Thread: Why @GMX_IO Could Be The Next Defi Cash-Cow

So for the last week or so I’ve been doing a massive deep dive into @GMX_IO $GMX...

1/x

So for the last week or so I’ve been doing a massive deep dive into @GMX_IO $GMX...

1/x

Its extremely complex, and I don't understand all of the mechanics, but its a fascinating protocol generating massive organic cashflow, and I wanted to do a thread breaking down everything I've learned about it.

2/x

2/x

This thread is a very basic overview, however there is absolutely incredible institutional-grade research on it available totally free on this here bird-app and on Medium, which I'll be linking to throughout (really incredible stuff tbh).

3/x

3/x

.. @GMX_IO is a permissionless exchange offering leveraged/margin trading based on Chainlink price feeds.

This is essentially the ‘leveraged trading’ we hear about every time the market tanks and a bunch of traders on FTX get liquidated, but ON-CHAIN.

4/x

This is essentially the ‘leveraged trading’ we hear about every time the market tanks and a bunch of traders on FTX get liquidated, but ON-CHAIN.

4/x

One of the reasons this is a big deal is the vast market size…

As broken down by gigabrain #1 who I’ll be referencing - @0xKepler- “BTC and ETH perpetual futures contracts have a monthly trading volume of ~$2T. In comparison, spot volume is roughly 7x smaller, at $30B."

5/x

As broken down by gigabrain #1 who I’ll be referencing - @0xKepler- “BTC and ETH perpetual futures contracts have a monthly trading volume of ~$2T. In comparison, spot volume is roughly 7x smaller, at $30B."

5/x

To serve this market, @GMX_IO launched as Gambit Finanial earlier this year on BSC, then re-branded to Gmx(dot)io on Arbitrum.

In that time they have seen dramatically increased trading volume, and just expanded to Avax this week.

6/

In that time they have seen dramatically increased trading volume, and just expanded to Avax this week.

6/

According to gigabrain #2 - @PressieMoonBoy - Gmx did over 200M trade volume on January 12th, with a tvl of just 140M.

That level of utilization (the ratio of volume to tvl) is quite breathtaking, and demonstrates how profitable this type of protocol can be.

7/

That level of utilization (the ratio of volume to tvl) is quite breathtaking, and demonstrates how profitable this type of protocol can be.

7/

But how does it work? And how do you get access to that cashflow? That’s what we’ll dive into below!

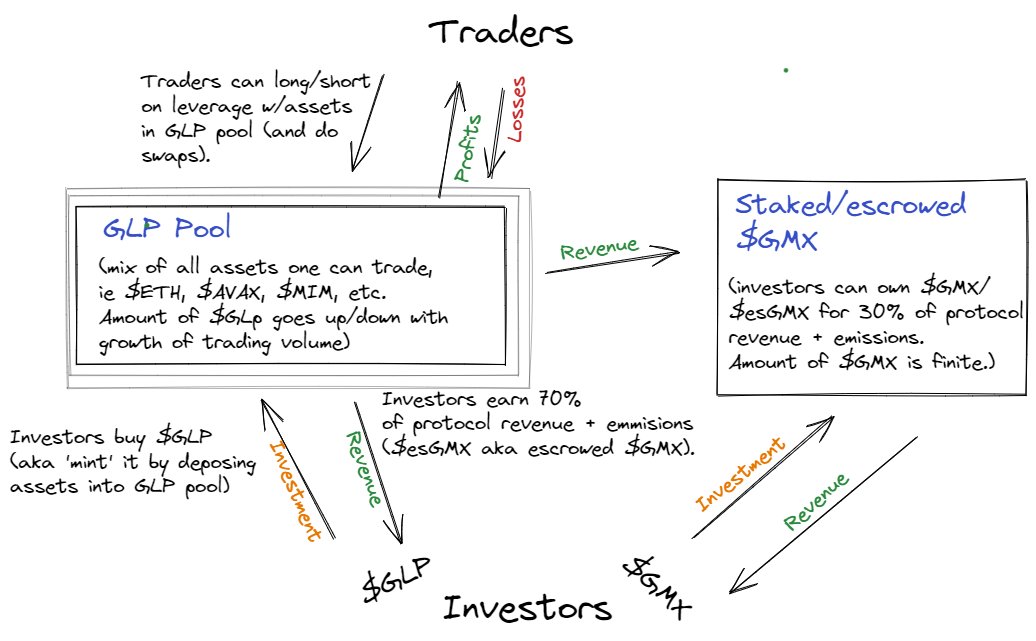

As detailed in the #FrenchChart below, @GMX_IO uses an interesting strategy based on their $GLP pool + $GMX protocol/governance token.

8/x

As detailed in the #FrenchChart below, @GMX_IO uses an interesting strategy based on their $GLP pool + $GMX protocol/governance token.

8/x

$GLP tokens represent shares in the GLP pool, which is a pool of the assets supported by the protocol.

The GLP pool is essentially the liquidity that traders use to long/short/swap/etc.

9/x

The GLP pool is essentially the liquidity that traders use to long/short/swap/etc.

9/x

$GLP providers earn 70% of the protocols revenue- but remember- the supply is not fixed, so the return LP’ing $GLP should stay relatively constant whether the protocol grows or shrinks (remember this for when we talk about $GMX in comparison!).

10/x

10/x

With that said, the value of $GLP will go up or down depending on the changing value of the mix of tokens inside of it.

$ETH makes up the majority of it, but there are other blue chips, and stablecoins, so its somewhat similar to the atricrypto pool on @CurveFinance.

11/x

$ETH makes up the majority of it, but there are other blue chips, and stablecoins, so its somewhat similar to the atricrypto pool on @CurveFinance.

11/x

There’s also the risk that traders’ collective results will cause the $GLP pool to underperform the returns of their underlying assets.

However, as a smol-brain it seems to me that basically the protocol is ever-perfecting their algorithms and rules to minimize this risk.

12/

However, as a smol-brain it seems to me that basically the protocol is ever-perfecting their algorithms and rules to minimize this risk.

12/

Then there’s the yield.

The yield comes from the fees paid by traders.

These include open & close fees (on overall position size), swap fees, and borrowing fees.

These fees + available volume must be managed by the protocol in a way as to minimize directionality risk.

13/x

The yield comes from the fees paid by traders.

These include open & close fees (on overall position size), swap fees, and borrowing fees.

These fees + available volume must be managed by the protocol in a way as to minimize directionality risk.

13/x

So how much revenue does all this generate?

Gigabrain #3- @Mark2work - has analyzed existing data to infer that protocol revenue = approximately 0.00147 of overall volume traded, and at current prices $1 of $GLP providers a $0.31 return of pure organic protocol revenue.

14/x

Gigabrain #3- @Mark2work - has analyzed existing data to infer that protocol revenue = approximately 0.00147 of overall volume traded, and at current prices $1 of $GLP providers a $0.31 return of pure organic protocol revenue.

14/x

Right now there’s also emissions of (escrowed) $GMX being paid out to $GLP providers though, and on Avax providing $GLP is currently earning over 100% apr.

The tokenomics of $GMX itself are the next thing to cover.

15/

The tokenomics of $GMX itself are the next thing to cover.

15/

$GMX holders get governance rights and also get 30% of all protocol fees.

In the case of $GMX though- unlike $GLP- the total number of tokens is finite, meaning that your returns from it are directly affected by the protocol’s total volume.

16/x

In the case of $GMX though- unlike $GLP- the total number of tokens is finite, meaning that your returns from it are directly affected by the protocol’s total volume.

16/x

As @Mark2work shows, at 200M per day volume, $1 of $GMX at current prices would earn 10% apr via organic protocol revenue, 6% once fully diluted.

At 3.3B/day though, the same $1 of $GMX would be earning 163% apr from organic revenue, or exactly 100% once fully diluted.

17/x

At 3.3B/day though, the same $1 of $GMX would be earning 163% apr from organic revenue, or exactly 100% once fully diluted.

17/x

As a result, at current volumes its more profitable to LP $GLP, but once the protocol hits 700M in volume per day $GMX (at current prices) becomes more profitable.

(link to cited works at end of thread)

18/x

(link to cited works at end of thread)

18/x

In reality, the price of $GMX will likely go up as its yields go up. So, much like with Convex, you may eventually have a lower apr, but that’s only because the value of your tokens will have increased so much 😊

Also right now apr's for both are much higher bc emissions.

19/x

Also right now apr's for both are much higher bc emissions.

19/x

It appears the main question then is how much will volume grow from here?

I have zero experience in leveraged training, so I’m not very tied in to just how many people are using it, however the increasing volume suggests that it is indeed being used more and more.

20/x

I have zero experience in leveraged training, so I’m not very tied in to just how many people are using it, however the increasing volume suggests that it is indeed being used more and more.

20/x

It also seems to me that @GMX_IO is well-positioned to become a key money lego (delta neutral strats, etc).

It could also become heavily integrated with options platforms, and indeed- the great @tztokchad himself has meme’d about $GMX in the past:

21/x

It could also become heavily integrated with options platforms, and indeed- the great @tztokchad himself has meme’d about $GMX in the past:

https://twitter.com/tztokchad/status/1477725517612736516

21/x

I have taken a 2% position LP’ing $GLP, and a 1% position in $GMX.

If volume/$GMX price ratio goes up/down I may buy more/trim position.

Overall though it looks like a good, cashflowing token that has the chance to pull a “1% to 10%” move, a’la @noahseidman :)

22/x

If volume/$GMX price ratio goes up/down I may buy more/trim position.

Overall though it looks like a good, cashflowing token that has the chance to pull a “1% to 10%” move, a’la @noahseidman :)

22/x

Note: As of right now the team has not added liquidity for $GMX on Avalanche, so if you want to buy it you have to go to Arbitrum.

I am impatient so I did this but will likely bridge it back if possible to stake on Avalanche. My $GLP is also on Avalanche.

23/x

I am impatient so I did this but will likely bridge it back if possible to stake on Avalanche. My $GLP is also on Avalanche.

23/x

Finally, as mentioned, there are a bunch of INSANELY GOOD threads/articles on @GMX_IO, and I will link to every single one of them below and recommend reading and re-reading them all:

24/x

24/x

1: The brilliant @FloodCapital explaining the protocol, going over current volume and valuation, and other analysis:

25/x

https://twitter.com/FloodCapital/status/1462901024352522241

25/x

2. Gigabrain @PressieMoonBoy on why this business model has such vast potential for scale/profits:

26/x

https://twitter.com/PressieMoonBoy/status/1481811757396074500

26/x

3: The aforementioned thread on revenues, yield on $GLP vs $GMX, and more, by the amazing @Mark2work:

27/x

https://twitter.com/Mark2work/status/1480462616342544388

27/x

4: My man @john_mabe on market position, tokenomics, potential:

28/x

https://twitter.com/john_mabe/status/1481170120513056769

28/x

4: My man @john_mabe on market position, tokenomics, potential:

28/x

https://twitter.com/john_mabe/status/1481170120513056769

28/x

6: Good Medium article from a ‘Vikram Arum’ on Gmx: medium(dot)com/@ vikram.arun/gmx-the-trading-platform-of-the-people-by-the-people-for-the-people-c4856897478

30/x

30/x

7: Absolutely incredible Medium article from genius @0xKepler giving extremely thorough analysis of project (must-read!):

31/x

https://twitter.com/0xKepler/status/1478713572444323840

31/x

Finally... I should add that this is a very complex protocol and there's a high likelihood I butchered some of the above explanations/mis-stated specifics.

Plz feel free to correct any mistakes below, or link to additional resources.

32/x

Plz feel free to correct any mistakes below, or link to additional resources.

32/x

Finally... most of the above would have been Latin to me before I dove into CT, so huge thanks to og educational accounts like:

@Ceazor7

@TaikiMaeda2

@Route2FI

@takegreenpill

@lemiscate

@JackNiewold

@blocmatesdotcom

@Prof_Crypto_B

@BillyBobBaghold

@Cryptoyieldinfo

@Ceazor7

@TaikiMaeda2

@Route2FI

@takegreenpill

@lemiscate

@JackNiewold

@blocmatesdotcom

@Prof_Crypto_B

@BillyBobBaghold

@Cryptoyieldinfo

Oops, looks like I did tweet 28/x twice and forgot this one:

5: Great thread on @GMX_IO from back in November by @ILiketoCope:

5: Great thread on @GMX_IO from back in November by @ILiketoCope:

https://twitter.com/ILiketoCope/status/1464870418926428163

More great info from @john_mabe on potential @dopex_io integrations:

https://twitter.com/john_mabe/status/1482161655098507264

• • •

Missing some Tweet in this thread? You can try to

force a refresh