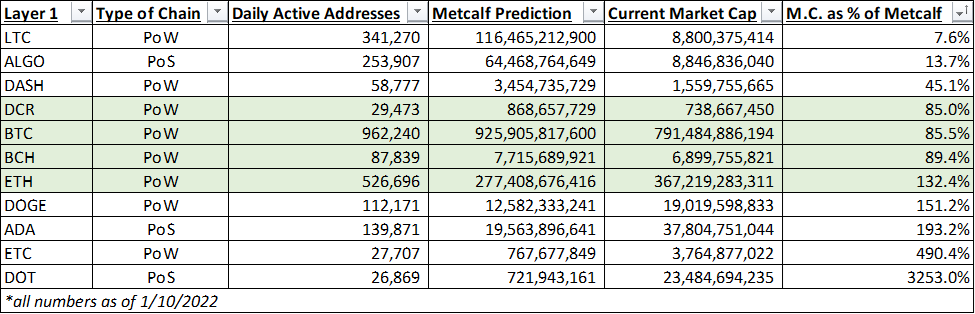

Have you ever wondered if L1 valuations follow Metcalf's Law? If so, I did the hard work for you and ran the numbers to find out. We look at $BTC, $ETH, $BCH, $ETC, $DOT, $ADA, $DOGE, $DCR, $DASH, $ALGO, and $LTC. tldr; it's... not that great, but close in some cases. More below:

All data as of Jan 10, 2022. Here is the summary of the results if you don't want to look at visuals for each individual coin:

First, the OG: bitcoin $BTC. It turns out this pretty well follows Metcalf's Law. It could be because there is little happening over the chain other than pure transaction volume. Predicts that bitcoin is 14.5% undervalued... could be accurate...

Next, the second OG (is that a thing?): etherum $ETH. This one also follows Metcalf's Law pretty well, which isn't a surprise since smart contracts do allow participants to add value over the network. Shows ETH overvalued by 32.4% (short term bearish?!)...

Another oldie up next, bitcoin cash $BCH. Similarly to Bitcoin, the valuation of this blockchain seems to follow Metcalf pretty closely and shows that it's slightly undervalued by 10.6% (a day's volatility in crypto-world!)...

Let's keep going with the OG forks (technically ETH is the fork, but moving on...) Ethereum Classic $ETC seems to show a sad story 😢 and not a great prediction by Metcalf. Active users who still believe this is the main chain hodl on as the market cap slowly bleeds out. Yikes...

The final oldie that we will talk about before getting into more exciting things is Litecoin $LTC. A chain that's been chugging along since 2011 - longer than most everyone has been in crypto. Metcalf is either a bad prediction metric, or this chain is way undervalued, by 92.4%!

Polkadot $DOT is a super interesting project and a technical one focused on a multi-chain world. What we see here is the emergence of hype. People were super pumped about this project when it first launched and then re-based their expectorations once the excitement wore off:

Algorand $ALGO claims to be a scalable, AI, future-chain of some kind... idk. What I do know is that either a) Metcalf loses it here, b) my data is inaccurate, or c) this chain is severely undervalued by 86.3%... I don't think it's c.

The next chain is one of the most meme-y ones out there: Dash $DASH. It seems that Metcalf kind of tracks the market cap, but more tellingly, the market cap is still < Metcalf... perhaps because of the lack of utility of the chain? 54.9% undervalued based on this metric alone:

Now, the final two that you've all been waiting for. First, we will look at Cardano $ADA, the most YouTube-influencer-pump-and-dump dumpster fire chain out there. Not surprisingly, Metcalf shows this chain is more than 93.1% over-valued:

Finally, the meme-king itself. Dogecoin $DOGE. The Elon Musk led chain is the second most overvalued by Metcalf at 51.2%. To be honest, any true investment analyst would say its intrinsic value is zero, but Metcalf knows nothing of financial analysis, only number of nodes:

So, I would recommend that you only look at this metric as a curiosity, or as a very light weighting in your fundamental analysis. It could be helpful on $BTC, $ETH, $ECH, or $BCH, but otherwise, I would steer clear. Also, thanks to @e_krispy31 for the assistance on research.

• • •

Missing some Tweet in this thread? You can try to

force a refresh