Angel One Ltd conduced the conference for Q3 today at 11:00 AM.

Here are the conference call highlights

🧵👇

Here are the conference call highlights

🧵👇

Business Updates:

• 35% of payout given as interim dividend.

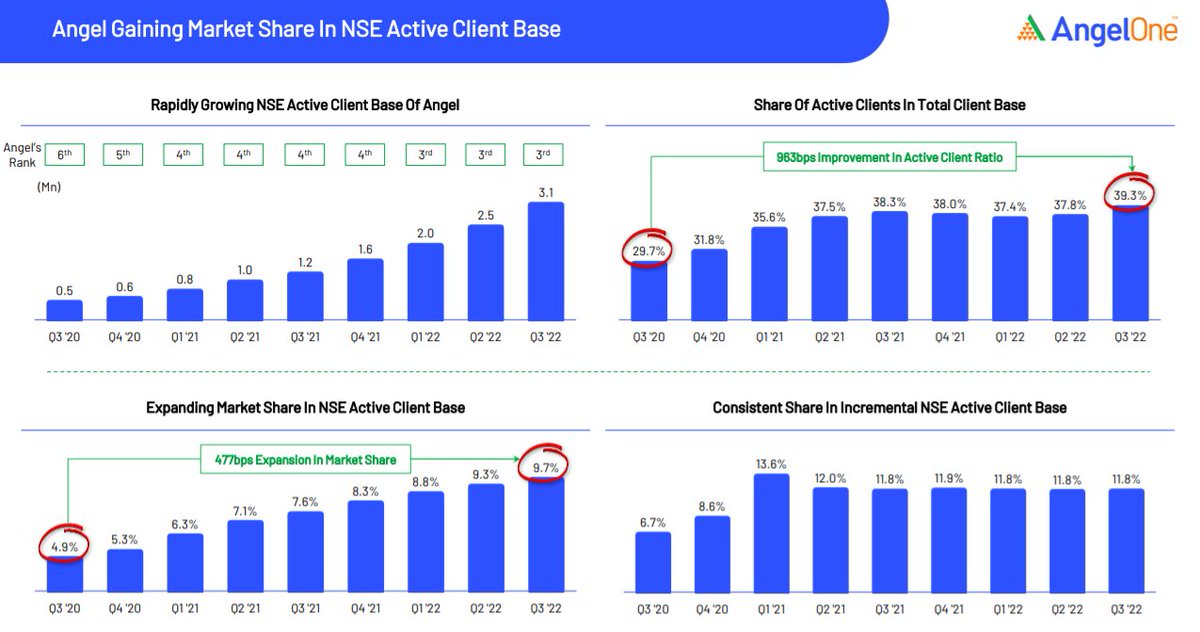

• Client Activation increased to 39% from 37% in Q2 FY22.

• Build new digitize app, for increasing client experience. New app is in beta and is expected to launch soon.

• Acquired 3.8Mil client in current year.

• 35% of payout given as interim dividend.

• Client Activation increased to 39% from 37% in Q2 FY22.

• Build new digitize app, for increasing client experience. New app is in beta and is expected to launch soon.

• Acquired 3.8Mil client in current year.

Industry Update:

• India has open 10 Million new account in Q3, taking total count of 81 Million.

• Mgmt expect this growth to be sustainable.

• Total trade volumes had increased even in the correction market.

• Industry shifted from charging turnover base to order base.

• India has open 10 Million new account in Q3, taking total count of 81 Million.

• Mgmt expect this growth to be sustainable.

• Total trade volumes had increased even in the correction market.

• Industry shifted from charging turnover base to order base.

Market Presence:

• Share of commodity market has increased continuously.

• Cash market got impacted due to changing norms by SEBI leading to impact in margins.

• Commodity market share is high because of trust build by Angel, and uptime on both the shifts given by Angel

• Share of commodity market has increased continuously.

• Cash market got impacted due to changing norms by SEBI leading to impact in margins.

• Commodity market share is high because of trust build by Angel, and uptime on both the shifts given by Angel

Clients:

• Active client ratio increased to 3.1 Million

• Number of order grew 6x reaching to 180 Million.

• Commodity segment has remain at all time best.

• Avg. client funding book reached to ~Rs 16.4 Billion.

• Avg revenue per client has grew by 5.8x.

• Active client ratio increased to 3.1 Million

• Number of order grew 6x reaching to 180 Million.

• Commodity segment has remain at all time best.

• Avg. client funding book reached to ~Rs 16.4 Billion.

• Avg revenue per client has grew by 5.8x.

Data:

• Cost to income are at 49% and mgmt expect it to be sustainable.

• With increasing market share, mgmt expect margin to be sustainable. Increasing margin would be devoted to technology spend.

• ARPU decline to 528Rs. But. co. focus on increasing margin, ARPU may decline

• Cost to income are at 49% and mgmt expect it to be sustainable.

• With increasing market share, mgmt expect margin to be sustainable. Increasing margin would be devoted to technology spend.

• ARPU decline to 528Rs. But. co. focus on increasing margin, ARPU may decline

Super App:

• With new app co. focuses on first customer to easily place the order.

• New app will be usable across country, with low bandwidth, vernacular in language, and different financial instrument will be added.

• This will be started with MF, Insurance first.

• With new app co. focuses on first customer to easily place the order.

• New app will be usable across country, with low bandwidth, vernacular in language, and different financial instrument will be added.

• This will be started with MF, Insurance first.

Technology spend:

• Any technology expense related to development will be capitalize.

• Tech spend in 9 months is 100cr of which CAPEX is 6cr.

• New app will bundle all the financial service for the customer in need.

• App will be based on AI / ML with knowledge feature.

• Any technology expense related to development will be capitalize.

• Tech spend in 9 months is 100cr of which CAPEX is 6cr.

• New app will bundle all the financial service for the customer in need.

• App will be based on AI / ML with knowledge feature.

Focus:

• Mgmt focus on increasing the market share & increase in margin.

• This may lead to decline in ARPU, but focus may remain on adding clients, which will increase ARPU in future.

• Break even has remain 4-5 months

• Revenue Share in int. income & broking are increasing

• Mgmt focus on increasing the market share & increase in margin.

• This may lead to decline in ARPU, but focus may remain on adding clients, which will increase ARPU in future.

• Break even has remain 4-5 months

• Revenue Share in int. income & broking are increasing

Why change to new app?

• Over past 3 years, there is lot more customer shift in the industry.

• With increasing data, new customer looks for such services, hence new app is taken.

• While new services of ML will be in need for future which will be used come in industry soon.

• Over past 3 years, there is lot more customer shift in the industry.

• With increasing data, new customer looks for such services, hence new app is taken.

• While new services of ML will be in need for future which will be used come in industry soon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh