1/

Sharing a thread to understand how @ConvexFinance successfully acquired the majority of veCRV and is now a major influence on @CurveFinance . #CurveWars

🧵👇

Sharing a thread to understand how @ConvexFinance successfully acquired the majority of veCRV and is now a major influence on @CurveFinance . #CurveWars

🧵👇

2/

The fundamental concept of Convex is to serve as a proxy for a pool of CRV holders to collectively influence decision-making on Curve to boost rewards for Liquidity Pools of their choice. As an individual, they are powerless. As a team, they become formidable.

The fundamental concept of Convex is to serve as a proxy for a pool of CRV holders to collectively influence decision-making on Curve to boost rewards for Liquidity Pools of their choice. As an individual, they are powerless. As a team, they become formidable.

3/

As a protocol, convex earns revenue by taking a fixed fee of 17% from all the LP token pools, which are then distributed to various stakeholders.

As a protocol, convex earns revenue by taking a fixed fee of 17% from all the LP token pools, which are then distributed to various stakeholders.

5/

First, provide liquidity. Instead of depositing my LP token in Curve’s liquidity gauge, I’ll deposit them in Convex’s Curve LP Token Pool.

First, provide liquidity. Instead of depositing my LP token in Curve’s liquidity gauge, I’ll deposit them in Convex’s Curve LP Token Pool.

6/

By doing so, I get to earn CVX rewards on top of what I’ll be earning from depositing in curve’s liquidity gauge. CVX are minted at a determined ratio of CRV earnings up to a total supply of 100 million.

By doing so, I get to earn CVX rewards on top of what I’ll be earning from depositing in curve’s liquidity gauge. CVX are minted at a determined ratio of CRV earnings up to a total supply of 100 million.

7/

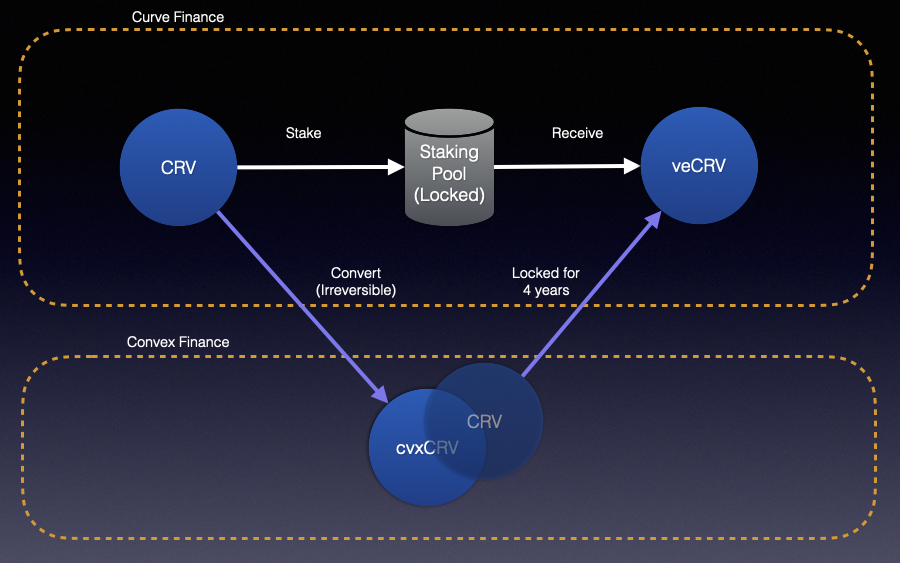

Second, stake cvxCRV. Instead, of locking CRV for veCRV on Curve and committing, I can convert CRV into cvxCRV and stake them. Converting CRV into cvxCRV is irreversible, but I can unstake cvxCRV anytime and a secondary market is available on Sushiswap to trade cvxCRV/CRV.

Second, stake cvxCRV. Instead, of locking CRV for veCRV on Curve and committing, I can convert CRV into cvxCRV and stake them. Converting CRV into cvxCRV is irreversible, but I can unstake cvxCRV anytime and a secondary market is available on Sushiswap to trade cvxCRV/CRV.

8/

By staking cvxCRV, I get to earn the fees as a veCRV, plus 10% of earnings and CVX tokens on top of that. The downside is that I give up my voting rights to the convex community, the vlCVX holders.

By staking cvxCRV, I get to earn the fees as a veCRV, plus 10% of earnings and CVX tokens on top of that. The downside is that I give up my voting rights to the convex community, the vlCVX holders.

9/

Third, stake CVX to earn 5% of earnings.

Lastly, lock CVX for vlCVX, for up to a maximum of 16 weeks. As a vlCVX holder, I have voting rights and I get to earn 5% + 1% of earnings.

Third, stake CVX to earn 5% of earnings.

Lastly, lock CVX for vlCVX, for up to a maximum of 16 weeks. As a vlCVX holder, I have voting rights and I get to earn 5% + 1% of earnings.

10/

As convex locks all CRV received/earned for the maximum period of 4 years on Curve, another benefit of vlCVX holders is they can enjoy maximum voting power while only having to lock for a shorter period of time.

As convex locks all CRV received/earned for the maximum period of 4 years on Curve, another benefit of vlCVX holders is they can enjoy maximum voting power while only having to lock for a shorter period of time.

11/

Aside from the innovative mechanics to attract and retain TVL, their reward distribution mechanism was well thought out too. Upon claiming CRV, it is converted and paid out in cvxCRV. The CRV would then be locked, which enhances their value as a proxy to attract more TVL.

Aside from the innovative mechanics to attract and retain TVL, their reward distribution mechanism was well thought out too. Upon claiming CRV, it is converted and paid out in cvxCRV. The CRV would then be locked, which enhances their value as a proxy to attract more TVL.

13/

Moving forward, it seems they have the intention to repeat their success at @fraxfinance 👀

Moving forward, it seems they have the intention to repeat their success at @fraxfinance 👀

https://twitter.com/crypto_condom/status/1473645067537510406?s=20

fyi on how fees are accrued in @CurveFinance for veCRV token holders.

https://twitter.com/dicksonlai_/status/1484149285260521473?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh