0/n

I have studied Manali Petrochem, sharing here is the summary.

@Atulsingh_asan Bhai, I know you have been tracking MPL for a while, pls do share if I misquoted or missed any key points.

@sahil_vi, @ishmohit1 - Would appreciate your feedback on the approach

@VVVStockAnalyst

I have studied Manali Petrochem, sharing here is the summary.

@Atulsingh_asan Bhai, I know you have been tracking MPL for a while, pls do share if I misquoted or missed any key points.

@sahil_vi, @ishmohit1 - Would appreciate your feedback on the approach

@VVVStockAnalyst

1/n

Let's learn about Manali Petro

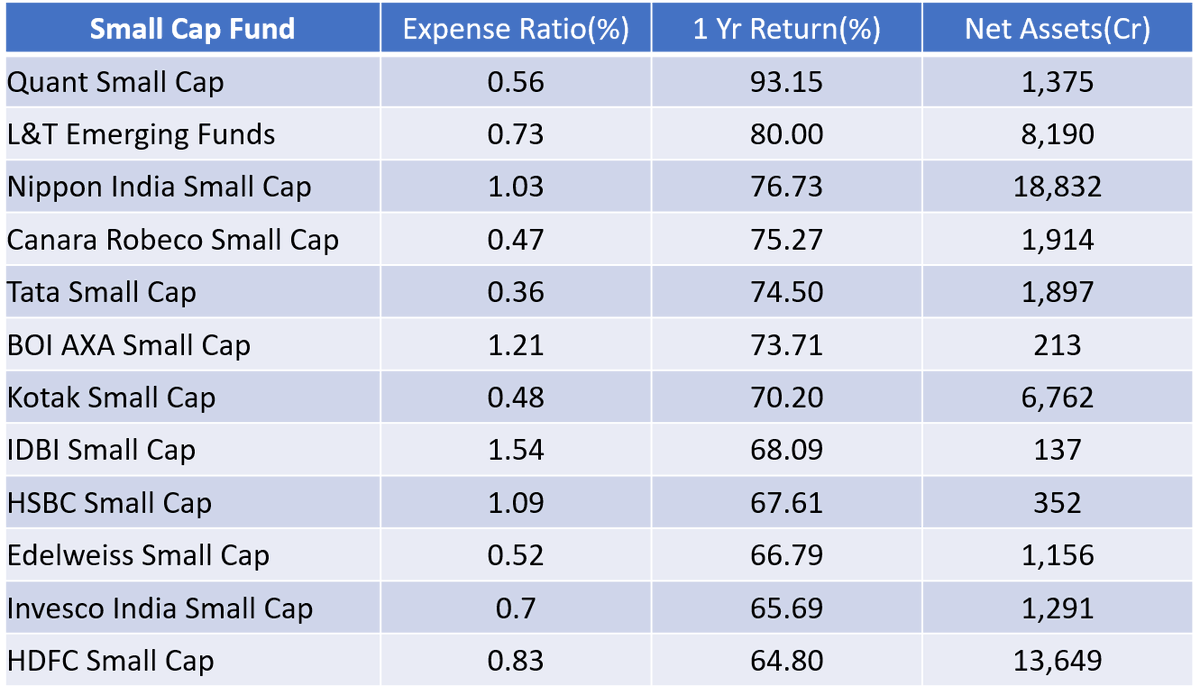

Many Petrochemical companies are available at attractive valuations. Kothari Petro has given 60% in last one month. Can it happen for others? Listed below are various Petrochem companies but I am covering Manali Petro Chem in detail today.

Let's learn about Manali Petro

Many Petrochemical companies are available at attractive valuations. Kothari Petro has given 60% in last one month. Can it happen for others? Listed below are various Petrochem companies but I am covering Manali Petro Chem in detail today.

2/n

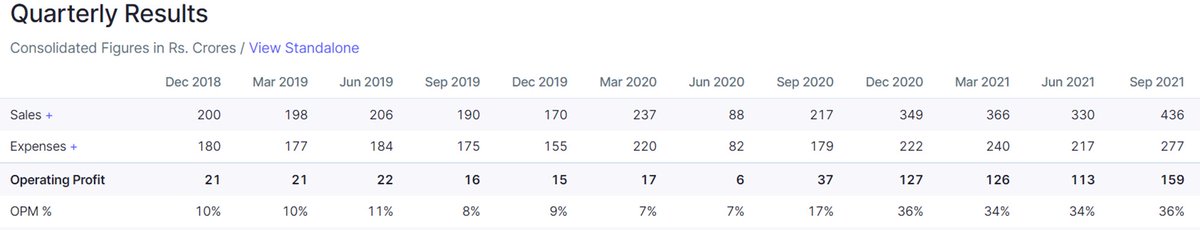

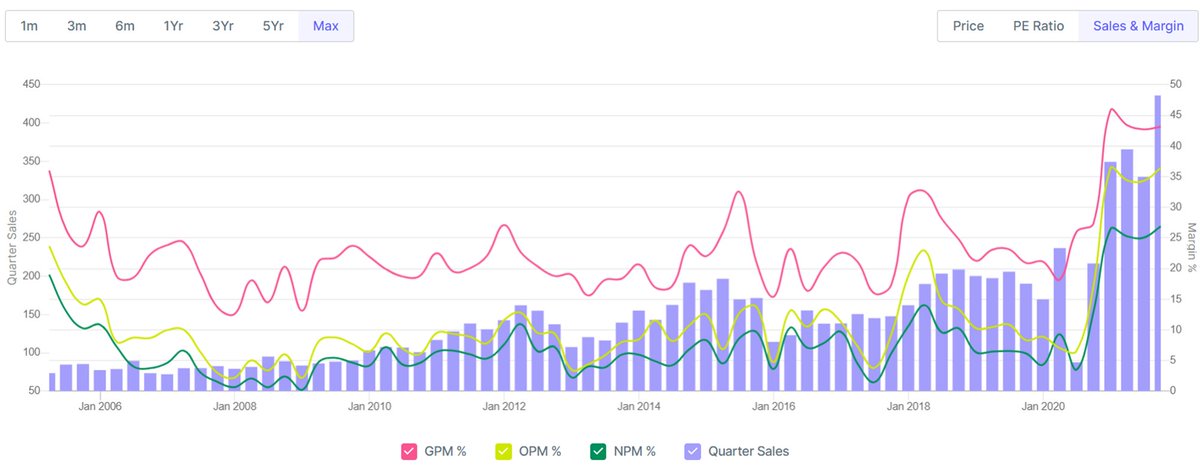

Why am I talking about Manali Petro?

1. Bcoz what used to be a revenue of 170-200 crores per quarter 2 years ago has jumped to 436 crores for Q2FY22

2. Because what used to be ~10% OPM two years ago jumped to ~36% for Q2FY22

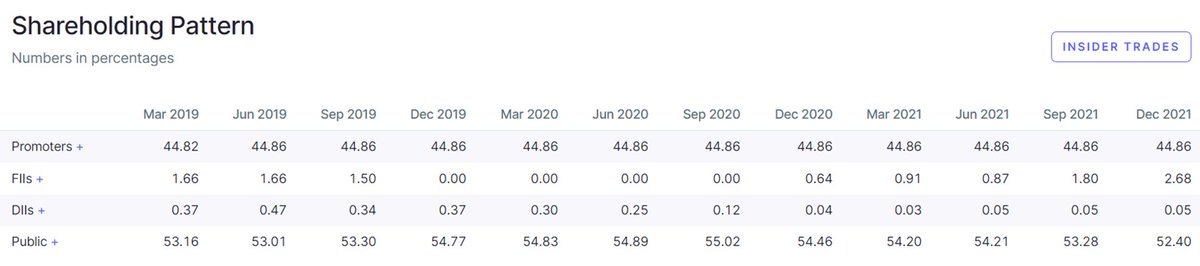

3. FII shareholding went up to 2.68%, highest ever

Why am I talking about Manali Petro?

1. Bcoz what used to be a revenue of 170-200 crores per quarter 2 years ago has jumped to 436 crores for Q2FY22

2. Because what used to be ~10% OPM two years ago jumped to ~36% for Q2FY22

3. FII shareholding went up to 2.68%, highest ever

3/n

Manali Petrochemicals Limited (MPL) is engaged in developing innovative products, since 1986, that find application in a variety of industries such as appliances, automotive, bedding, food & fragrances, furniture, footwear, paints and coatings, and pharmaceuticals.

Manali Petrochemicals Limited (MPL) is engaged in developing innovative products, since 1986, that find application in a variety of industries such as appliances, automotive, bedding, food & fragrances, furniture, footwear, paints and coatings, and pharmaceuticals.

4/n

Company operates in the Polyurethanes industry. Polyurethane known as PU is a mixture of compounds containing urethane, urea, Isocyanates, allophanates etc. In chemical terms it is essentially a polymer(all plastics are polymers, however, not all polymers are plastics).

Company operates in the Polyurethanes industry. Polyurethane known as PU is a mixture of compounds containing urethane, urea, Isocyanates, allophanates etc. In chemical terms it is essentially a polymer(all plastics are polymers, however, not all polymers are plastics).

5/n

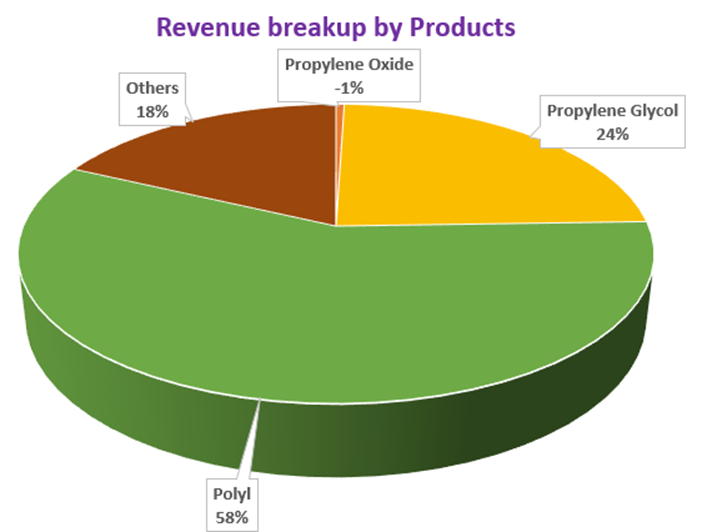

Procut mix

Company is a manufacturer of propylene glycol, polyether polyol & related substances. It is the only domestic manufacturer of Propylene Glycol. They also manufacture Propylene Oxide, the input material for these products. Thus, it has got Backward integration.

Procut mix

Company is a manufacturer of propylene glycol, polyether polyol & related substances. It is the only domestic manufacturer of Propylene Glycol. They also manufacture Propylene Oxide, the input material for these products. Thus, it has got Backward integration.

6/n

Propylene Glycol (PG) is most commonly used as drug solubilizer in tropical, oral & injectable medications, stabilizer for vitamins as well as in food & flavor and fragrance industries. FDA has recognized PG as a safe additive for human consumption.

Propylene Glycol (PG) is most commonly used as drug solubilizer in tropical, oral & injectable medications, stabilizer for vitamins as well as in food & flavor and fragrance industries. FDA has recognized PG as a safe additive for human consumption.

7/n

MPL supplies more of food & pharmaceutical grade PG to the Indian market. India market for both PG & Polyols are dominated by imports. For last few quarters, the market has gone thru lot of fluctuations due to COVID-19 disruptions and supply-chain challenges

MPL supplies more of food & pharmaceutical grade PG to the Indian market. India market for both PG & Polyols are dominated by imports. For last few quarters, the market has gone thru lot of fluctuations due to COVID-19 disruptions and supply-chain challenges

8/n

Lets understand why the revenues and earnings shot up. Two factors:

1. Imports dominate India PG and Polyol markets. So, when COVID-10 disrupted supply chain, imports couldn't happen and local manufacturers were the only choice for industries. Needless to say MPL benefited

Lets understand why the revenues and earnings shot up. Two factors:

1. Imports dominate India PG and Polyol markets. So, when COVID-10 disrupted supply chain, imports couldn't happen and local manufacturers were the only choice for industries. Needless to say MPL benefited

9/n

2. Logistics constraints also created shortage in developed markets and hence exporters to India shifted their focus to those lucrative markets.

In sum, the Indian market witnessed supplies falling short of demand & the prices peaked to unprecedented levels.

2. Logistics constraints also created shortage in developed markets and hence exporters to India shifted their focus to those lucrative markets.

In sum, the Indian market witnessed supplies falling short of demand & the prices peaked to unprecedented levels.

10/n

Before we get into thesis & anti-thesis, one of the burning questions is, "Is this a sunset industry?"

While in general Petrochem is considered sunset industry, MPL has already embarked on a green polyol production, so they are working ahead. Read @ tinyurl.com/4tbm853u

Before we get into thesis & anti-thesis, one of the burning questions is, "Is this a sunset industry?"

While in general Petrochem is considered sunset industry, MPL has already embarked on a green polyol production, so they are working ahead. Read @ tinyurl.com/4tbm853u

11/n

Application of PG and Polyols will continue to exist across industries but it will shift towards greener Chemistry. So, in that sense, MPL is here to stay. Thus, it leads us to final question of “Can the company sustain the earnings and margins?”

Application of PG and Polyols will continue to exist across industries but it will shift towards greener Chemistry. So, in that sense, MPL is here to stay. Thus, it leads us to final question of “Can the company sustain the earnings and margins?”

12/n

Thesis

1. Global PU market size valued at US$ 70bil in 2020 & would continue to grow.

2. Asian market is dominated by China followed by Japan.

3. At US$~200mil, MPL is just at 0.3% market share, so there is huge opportunity

Thesis

1. Global PU market size valued at US$ 70bil in 2020 & would continue to grow.

2. Asian market is dominated by China followed by Japan.

3. At US$~200mil, MPL is just at 0.3% market share, so there is huge opportunity

13/n

Thesis

4. MPL has enhanced it's market share in IND thx to COVID-19 & so there is a fair chance some of these new clients will stay with MPL instead of importing again

5. FIIs have increased their share in Q3 & perhaps they have fair idea of the earnings sustainability

Thesis

4. MPL has enhanced it's market share in IND thx to COVID-19 & so there is a fair chance some of these new clients will stay with MPL instead of importing again

5. FIIs have increased their share in Q3 & perhaps they have fair idea of the earnings sustainability

14/n

Anti-thesis

1. the Indian Polyol & PG market under normal circumstances is dominated by imports. Major players such as DOW, Sadara, etc. have higher capacity offer higher quantity of Polyols to Indian market at very low prices.

Anti-thesis

1. the Indian Polyol & PG market under normal circumstances is dominated by imports. Major players such as DOW, Sadara, etc. have higher capacity offer higher quantity of Polyols to Indian market at very low prices.

15/n

Anti-thesis

2. Even imposition of Anti-Dumping Duties has not alleviated woes of the domestic producers as the MNCs either supply the materials from places not covered under ADD or bear the additional cost.

Anti-thesis

2. Even imposition of Anti-Dumping Duties has not alleviated woes of the domestic producers as the MNCs either supply the materials from places not covered under ADD or bear the additional cost.

16/n

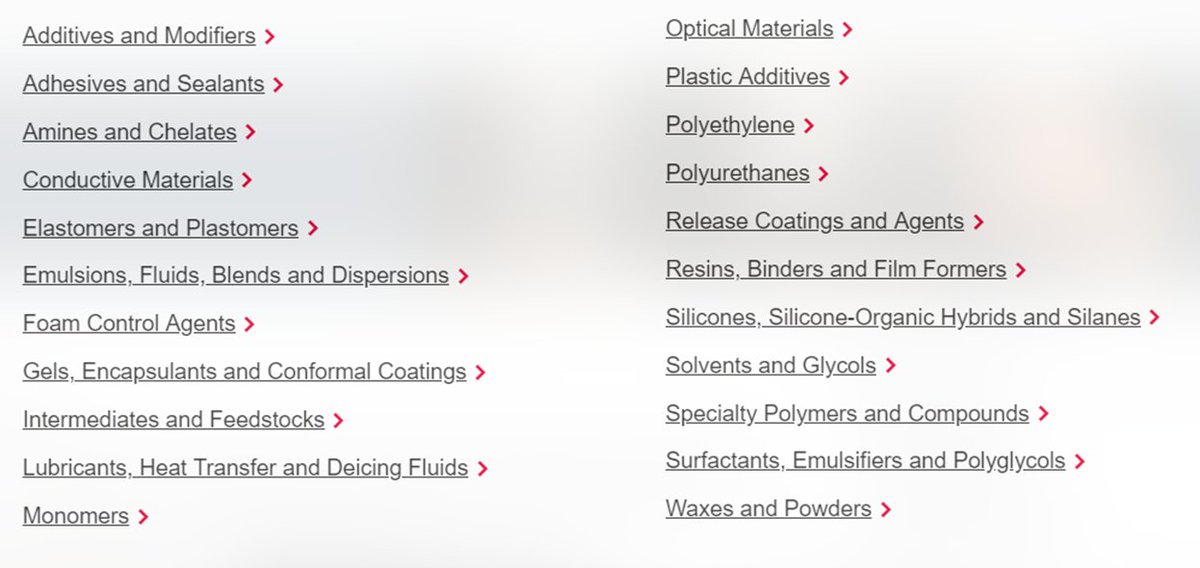

Anti-thesis

3. DOW and Sadara have far superior product portfolio (see the image) so there is a good chance, their Indian clients must be consuming few other products as well. Thus, all such clients might go back to importing once the logistics issues settle down.

Anti-thesis

3. DOW and Sadara have far superior product portfolio (see the image) so there is a good chance, their Indian clients must be consuming few other products as well. Thus, all such clients might go back to importing once the logistics issues settle down.

17/n

Anti-thesis

4. Across the globe, the top manufacturers control over 60% of the total PU production giving them enormous control over product pricing and other strategies. Thus, if DOW or Sadara slash the prices once logistics issue are resolved, MPL's earning will evaporate

Anti-thesis

4. Across the globe, the top manufacturers control over 60% of the total PU production giving them enormous control over product pricing and other strategies. Thus, if DOW or Sadara slash the prices once logistics issue are resolved, MPL's earning will evaporate

18/n

Anti-thesis

5. Discharge of waste out of the manufacturing process is an issue and there is a NGT case that's been filed on several companies including MPL. While this is a common risk for all chemical companies, just wanted to call it out

Anti-thesis

5. Discharge of waste out of the manufacturing process is an issue and there is a NGT case that's been filed on several companies including MPL. While this is a common risk for all chemical companies, just wanted to call it out

19/n

Valuations - Earnings went up since 2020 because revenue doubled but expenses went up only by 30% and hence P/E became sub 5. Otherwise, historically, OPM has only been around 9-10%. Thus the current cheap valuation is due to temporary advantage that COVID presented.

Valuations - Earnings went up since 2020 because revenue doubled but expenses went up only by 30% and hence P/E became sub 5. Otherwise, historically, OPM has only been around 9-10%. Thus the current cheap valuation is due to temporary advantage that COVID presented.

Conclusion

There is a bit of uncertainty around whether MPL's enhanced business will stay with them or will the MNCs will take over what really was their original share.

If MPL will be able to retain large portion, it will be a great stock to own, if not it cud become Panacea

There is a bit of uncertainty around whether MPL's enhanced business will stay with them or will the MNCs will take over what really was their original share.

If MPL will be able to retain large portion, it will be a great stock to own, if not it cud become Panacea

• • •

Missing some Tweet in this thread? You can try to

force a refresh