Ready for some chart crimes? I'm going to show 10 charts & come to the conclusions that prove my point. Haha.. just kidding, but I do want to share some interesting stuff.

Metric mainly being used is Gross Profit/EV Yield (LTM). Used @KoyfinCharts for these.

Metric mainly being used is Gross Profit/EV Yield (LTM). Used @KoyfinCharts for these.

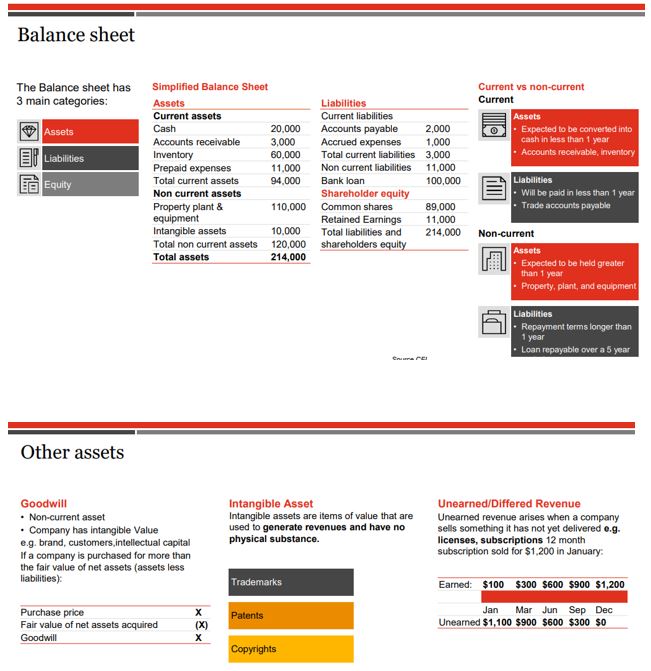

Yes I'm aware that there's a mile wide gap between Gross Profit and FCF, but a good GM margin along with huge yrly growth affords the company to spend on OPEX (hopefully spending in the right areas) while building a durable company & getting towards sustainable FCF generation.

Although I have used EV/GP/NTM growth before, I haven't used the inverted metric (LTM) to see what yield we're getting on the GP (unlike the FCF yield used on mature companies).

Looking back, anytime we get to GP/EV yield of < 2% 🚨, especially if you're entering into a big position then, we're just asking the Market to punish us.😂

You better know the Co really well and why it's GM% might improve or grow really fast. If not, watch out.

You better know the Co really well and why it's GM% might improve or grow really fast. If not, watch out.

Below are 10 companies that I currently own, which are a good exercise for this. Only showing the (mostly GAAP) unprofitable growth Cos.

For each stock below, making a historical comment on the GP/EV yield and one fundamental comment on what I like to see soon.

For each stock below, making a historical comment on the GP/EV yield and one fundamental comment on what I like to see soon.

1⃣ $ROKU

GP/EV yield now is as high as during COVID crash. Dec'18 was even higher. Overall 2018 wasn't a great year for ROKU but was a great oppty for those who saw the Platform/Ad strategy earlier.

Would like to see TRC traction, ARPU increase and less HW/supply chain issues.

GP/EV yield now is as high as during COVID crash. Dec'18 was even higher. Overall 2018 wasn't a great year for ROKU but was a great oppty for those who saw the Platform/Ad strategy earlier.

Would like to see TRC traction, ARPU increase and less HW/supply chain issues.

2⃣ $SQ

GP/EV yield now is at a post COVID high. March 2020 was higher. Could be a lot of GP growth ahead on Seller side. Let's see.

Would like to see smooth acquisition/integration of Afterpay between the Seller and Cash App business.

GP/EV yield now is at a post COVID high. March 2020 was higher. Could be a lot of GP growth ahead on Seller side. Let's see.

Would like to see smooth acquisition/integration of Afterpay between the Seller and Cash App business.

3⃣ $UPST

GP/EV yield now is at the highest level since IPO days. With so much growth ahead, either the yield spikes or the stock🚀. Let's see.

Would like to see close monitoring of loan performance to ensure the current loan growth doesn't come back to bite in bad times.

GP/EV yield now is at the highest level since IPO days. With so much growth ahead, either the yield spikes or the stock🚀. Let's see.

Would like to see close monitoring of loan performance to ensure the current loan growth doesn't come back to bite in bad times.

4⃣ $TDOC

GP/EV yield now is at post COVID highs and slightly higher than 2019.

Would like to see better Management of the company, good integration (& continued development) of existing products and cross-selling. Hoping to see the business growth & stock direction aligned.

GP/EV yield now is at post COVID highs and slightly higher than 2019.

Would like to see better Management of the company, good integration (& continued development) of existing products and cross-selling. Hoping to see the business growth & stock direction aligned.

5⃣ $DOCU

GP/EV yield now is at post COVID highs, but still lower than 2019 (probably when it was viewed as just an E-Signature company).

Would like to see actual growth in CLM business to prove to the Market that it's not just a E-Signature company.

GP/EV yield now is at post COVID highs, but still lower than 2019 (probably when it was viewed as just an E-Signature company).

Would like to see actual growth in CLM business to prove to the Market that it's not just a E-Signature company.

6⃣ $TWLO

GP/EV yield now surprisingly is still low and haven't reached COVID crash levels. Can't compare to 2018 when it was a different Company & also overly reliant on 2-3 customers.

Would like to see organic growth stabilize (around 40%) and good traction with Segment.

GP/EV yield now surprisingly is still low and haven't reached COVID crash levels. Can't compare to 2018 when it was a different Company & also overly reliant on 2-3 customers.

Would like to see organic growth stabilize (around 40%) and good traction with Segment.

7⃣ $FVRR

GP/EV yield now is at post COVID high but still much lower than Pre Mar-2020 levels. Either we got way too excited with this Freelancing stuff (post COVID) or the Company has plenty of growth ahead (my current bet).

Would like to see growth in Sellers/Buyers/Business

GP/EV yield now is at post COVID high but still much lower than Pre Mar-2020 levels. Either we got way too excited with this Freelancing stuff (post COVID) or the Company has plenty of growth ahead (my current bet).

Would like to see growth in Sellers/Buyers/Business

8⃣ $GDRX

GP/EV yield now is highest ever. One of the Cos I cheer the most for (yeah Gov and incumbents aren't gonna bring down those prescription prices anytime soon).

Would like to see increasing consumer awareness & more utilization of the core product helping adj offerings.

GP/EV yield now is highest ever. One of the Cos I cheer the most for (yeah Gov and incumbents aren't gonna bring down those prescription prices anytime soon).

Would like to see increasing consumer awareness & more utilization of the core product helping adj offerings.

9⃣ $PINS

GP/EV yield now is at the highest level (except the brief COVID crash). Hopefully what currently looks like value doesn't turn out to be a value trap.

Would like to see the MAU bleeding stop (or minimize), ARPU growth (both domestic/intl) and Social commerce traction.

GP/EV yield now is at the highest level (except the brief COVID crash). Hopefully what currently looks like value doesn't turn out to be a value trap.

Would like to see the MAU bleeding stop (or minimize), ARPU growth (both domestic/intl) and Social commerce traction.

🔟 $PTON

GP/EV yield now is at the highest ever. Ah! the poster child of self-inflicted wounds.😂

Would like to see Co managing costs in line with expected demand, keeping Content quality high, managing supply chain issues & especially setting right expectations with Wall St.

GP/EV yield now is at the highest ever. Ah! the poster child of self-inflicted wounds.😂

Would like to see Co managing costs in line with expected demand, keeping Content quality high, managing supply chain issues & especially setting right expectations with Wall St.

As mentioned, I was using this GP/EV (LTM) yield to show its usefulness in monitoring the high growth unprofitable Cos which might better indicate both froth and attractive periods, rather than looking at just the stock price or EV/S (as GM margin can vary hugely).

In a normal world, FCF yield of 2% is not considered attractive unless the biz is still accelerating. So when the GP yield itself is 1-2%, we're setting the business up for a huge task not to have even the slightest slowdown & asking for a continued favorable valuation period.

All these GP/EV yields could continue spiking higher due to Macro in the next few months (primarily due to the drop in stock price), but the higher it goes the more interested I'll be (unless the qtrly results show a slowing/weakening business).

All metrics have certain drawbacks and don't universally fit to all types of companies (or Co life stages). So use it contextually and along with other reliable and time tested metrics.

/END

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh