Breaking: A previously-unreleased pro-oil/gas letter sent by @BlackRock to Texas lawmakers and oil/gas executives reveals that the company is simultaneously 1) trying to gain status by supporting anti-oil/gas net zero goals, and 2) trying not to lose any pro-oil/gas investors.

🧵

🧵

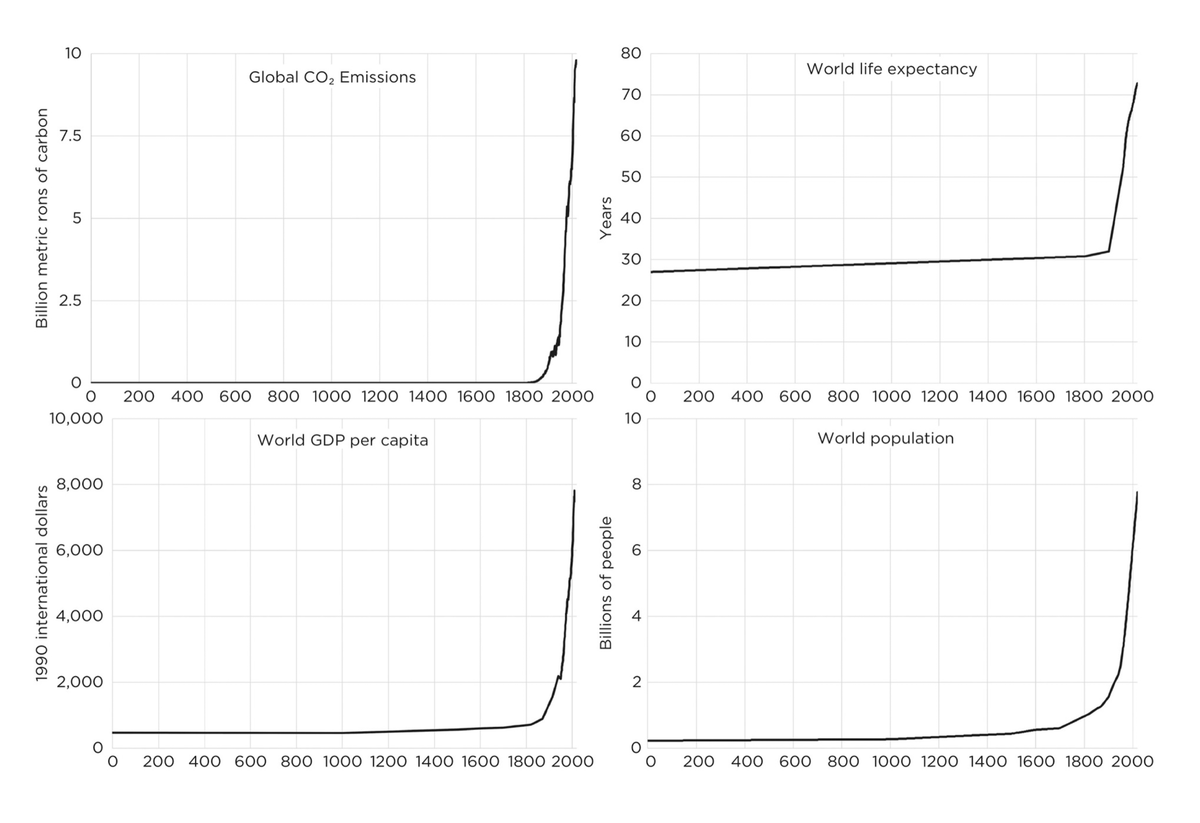

BlackRock's Larry Fink is the #1 leader in the financial world for the economically baseless idea that the global economy should and will be net-zero by 2050. This idea would mean the rapid and total or near-total destruction of the oil and gas industry.

alexepstein.substack.com/p/the-esg-move…

alexepstein.substack.com/p/the-esg-move…

In response to BlackRock and others advocating anti-oil-and-gas "net zero" policies, TX pension funds have started refusing to do business with anti-oil/gas institutions. BlackRock's response: a covert PR campaign to tell TX lawmakers and oil execs that it's very pro oil/gas!

Reading BlackRock's PR letter to TX lawmakers and oil execs, you would think that BlackRock has been a public champion of oil and gas--instead of the #1 advocate for "net zero" policies that necessitate the near-term destruction of oil and gas and have already slashed investment.

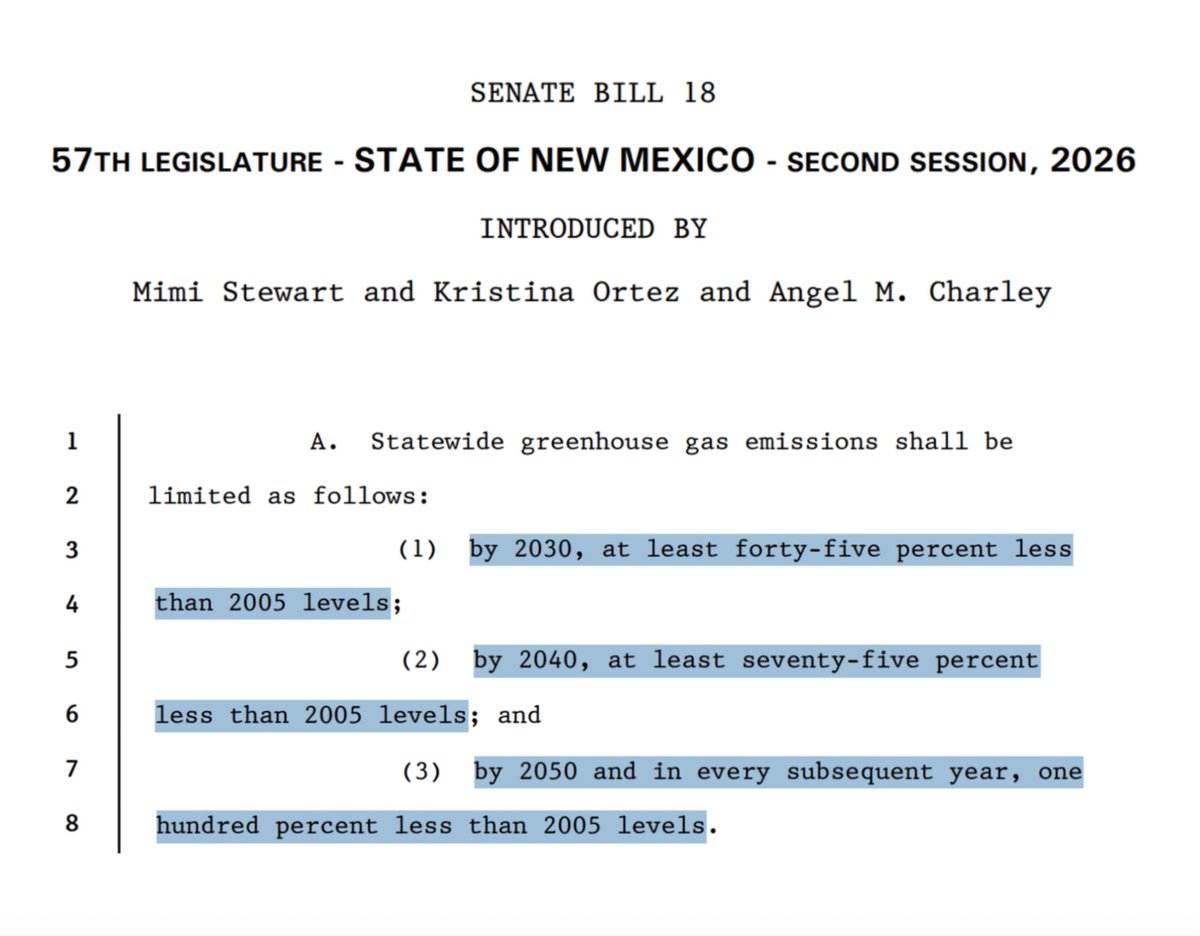

In his 2021 Letter to CEOs, Larry Fink said BlackRock is "committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner"--which means "emissions need to decline by 8-10% annually between 2020 and 2050."

This would obviously destroy the oil/gas industry.

This would obviously destroy the oil/gas industry.

The BlackRock-led "net zero" ESG movement is a major cause of oil/gas investment declining dramatically, leading to unnecessarily high prices. From 2011-2021, oil/gas exploration investments declined by 50%. Less investment = less supply = higher prices.

alexepstein.substack.com/p/the-esg-move…

alexepstein.substack.com/p/the-esg-move…

BlackRock's TX letter repeatedly and validly praises oil and gas companies--e.g., "these companies play crucial roles in the economy" and warns against rapid elimination. But such thoughts and warnings were totally absent from Larry Fink's ultra-influential 2021 Letter to CEOs.

Larry Fink's 2021 Letter to CEOs was pure climate catastrophism and "net zero" fantasy--to the point that his only comment about China, which was and is rapidly increasing its fossil fuel use, was to praise China's "historic commitments to achieve net zero emissions"!

Larry Fink's 2022 Letter to CEOs should have

1) Explicitly acknowledged the immense value of oil/gas and the peril of rapid elimination and

2) Explicitly acknowledged and apologized for BlackRock's role in causing today's oil/gas underinvestment and shortages.

It does neither.

1) Explicitly acknowledged the immense value of oil/gas and the peril of rapid elimination and

2) Explicitly acknowledged and apologized for BlackRock's role in causing today's oil/gas underinvestment and shortages.

It does neither.

Instead of acknowledging oil/gas's immense value and apologizing for BlackRock's role in today's energy shortages, Larry Fink's 2022 letter makes a trivializing reference to their value and does not even mention today's energy crisis, let alone reflect on BlackRock's culpability.

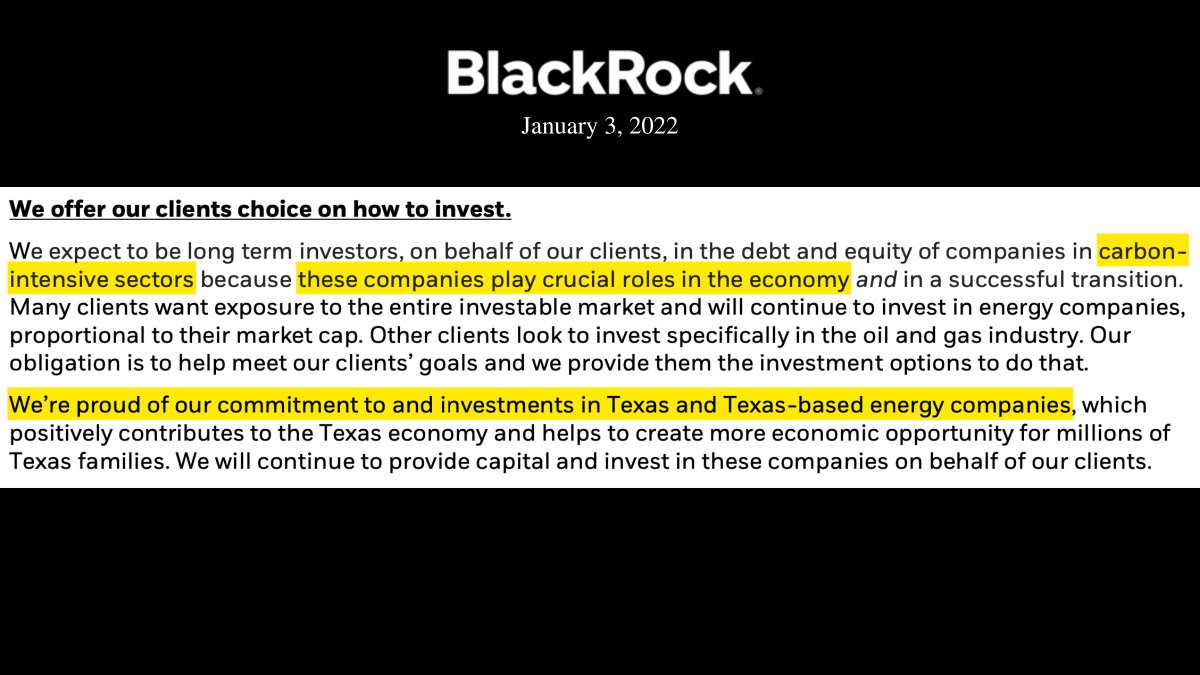

Here is the full letter that BlackRock circulated among TX lawmakers and oil/gas executives.

While I am the first to release this letter, I am not breaking any laws/confidentiality in doing so.

Note: BlackRock mislabeled the year as 2021 instead of 2022.

industrialprogress.com/blackrock/

While I am the first to release this letter, I am not breaking any laws/confidentiality in doing so.

Note: BlackRock mislabeled the year as 2021 instead of 2022.

industrialprogress.com/blackrock/

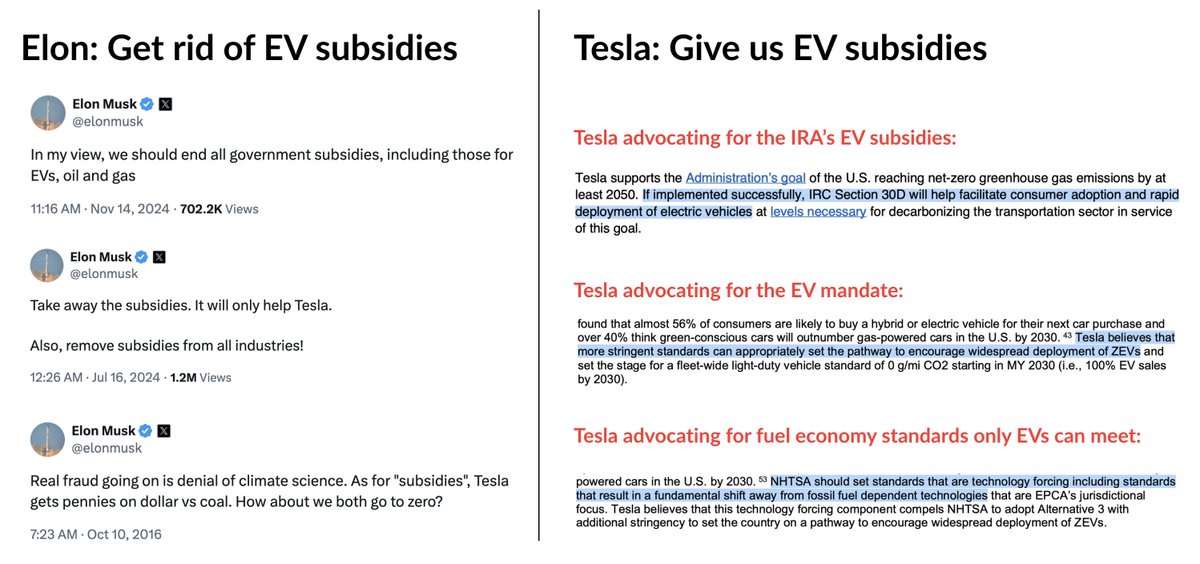

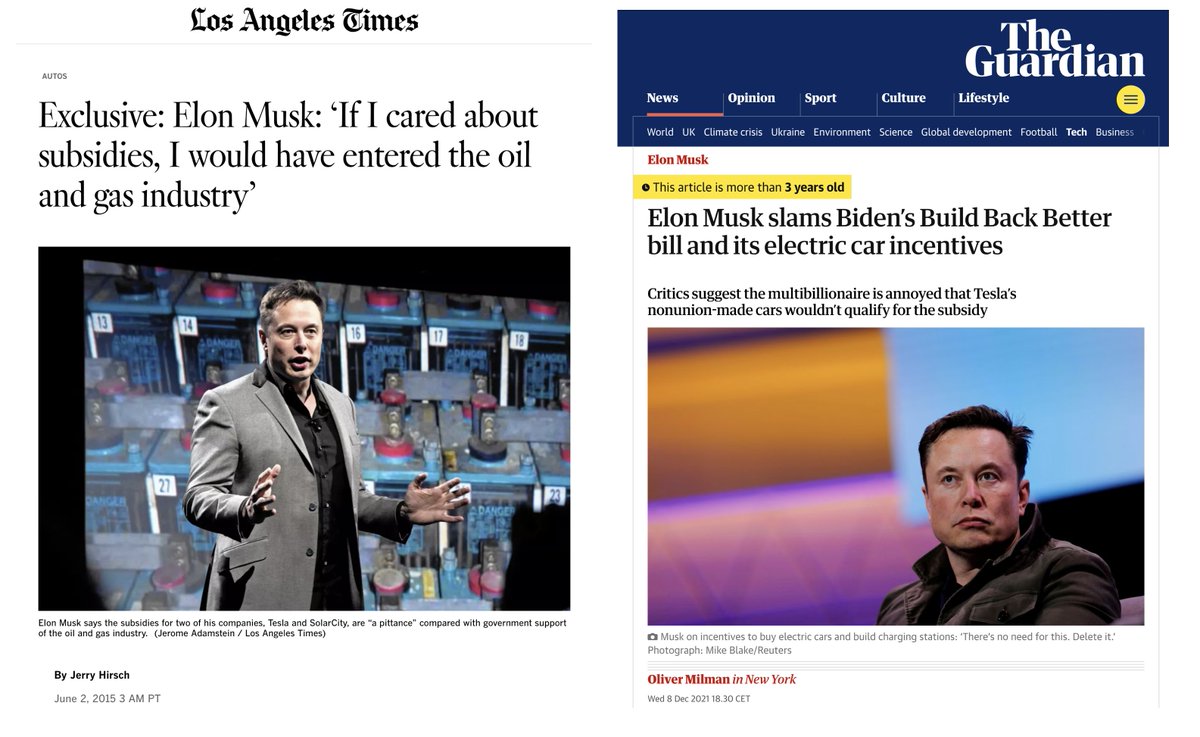

Texans and others shouldn't be fooled by BlackRock's PR campaign to pretend to be big supporters of oil and gas while leading the "net zero" policy push that will destroy oil and gas--and, as a result, the global economy and standard of living.

alexepstein.substack.com/p/the-esg-move…

alexepstein.substack.com/p/the-esg-move…

• • •

Missing some Tweet in this thread? You can try to

force a refresh