In November 2020, a journalist wrote a piece titled "Why I Am Losing Hope In India". The screed was shared widely by the usual suspects, offering an extremely negative prognosis on how the India story might be on its last legs.

Let us assess how things have turned out over the last ~15 months for India and the Indian economy.

Entrepreneurship: 2021 was a record year for IPOs and for new unicorns minted.

Entrepreneurship: 2021 was a record year for IPOs and for new unicorns minted.

India continued to see net investment from institutional investors, even as other Asian countries saw significant net outflows - reflecting investor confidence in Indian business.

Public health: India started vaccinations on January 16 2021. As of this morning, over 1.58 billion shots were completed. ~95% of eligible persons have received one dose, about 70% of eligible persons are fully vaccinated.

India's vaccination rate has been *the world's fastest*.

India's vaccination rate has been *the world's fastest*.

Macro: @IMFNews projects India to be the world's fastest growing economy - for 2021 and 2022. India, a ~$3T GDP economy, leads not just Asian or emerging economies, but is likely to be the world's growth engine.

Goods exports are picking up as the various economic reforms implemented in the last 8 years bear fruit, helping raise India's share of global goods export to an all-time high.

Indian savings are financializing like never before, getting invested into equities, and it is still early days as workers join formal economy and park savings into stocks.

Finally: National-scale programs like @jaljeevan_ have been making sustained progress over the last 3 years, despite the challenges brought by the global pandemic.

These programs especially benefit women ideasforindia.in/topics/social-…

https://twitter.com/RMantri/status/1324372955749445633?s=20

https://twitter.com/RMantri/status/1364098769688489987?s=20

These programs especially benefit women ideasforindia.in/topics/social-…

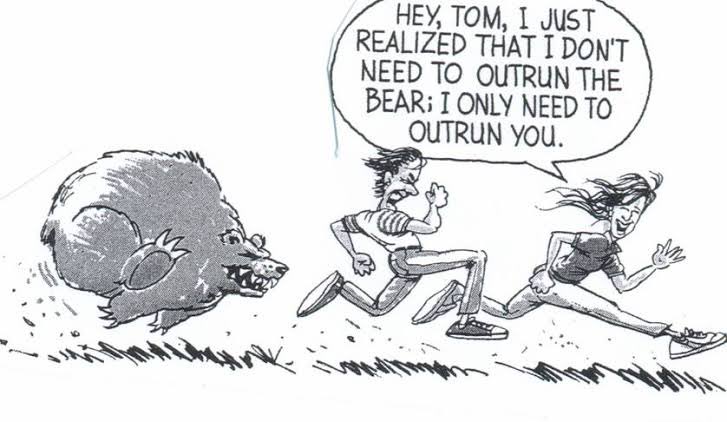

So next time you see some journalist penning fictional prose written in tear-jerking style, and passing it off as serious analysis, your reaction should be...😉

#LongIndia #IndiaTech

#LongIndia #IndiaTech

• • •

Missing some Tweet in this thread? You can try to

force a refresh