Husband. Set of atoms which is self aware

My apologies, i dont tolerate stupidity

I have deep researched & thought backed views which i stand up for

44 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/sahil_vi/status/1659567112866910211?s=20

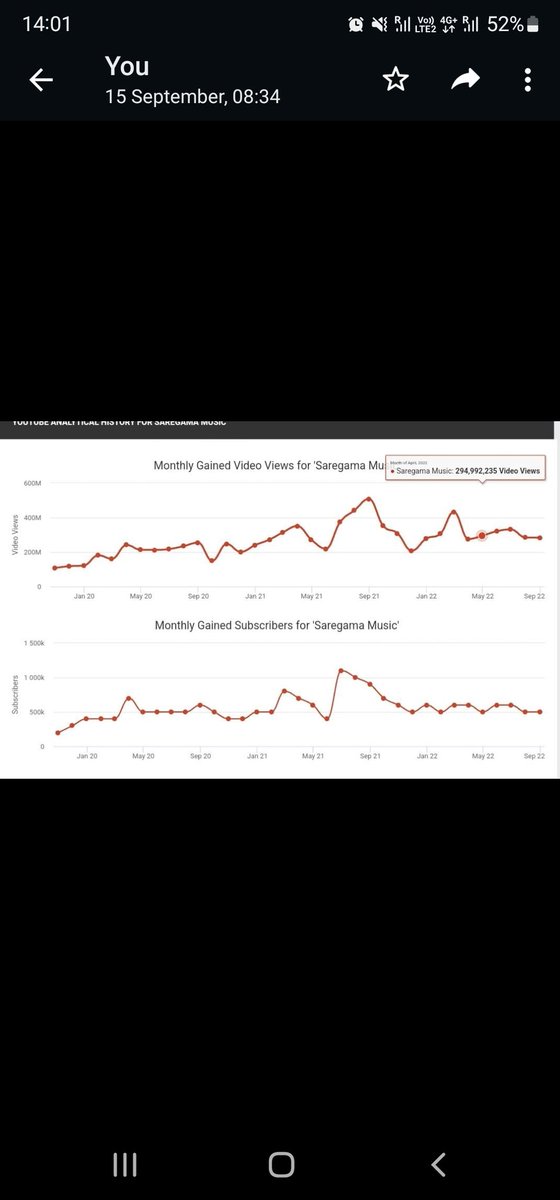

look at the music segment PBT (since it's dominated by streaming, carvan low margin)

look at the music segment PBT (since it's dominated by streaming, carvan low margin)

When you do you will realise following:

When you do you will realise following:

Disclaimer

Disclaimer

The idea of "Universe 25" Came from the American scientist John Calhoun, who created an "ideal world" in which hundreds of mice would live and reproduce.

The idea of "Universe 25" Came from the American scientist John Calhoun, who created an "ideal world" in which hundreds of mice would live and reproduce.

Whatever i present, is always just sharing of knowledge. I am NOT a sebi registered advisor. This is not a buy or sell.

Whatever i present, is always just sharing of knowledge. I am NOT a sebi registered advisor. This is not a buy or sell.

#1 AGMs: Company YouTube Channels

#1 AGMs: Company YouTube Channels

https://twitter.com/cheerssmiling/status/1584398194753998848?t=amkCP9OPY1wHGP7dbUxp4w&s=08

The co we are talking about is building TCAS :

The co we are talking about is building TCAS :

This is the time to truly find out whether your conviction is your own, or borrowed.

This is the time to truly find out whether your conviction is your own, or borrowed.

Q: How does AVL earn its money?

Q: How does AVL earn its money?

https://twitter.com/sahil_vi/status/1570550902850977794?t=hsb__xxdTImXIxRAg2yXMw&s=19

Q1: What does Tinna Rubber do?

Q1: What does Tinna Rubber do?

Negatives first

Negatives first

We already form an opinion on whether we want to own the company or not. Then, we try to look for confirming evidence that supports that bias to own a low pe company. psychologytoday.com/us/blog/ambiga…

We already form an opinion on whether we want to own the company or not. Then, we try to look for confirming evidence that supports that bias to own a low pe company. psychologytoday.com/us/blog/ambiga…