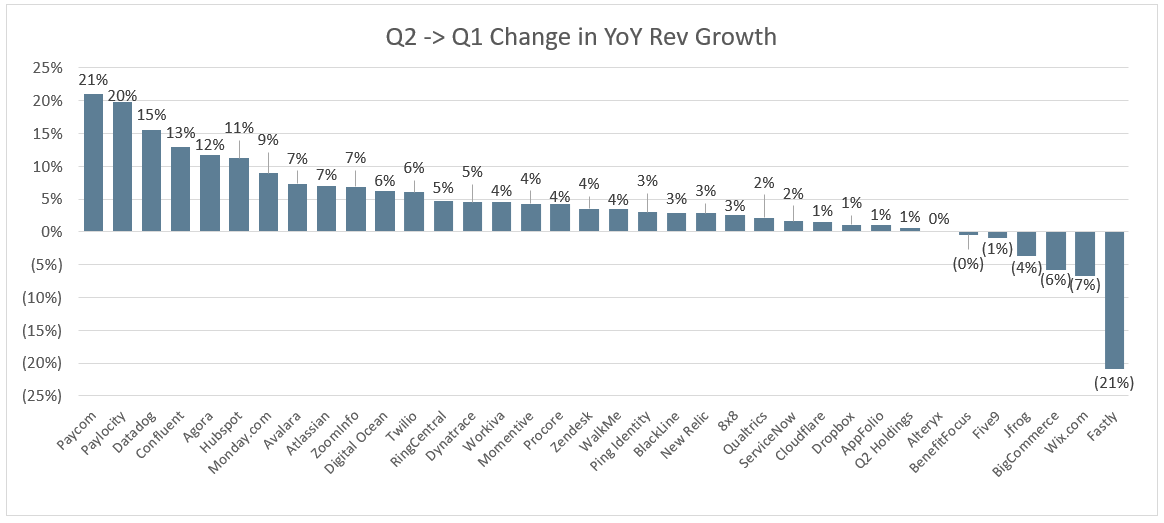

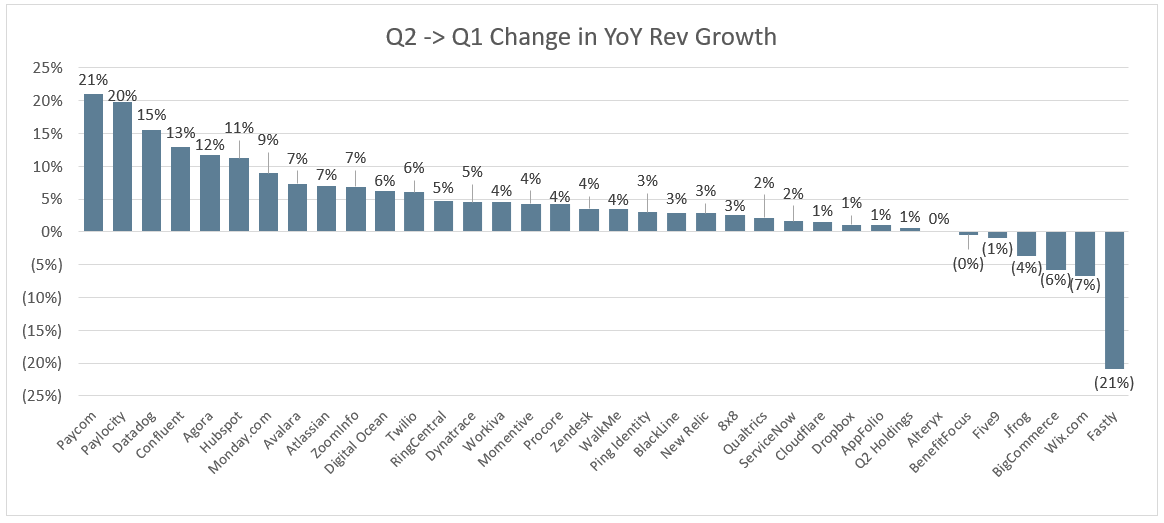

I removed 3 companies - Shopify, Olo and BigCommerce. All were major Covid beneficiaries. Q1 this year lapped a 2020 Q1 that did not see much Covid benefit, while Q2 lapped a 2020 Q2 which did see a Covid benefit. So the YoY compare between Q2'21 to Q2'21 isn't as relevant

I removed 3 companies - Shopify, Olo and BigCommerce. All were major Covid beneficiaries. Q1 this year lapped a 2020 Q1 that did not see much Covid benefit, while Q2 lapped a 2020 Q2 which did see a Covid benefit. So the YoY compare between Q2'21 to Q2'21 isn't as relevant

2. Product Expansion Velocity: At IPO (in 2019) Crowdstrike had 10 modules. They now have 19. Amazing product development velocity

2. Product Expansion Velocity: At IPO (in 2019) Crowdstrike had 10 modules. They now have 19. Amazing product development velocity

Analysts constantly underestimate leading cloud companies ability to sustain higher growth rates for longer periods of time

Analysts constantly underestimate leading cloud companies ability to sustain higher growth rates for longer periods of time