Price was X a year ago

Price is 4X today.

That’s a pity isn’t it?

Nope, its pitti. 🤣🤣 And it is still undervalued imo.

A thread to understand whether pitti deserves our pity or our interest.

Plz retweet if you find it useful. 🙏🙏

🧵🧵🧵👇👇

Price is 4X today.

That’s a pity isn’t it?

Nope, its pitti. 🤣🤣 And it is still undervalued imo.

A thread to understand whether pitti deserves our pity or our interest.

Plz retweet if you find it useful. 🙏🙏

🧵🧵🧵👇👇

Let's dive right into the belly of the beast.

We cover the analysis in 7 sections:

1. Products

2. Industry Analysis

3. Durable Competitive Advantages

4. Growth Triggers

5. Profitability Triggers

6. Valuation

7. Anti thesis

8. What am I doing?

We cover the analysis in 7 sections:

1. Products

2. Industry Analysis

3. Durable Competitive Advantages

4. Growth Triggers

5. Profitability Triggers

6. Valuation

7. Anti thesis

8. What am I doing?

1. Products

Before we understand pitti’s products let us understand the user facing product they go into. Do you know how Electricity is generated at a Hydro power project? Its a turbine.

Before we understand pitti’s products let us understand the user facing product they go into. Do you know how Electricity is generated at a Hydro power project? Its a turbine.

Water falls from a height, has kinetic energy, with that energy we turn the turbine, the magnetic in the turbine produces electricity. Why??

This is due to what is known as Faraday’s law.

Without going too technical,

Magnet + Kinetic Energy = electricity

Magnet + electricity = Kinetic Energy

Without going too technical,

Magnet + Kinetic Energy = electricity

Magnet + electricity = Kinetic Energy

The first principle applies to turbines (power generation). The second one applies to motors. Those that are in your EV, in your mixer grinder, in your Toy Cars.

Bear with me, this will all make sense. This is not a useless physics lecture.

So Pitti’s metal lamination sheets go into Turbines, generators, motors (consumer electronics: washing machine, mixer, industrial motors, EV motors).

Do you see these weird concentric circular plate of metal with long stripes? This is a metal lamination. This is what pitti makes. These go into motors & turbines.

The first question you SHOULD ask is why would one want to make this lamination as a series of individual metal sheets instead of a single blob of metal. Good question. A related question is why even make metal lamination for motors/Turbines.

Basically electricity going through the coil inside the induction stove produces magnetic field. That magnetic field produces electricity inside your induction compatible utensil (Faraday’s law again!!). That current dissipates itself as heat & that heat heats your food.

The eddy current is desirable in Induction stoves, but not so desirable in motors, turbines. Why??

Coz these eddy currents are a pain in the backside for motors. They reduce the effectiveness of motors.

Coz these eddy currents are a pain in the backside for motors. They reduce the effectiveness of motors.

Those spiky circular plates now start to make sense!! Pitti’s products make sense!! They ensure that eddy currents are minimized (when there is no path, where will current flow??) & thus effectiveness of the motors is maximized.

These metal sheet laminations are a critical part which goes into the motors/turbines. They’re probably not a large part of a motor’s cost but a critical application for sure.

That’s how pitti started, as a metal lamination maker for motors. Then, they climbed up the value chain. Went into making other parts of the motors, sub-assemblies. Rotors. Some of their products are 99% ready to use!!!

And who are Pitti’s Clients? A better question might be who ISN’T pitti’s client?

General Electric,Siemens, L&T, BHEL, Indian Railways, ReGen, Metro projects in India

General Electric,Siemens, L&T, BHEL, Indian Railways, ReGen, Metro projects in India

Pitti divides its revenues into 2 parts. Revenues from base metal laminations form around 30% of topline. The rest of 70% are value added products.

These parts are the ones which are “machined”. These parts are the sub-assemblies, the rotor shafts. The “other parts” of motor/turbine I referred to.

2. Industry Tailwinds

Pitti categorizes its components as per end user industry. There are 8 or so categories.

Pitti categorizes its components as per end user industry. There are 8 or so categories.

Secular Demand: Consumer Durables, Data center, Railway & Metro, Renewable Energy. Around 40%. Rest of the 60% demand is cyclical.

Demand for Industrial motors/turbines is driven by replacement market & OEM market. OEM demand is cyclical & increases when an overall capex cycle happens. Looks like current demand levels (for things like industrial motors) is the bare minimum.

The general consensus seems to be that India Inc capacity utilization is around 70-75% & so capex cycle has started. If indeed this is so, it will lead to high demand for pitti’s products.

economictimes.indiatimes.com/news/company/c…

economictimes.indiatimes.com/news/company/c…

3. Durable Competitive Advantages

(i) Pitti's biggest durable competitive advantage is the sicky deep customer relations it has developed. It will take any competitor 4-5 years at least to commercialize a rival product. This makes disruption a very low probability event.

(i) Pitti's biggest durable competitive advantage is the sicky deep customer relations it has developed. It will take any competitor 4-5 years at least to commercialize a rival product. This makes disruption a very low probability event.

(iii) In addition, by moving up the value chain pitti has managed to consolidate the supply chain, being the one stop shop for their customers. Higher margins, higher stickiness, higher entry barriers, all rolled into one.

4. Growth Triggers

(i) Pitti is increasing their installed capacity from 40000 ton right now to 72000 ton/annum by H1FY24 (2 years later). Machine hours (value addition) capacity is increasing from 3,70,000 machine hours to 6,00,000 machine hours. 270cr capex for this.

(i) Pitti is increasing their installed capacity from 40000 ton right now to 72000 ton/annum by H1FY24 (2 years later). Machine hours (value addition) capacity is increasing from 3,70,000 machine hours to 6,00,000 machine hours. 270cr capex for this.

(ii) Co has guided for 1800 cr of revenue runrate by end of H1FY24. Current TTM revenues are 739. This would be a ~2.5x increase in revenue potential.

(iv) Pitti supplies to Medha. Largest private railway coach factory in India.

(v) They are expecting the railway, metro part of sales base (28% of sales) to grow at 25-30% per annum.

https://twitter.com/Aryan_warlord/status/1294353154805395456

(v) They are expecting the railway, metro part of sales base (28% of sales) to grow at 25-30% per annum.

5. Profitability Triggers

(i) They are actively working on improving their working capital cycle. Currently at 99 days. Planning to bring it down to 75 days by end of year.

(i) They are actively working on improving their working capital cycle. Currently at 99 days. Planning to bring it down to 75 days by end of year.

Reducing the working capital cycle improves ROCE by reducing capital deployed. Current ROCE is around 20% already. They can easily do 25% once WC is reduced.

This working capital reduction is being driven by multiple initiatives. As proportion of domestic increases, WC comes down (exports have longer WC cycle). Second, they are consciously reducing debtor days by asking all customers to pay on time.

(ii) As they move up the value chain, from sheet laminations to rotors, shafts, sub-assemblies, their EBITDA/ton would go up by 25-30%.

(iii) Here is something you generally do not get to see. Maharashtra government is paying them incentives to set up factory in maharashtra (aurangabad). 400cr over 13 years. That's wow.

Thats a solid 30cr of "other income" that directly hits the bottomline. With this additional income, they are confident of crossing 25% ROCE

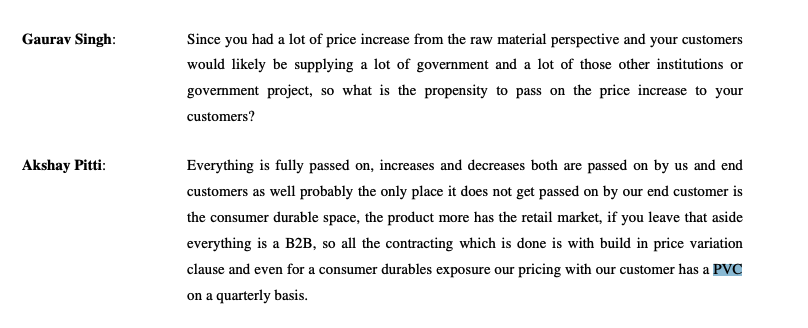

(v) Pitti also has a Quarterly raw material price volatility pass through mechanism. this means, that they can pass through any RM price increases to customers.

6. Valuations.

Here you have a play on india capex revival. Making a critical component which goes into electric motors/turbines. Sticky customers. High entry barriers. Available at ~1x sales, 16x earnings. Growing at 25-30% per annum, 25% ROCE, improving margins.

CHEAP.

Here you have a play on india capex revival. Making a critical component which goes into electric motors/turbines. Sticky customers. High entry barriers. Available at ~1x sales, 16x earnings. Growing at 25-30% per annum, 25% ROCE, improving margins.

CHEAP.

7. Anti-thesis pointers

Well, if the co is doing so well, then why is it so cheap. What is the seller thinking?

(i) Some of promoter holding is pledged. Debt is high. Both are linked.

Well, if the co is doing so well, then why is it so cheap. What is the seller thinking?

(i) Some of promoter holding is pledged. Debt is high. Both are linked.

Although Mr Pitti says that the pledge was something SBI asked them to create. Its probably good for investors to be wary of pledged promoter stakes. And debt.

(ii) Over promise & under deliver?

Pitti has been setting a sales target of 1000cr for some time now. See the FY14 annual report. FY16, FY18. Even in FY22, they wont achieve 1000cr most likely.

Pitti has been setting a sales target of 1000cr for some time now. See the FY14 annual report. FY16, FY18. Even in FY22, they wont achieve 1000cr most likely.

This seems to be one co which is too bullish. Thus we must discount their guidance a bit since they are unable to walk the talk.

(iii) If india capex revival does not happen, then pitti wont be able to grow as well. Moreover, replacement demand is only a small subset of all demand, so pitti's revenue base are temporary (there until capex lasts, then reduces. Cyclical).

8. What am I doing?

This is one of the most interesting companies I have come across. Still I have decided not to invest. Why??

One word: Portfolio construction.

This is one of the most interesting companies I have come across. Still I have decided not to invest. Why??

One word: Portfolio construction.

I find pix to be a strictly better opportunity. (thread on pix:

Large part of Pitti revenue base is cyclical. Hard to give good valuations to such cos. Despite growth & profitability.

https://twitter.com/sahil_vi/status/1431578586620825603?s=20)

Large part of Pitti revenue base is cyclical. Hard to give good valuations to such cos. Despite growth & profitability.

I cannot increase my portfolio size. I dont want to own 2 capex revival plays. Pix is strictly better in my view so i have decided not to own pitti. Well, that's a pity.

Not really though, always. a good learning experience. :D

Never thought faraday & lenz will turn up.

Not really though, always. a good learning experience. :D

Never thought faraday & lenz will turn up.

Even though I am not investing in pitti, you might still find it useful. Specially if you're bullish on india capex revival. Do evaluate but make your own decision. Your risk capital, your loss, your pain, your gain. :)

Hope this thread helped you understand pitti better.

I spent about 5 hours making it (in addition to time spent researching).

If you're new here consider following if you're interested in reading similar deep dives in the future.

I spent about 5 hours making it (in addition to time spent researching).

If you're new here consider following if you're interested in reading similar deep dives in the future.

Here is a thread of all my major investment related threads:

Some of them are useful, or so I have been told.

https://twitter.com/sahil_vi/status/1406848206181335046?s=20

Some of them are useful, or so I have been told.

Have a happy weekend (Its a day off for me tomorrow so my weekend starts NOW)

:D

Happy makar sankranti/pongal

:D

Happy makar sankranti/pongal

Wonderful thread by Prashant sir on pitti engineering.

https://twitter.com/drprashantmish6/status/1412098986341593095?t=LjxN7_neqc-Km3t6I5dfpg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh