Last month, WV Senator Joe Manchin heroically stopped "Build Back Better" legislation that would have ruined America's and above all WV's economy.

Now The @NYTimes and others are pressuring Manchin to reverse his stance via the false narrative that coal miners support BBB.

🧵

Now The @NYTimes and others are pressuring Manchin to reverse his stance via the false narrative that coal miners support BBB.

🧵

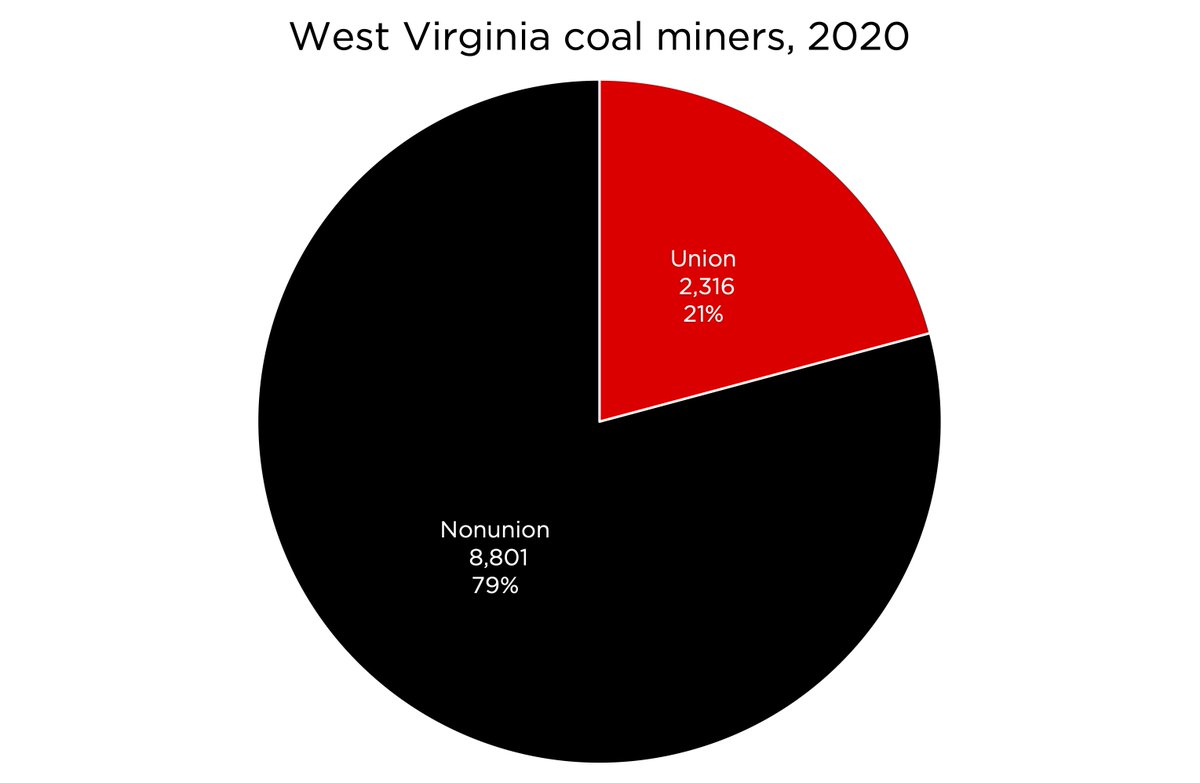

In an effort to undermine Joe Manchin’s opposition to Build Back Better, the @nytimes recently published a "news" article trying to portray @Sen_JoeManchin’s rejection of BBB as opposed to the interest of coal miners by citing a union that represents a small minority of miners.

The @nytimes article by @jonathanweisman, entitled "Manchin’s Choice on Build Back Better: Mine Workers or Mine Owners," cites certain unions supporting BBB, but neglects to mention that less than ¼ of WV’s coal miners are associated with unions. This is journalistic malpractice.

The reason that certain coal miner unions support BBB is not because they have an answer to the obvious truth that BBB would destroy the WV economy. It is because these unions overwhelmingly represent retirees, not workers, and are seeking BBB handouts. alexepstein.substack.com/p/why-build-ba…

A key fact evaded by the "coal miners support BBB" narrative is that the UMWA must pay out dozens of times more dollars to retirees than its limited coal miner members pay in: in 2017, it was $600M out vs. $15M in. Hence the UWMA prioritizes BBB handouts over miners and WV.

BBB would be an unmitigated disaster to WV energy in 3 ways:

1. It would make WV electricity much higher cost and much less reliable.

2. It would sabotage WV's growing would production.

3. It would sabotage WV's growing natural gas production.

alexepstein.substack.com/p/why-build-ba…

1. It would make WV electricity much higher cost and much less reliable.

2. It would sabotage WV's growing would production.

3. It would sabotage WV's growing natural gas production.

alexepstein.substack.com/p/why-build-ba…

While supporters of BBB portray coal as inevitably dead, that is not true. While BBB would kill coal, without BBB coal has many decades left. Last year global coal demand rose faster than for any other form of energy. And in WV, coal is crucial to the state's industrial economy.

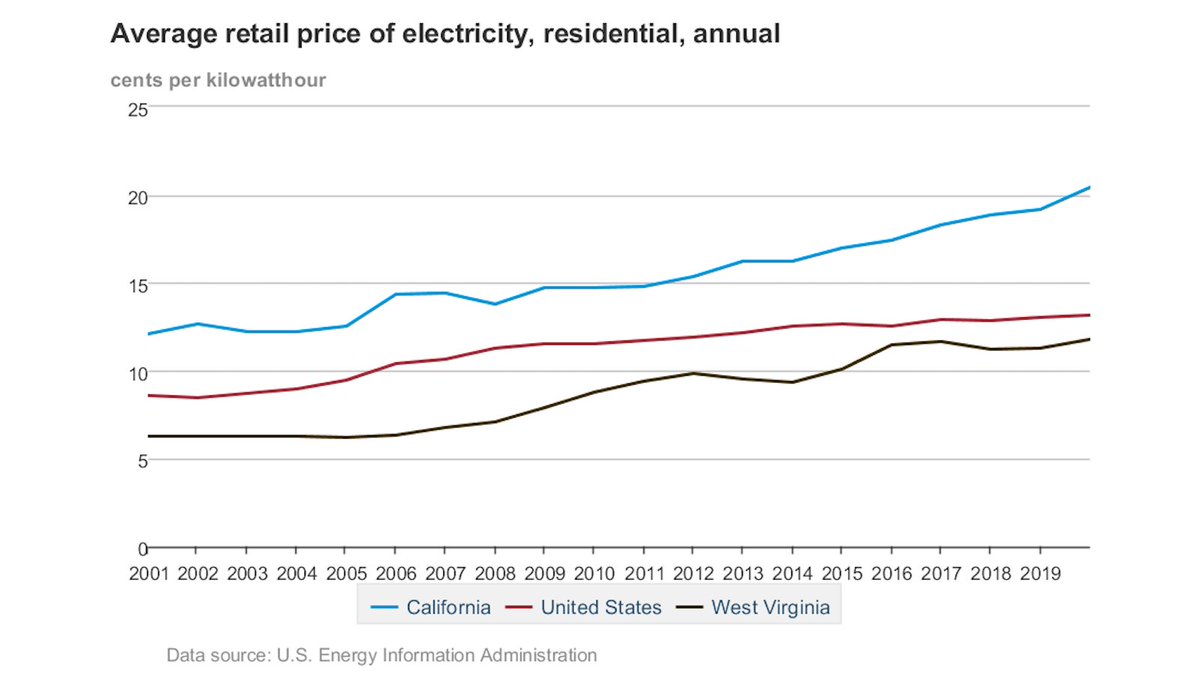

Low-cost, reliable electricity is one of WV's great assets. Thanks to its overwhelmingly coal-fired electricity, West Virginia has some of the lowest electricity rates in the country—second only to coal-heavy Kentucky on the East Coast.

Low-cost, reliable electricity saves everyone money and makes WV a hub of industry. The industrial sector uses over 40% of WV’s electricity.

Low-cost, reliable electricity also makes WV a major exporter of electricity to its regional grid, meaning more money from other states.

Low-cost, reliable electricity also makes WV a major exporter of electricity to its regional grid, meaning more money from other states.

If BBB passes, WV will suffer the same fate that Germany, California, Texas, and many others have: prematurely shutting down many reliable power plants at great cost, paying for massive new unreliable solar/wind infrastructure at great cost, and facing huge reliability risks.

While every state will be harmed by BBB’s imposition of high-cost, unreliable electricity, WV will suffer especially—whether from fleeing industry or from deadly winters when the power goes out and over 50% of the population is relying on electric heat.

Contrary to claims that Joe Manchin has destroyed America's (and WV's) future by opposing BBB, he has protected our future by preventing an unprecedented destruction of our energy industry--the industry that powers every other industry.

alexepstein.substack.com/p/intellectual…

alexepstein.substack.com/p/intellectual…

All the media organizations spreading disinformation about Build Back Better being good for WV coal miners--by ignoring the devastating consequences to WV's economy, and by pretending that the handout-seeking leaders of retiree unions represent most coal miners--should apologize.

• • •

Missing some Tweet in this thread? You can try to

force a refresh