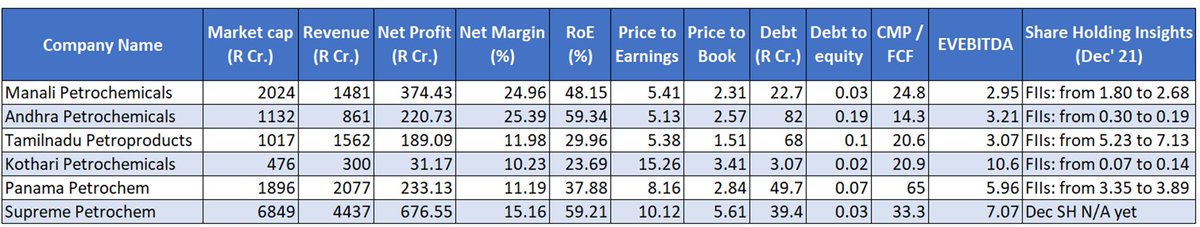

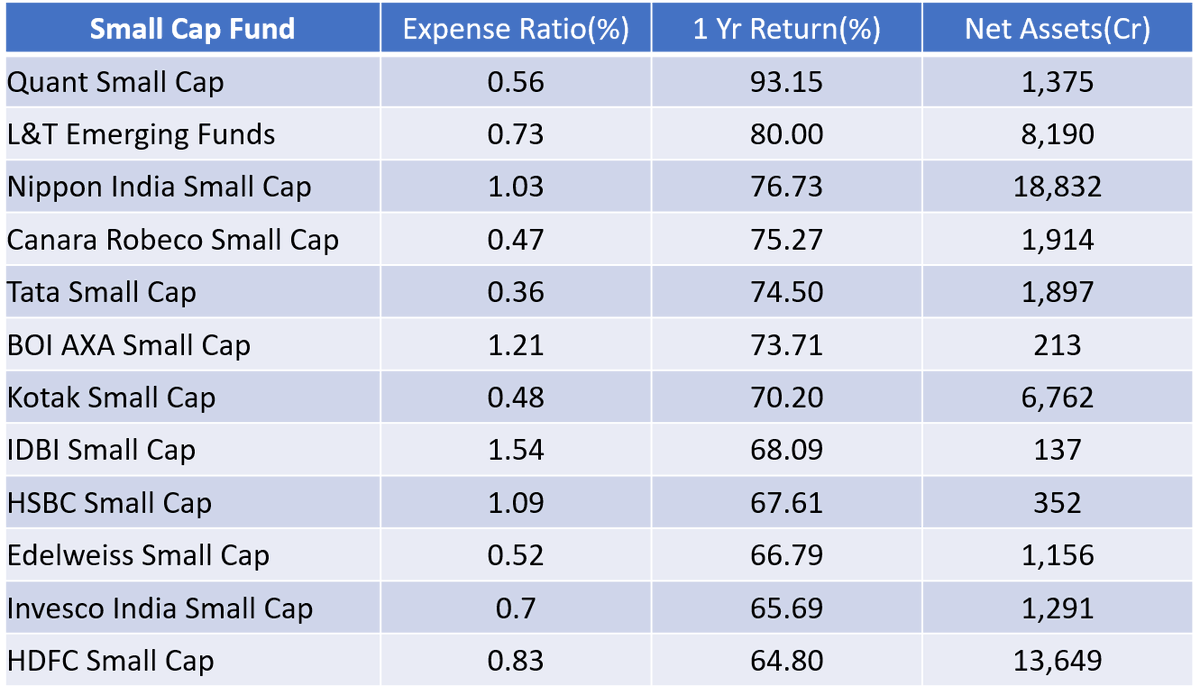

I enjoy studying Small Cap Companies & one of the best ways to study them is to observe the work of Small Cap Fund Mgrs. I analyzed top 12 funds & the top 5 holdings in those funds (Data-as of Dec'21). Nippon, in spite of large AUM, is doing very well!

Here is the summary:

(1/n)

Here is the summary:

(1/n)

(2/n)

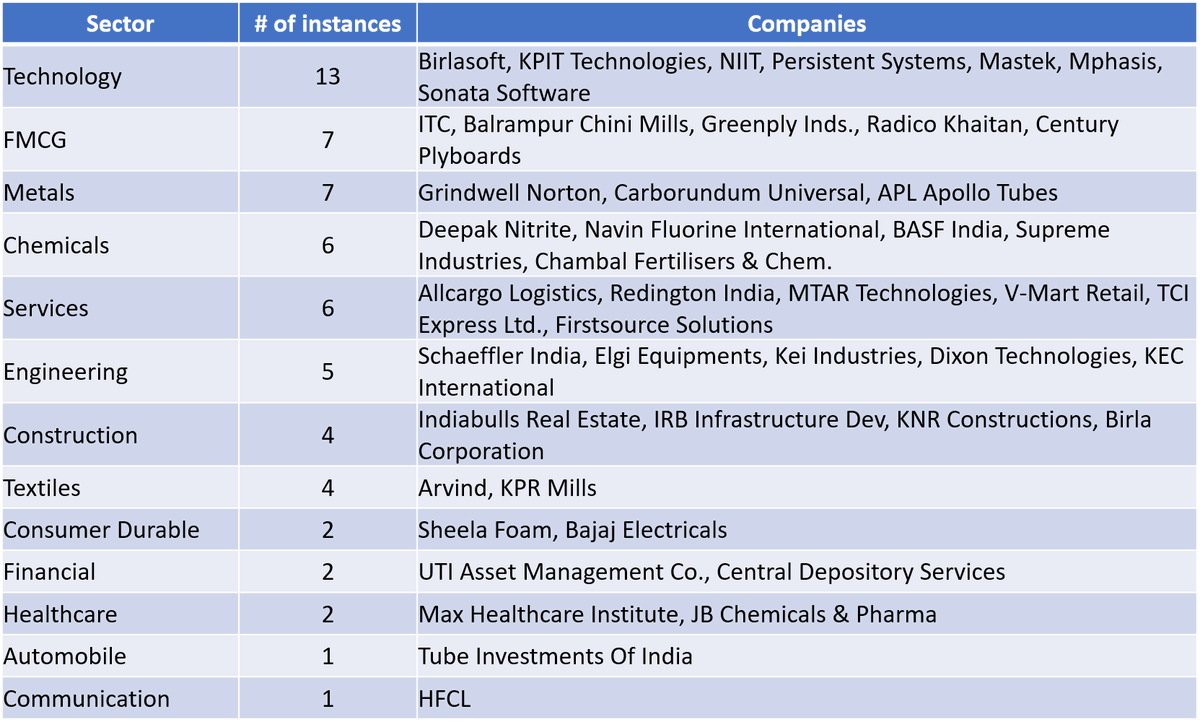

The usual suspects, SBI Small Cap & Axis Small Cap are missing from this list because their last one year returns are lower. My observation is SBI & Axis funds are a bit conservative and they actually perform well in sideways market. Lets see the sector allocation:

The usual suspects, SBI Small Cap & Axis Small Cap are missing from this list because their last one year returns are lower. My observation is SBI & Axis funds are a bit conservative and they actually perform well in sideways market. Lets see the sector allocation:

(3/n)

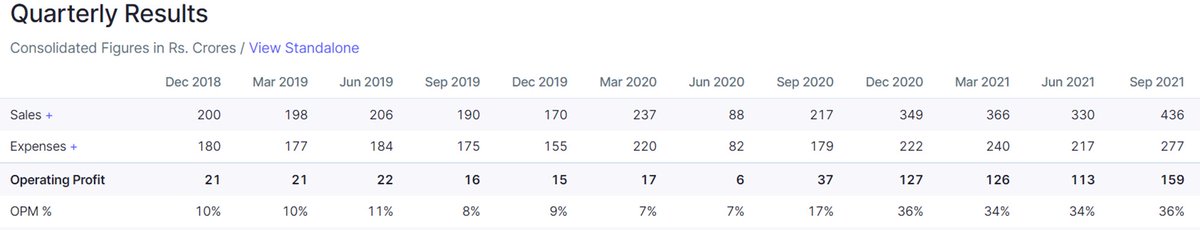

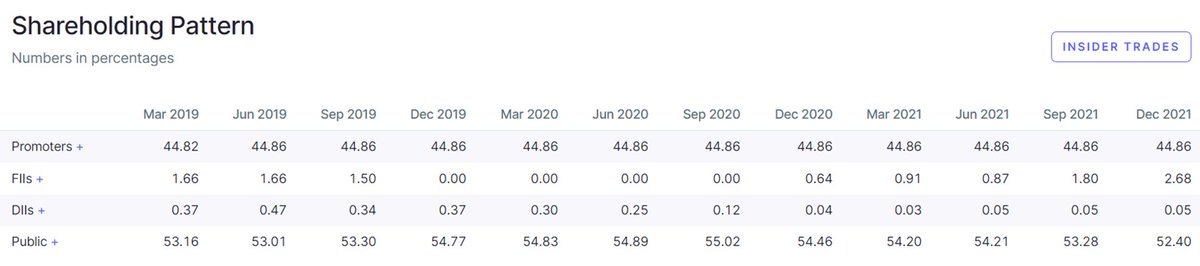

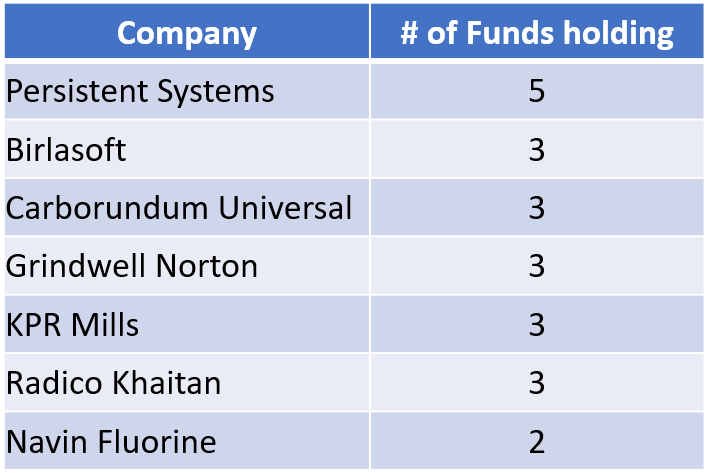

It's not surprising Technology is leading and Metals & Chemicals are in top 5. I am actually surprised Textiles' allocation was a bit conservative. Lets see the list of companies that are repeated in more than one fund.

It's not surprising Technology is leading and Metals & Chemicals are in top 5. I am actually surprised Textiles' allocation was a bit conservative. Lets see the list of companies that are repeated in more than one fund.

Conclusion:

1. Less commonality: Different Fund Mgrs are betting on different stocks in their top 5 (sign of bull market)

2. Best bet: Silicon Carbide stocks (EV, Capex cycle)

3. Fund mgrs are going with established names for top holdings

Which stocks do you hold from this list?

1. Less commonality: Different Fund Mgrs are betting on different stocks in their top 5 (sign of bull market)

2. Best bet: Silicon Carbide stocks (EV, Capex cycle)

3. Fund mgrs are going with established names for top holdings

Which stocks do you hold from this list?

• • •

Missing some Tweet in this thread? You can try to

force a refresh