1/ It's 🧵 time frens! Let's dig into @beethoven_x & breakdown why their #Fantom future seems so bright!

I’ll outline:

- What is @beethoven_x?

- How are they unique?

- Tokenomics & $BEETS opportunities

- Ongoing events to watch!

S/O to @Official_jgriff for the inspiration 🤝

I’ll outline:

- What is @beethoven_x?

- How are they unique?

- Tokenomics & $BEETS opportunities

- Ongoing events to watch!

S/O to @Official_jgriff for the inspiration 🤝

2/ Starting with what is @beethoven_x:

@beethoven_x is the first “next-generation” Automated Market Maker (AMM) protocol on #Fantom

They're a FRIENDLY fork of @BalancerLabs V2. Community vote/approved!

@beethoven_x was the 1st to bring the balancer tech to #Fantom ecosystem

@beethoven_x is the first “next-generation” Automated Market Maker (AMM) protocol on #Fantom

They're a FRIENDLY fork of @BalancerLabs V2. Community vote/approved!

@beethoven_x was the 1st to bring the balancer tech to #Fantom ecosystem

3/ 2020 brought the rise of DeFi & maturation of liquidity. @Uniswap pioneered innovation with 50/50 liquidity pools.

They created LP pairs where liquidity is denominated with 50% in asset 1 & 50% in asset 2

Ex: a $SPIRIT / $FTM LP

These pairs relied on the formula X*Y=K

They created LP pairs where liquidity is denominated with 50% in asset 1 & 50% in asset 2

Ex: a $SPIRIT / $FTM LP

These pairs relied on the formula X*Y=K

4/ @BalancerLabs came along & brought new innovation to the model!

The new innovation came from its trading pairs called "pools"

These pools can consist of MULTIPLE tokens, anywhere between 2 to 8...

Each token with a different weight or share of the pool, ranging 2% - 98%

The new innovation came from its trading pairs called "pools"

These pools can consist of MULTIPLE tokens, anywhere between 2 to 8...

Each token with a different weight or share of the pool, ranging 2% - 98%

5/ With multiple tokens present in each pool more capital efficient strategies can be deployed

Strategies combatting impermanent loss! 🥳

Via Smart Order Routing (SOR), the protocol can intelligently source liquidity to automatically determine the best available prices/swaps

Strategies combatting impermanent loss! 🥳

Via Smart Order Routing (SOR), the protocol can intelligently source liquidity to automatically determine the best available prices/swaps

6/ Another advancement vs. the @Uniswap model was the flexible fee structure from @BalancerLabs

Fees for pools are extremely customizable; ranging from 0.0001% to 10%

These fees are split between liquidity providers (LPs). You'll see that @beethoven_x uses fees very wisely!

Fees for pools are extremely customizable; ranging from 0.0001% to 10%

These fees are split between liquidity providers (LPs). You'll see that @beethoven_x uses fees very wisely!

7/ Additionally, these multi-token pools, auto balancing technology & smart order router enable @beethoven_x to offer a flavor of a self-balancing index fund

Think of it like an automated ETF...

And as an LP you get paid when the pool is rebalanced or swap fees are generated

Think of it like an automated ETF...

And as an LP you get paid when the pool is rebalanced or swap fees are generated

8/ So, how do they rebalance?

Market actors are incentivized to rebalance the pools & take advantage of arbitrage opps

The fees generated are what pays YOU as an investor in the pool

In TradFi, ETF money managers got paid for manually rebalancing index funds for boomers! 🦕

Market actors are incentivized to rebalance the pools & take advantage of arbitrage opps

The fees generated are what pays YOU as an investor in the pool

In TradFi, ETF money managers got paid for manually rebalancing index funds for boomers! 🦕

9/ Ultimately, @beethoven_x forking @BalancerLabs brought a new form of AMM to #Fantom

They offer unique technology & fill a protocol void on $FTM chain

Next we will dig into impactful differentiators of @beethoven_x & ways to capitalize on the protocols success!

Grab some:

They offer unique technology & fill a protocol void on $FTM chain

Next we will dig into impactful differentiators of @beethoven_x & ways to capitalize on the protocols success!

Grab some:

10/ So, how else is @beethoven_x unique?

1. They offer a stable swap AMM on #Fantom

2. They help protocols launch their token using Balancer's Liquidity Boot Strapping Pool (LBPs)

3. They have compelling/differentiated high yield farming opportunities for their native token

1. They offer a stable swap AMM on #Fantom

2. They help protocols launch their token using Balancer's Liquidity Boot Strapping Pool (LBPs)

3. They have compelling/differentiated high yield farming opportunities for their native token

11/ I mentioned in "Spirit Wars" 🧵 3, @beethoven_X is one of the only $FTM protocols with a Stable Swap AMM

A competitive advantage for them!

@beethoven_X can route large trades of stable assets before encountering significant price impact. I.E low slippage, equal outputs!

A competitive advantage for them!

@beethoven_X can route large trades of stable assets before encountering significant price impact. I.E low slippage, equal outputs!

12/ If you need to swap stables and don’t want to utilize @CurveFinance

@beethoven_x is a great place to do this w/ stable swap AMM!

As you can see in the picture below, the exchange is nearly 1:1 (or better depending on arbitrage). Use their stable swap AMM as needed!

@beethoven_x is a great place to do this w/ stable swap AMM!

As you can see in the picture below, the exchange is nearly 1:1 (or better depending on arbitrage). Use their stable swap AMM as needed!

13/ @beethoven_x also uniquely offers Liquidity Boostrapping Pools - LBPs

These LBPs help protocols bootstrap new token liquidity in a safer/fairer way than previous options from @Uniswap

Historically, @Uniswap 50/50 approach had three major challenges that needed innovation

These LBPs help protocols bootstrap new token liquidity in a safer/fairer way than previous options from @Uniswap

Historically, @Uniswap 50/50 approach had three major challenges that needed innovation

14/ The three major challenges with 50/50 token launches:

- Tiny volume changes often saw huge swings in price

- Irrational price-discovery became common (see above)

- Bots would front-run the community (pump & dump)

@beethoven_x helps solve this in the #Fantom ecosystem!

- Tiny volume changes often saw huge swings in price

- Irrational price-discovery became common (see above)

- Bots would front-run the community (pump & dump)

@beethoven_x helps solve this in the #Fantom ecosystem!

15/ How? Via @beethoven_x LBPs.

These are short-lived smart pools which dynamically change their token weights

Starting 5%/95% FTM/$TOKEN to 95%/5%

The result is that the token price continually experiences downward pressure throughout the sale then finds a stable value

These are short-lived smart pools which dynamically change their token weights

Starting 5%/95% FTM/$TOKEN to 95%/5%

The result is that the token price continually experiences downward pressure throughout the sale then finds a stable value

16/ LBPs offer unique mechanics for new token launches.

IMPORTANTLY, it’s unique to @beethoven_x as a value driver...

The key is protocol differentiation!

If you’d like to dig into the complete details check out their docs page here:

docs.beethovenx.io/balancer-v2-1/…

IMPORTANTLY, it’s unique to @beethoven_x as a value driver...

The key is protocol differentiation!

If you’d like to dig into the complete details check out their docs page here:

docs.beethovenx.io/balancer-v2-1/…

17/ We hope that Liquidity Bootstrapping Pools for token generation events will motivate many NEW projects to launch their token in a fairer & more transparent way in the #Fantom ecosystem

More business for @beethoven_x, more fee generation, more DAO treasury revenue!

More business for @beethoven_x, more fee generation, more DAO treasury revenue!

18/ NOW, onto some other juicy differentiators!!

The investors section:

- Farming / Staking opportunities w/ $BEETS token

- Greater protection against impermanent loss

- The tokenomics of $BEETS and why there is NO TIME LIKE THE PRESENT!

- Other lesser known fee drivers

The investors section:

- Farming / Staking opportunities w/ $BEETS token

- Greater protection against impermanent loss

- The tokenomics of $BEETS and why there is NO TIME LIKE THE PRESENT!

- Other lesser known fee drivers

19/ If you were to buy $BEETS token today:

What's the utility? What makes it compelling and unique?

Answer: high APR returns with a long runway ahead...

Come on over to the $BEETS staking page and you can learn more. I'll explain key details!

beets.fi/#/stake

What's the utility? What makes it compelling and unique?

Answer: high APR returns with a long runway ahead...

Come on over to the $BEETS staking page and you can learn more. I'll explain key details!

beets.fi/#/stake

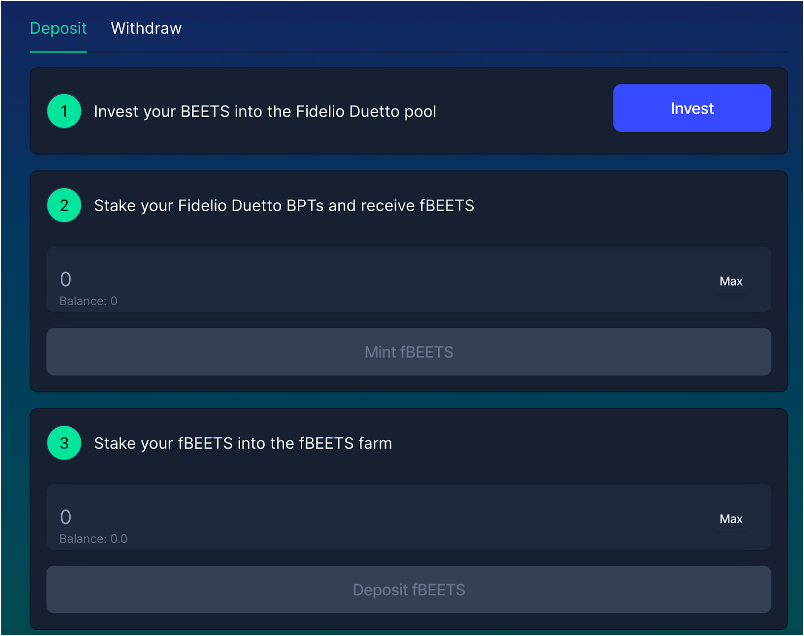

20/ You can stake $BEETS in the Fidelio Duetto pool in return for $fBEETS

Duetto is a 80/20 pool: meaning 80% of the pool consists of $BEETS, 20% consists of $FTM (remember the balancer)

Value: MINIMAL impermanent loss due to pool weighting, if $BEETS runs you retain value!

Duetto is a 80/20 pool: meaning 80% of the pool consists of $BEETS, 20% consists of $FTM (remember the balancer)

Value: MINIMAL impermanent loss due to pool weighting, if $BEETS runs you retain value!

21/ On @BeethovenX staking page, you will see “invest”

There you can deposit $BEETS into the Duetto pool

Again the pool is 80/20, so you will want to deposit some $FTM along with it!

This will mint Balance Provider Tokens (BPTs), you then turn into $fBEETS token to stake

There you can deposit $BEETS into the Duetto pool

Again the pool is 80/20, so you will want to deposit some $FTM along with it!

This will mint Balance Provider Tokens (BPTs), you then turn into $fBEETS token to stake

22/ Once you've gotten your BPTs (step 1)...

Go back to the staking page and complete step 2 (w/ contract approval)

Then, receive your $fBEETS!

Finally, complete step 3 by depositing your $fBEETS

You'll begin immediately earning $BEETS APR in return

Go back to the staking page and complete step 2 (w/ contract approval)

Then, receive your $fBEETS!

Finally, complete step 3 by depositing your $fBEETS

You'll begin immediately earning $BEETS APR in return

23/ The current APR on $fBEETS staking is 165%, paid out in $BEETS!

Point being: @beethoven_x offers amazing incentive return for stakers - we'll address the 3 ways APR is generated next!

Important note: time for MAX returns is of the essence and I’ll show you why shortly...

Point being: @beethoven_x offers amazing incentive return for stakers - we'll address the 3 ways APR is generated next!

Important note: time for MAX returns is of the essence and I’ll show you why shortly...

24/ Breaking down staking APR for $fBEETS:

30% of Beethoven X protocol revenue is used to reward $fBEETS holders. $fBEETS holders earn triple yield:

1. Swap fees earned as a Liquidity Provider (LP)

2. Farm incentives

3. 30% of Protocol Revenue

Absolutely love this model!

30% of Beethoven X protocol revenue is used to reward $fBEETS holders. $fBEETS holders earn triple yield:

1. Swap fees earned as a Liquidity Provider (LP)

2. Farm incentives

3. 30% of Protocol Revenue

Absolutely love this model!

25/ @beethoven_x APR mechanism is compelling & a big reason I'm so bullish on the $BEETS token…

Huge opportunity to capitalize. Especially in a bear market!

So why is time of the essence?

Let’s take a moment to examine the tokenomic emission schedule of @beethoven_x & $BEETS

Huge opportunity to capitalize. Especially in a bear market!

So why is time of the essence?

Let’s take a moment to examine the tokenomic emission schedule of @beethoven_x & $BEETS

26/ @beethoven_x token emission schedule decreases over 4 years. So far, about 55.6MM $BEETS have been minted

Between now - 8/10/22, 67.1MM MORE $BEETS will be emitted (see graph)

That curve will start to drop sharply. This is a great opportunity to accumulate b4 it flattens!

Between now - 8/10/22, 67.1MM MORE $BEETS will be emitted (see graph)

That curve will start to drop sharply. This is a great opportunity to accumulate b4 it flattens!

27/ Takeaway: There is no time like the present!

Staking on @beethoven_x NOW, means capturing max emission rewards on a rapidly decreasing schedule...

Think long term strategics here folks 🧠

For more info, you can find the full emission schedule here:

docs.beethovenx.io/beets/emission…

Staking on @beethoven_x NOW, means capturing max emission rewards on a rapidly decreasing schedule...

Think long term strategics here folks 🧠

For more info, you can find the full emission schedule here:

docs.beethovenx.io/beets/emission…

28/ Another pool to highlight:

"Fantom Conservatory of Music"

Remember comparing @beethoven_x to an index fund?

FCoM pool contains 7 #Fantom blue chips tokens, simplifying portfolio diversity!

It's a GREAT example of how the balancer tech creates unique value for investors!

"Fantom Conservatory of Music"

Remember comparing @beethoven_x to an index fund?

FCoM pool contains 7 #Fantom blue chips tokens, simplifying portfolio diversity!

It's a GREAT example of how the balancer tech creates unique value for investors!

29/ FYI, you don't need to hold ALL 7 tokens to deposit into the pool,2-3 will do…the power of the balancer V2!

Your initial token deposit auto balances between the 7 tokens giving exposure to a massive index of the #Fantom ecosystem…

Oh yeah, it also pays 145% APR in $BEETS

Your initial token deposit auto balances between the 7 tokens giving exposure to a massive index of the #Fantom ecosystem…

Oh yeah, it also pays 145% APR in $BEETS

30/ Effectively, you can diversify your #Fantom exposure w/ out buying unique positions in each protocol.

You can utilize the full power of the @beethoven_x balancer with a couple clicks of a button

Maximize exposure, minimize single asset risk (imp loss), & earning rewards!

You can utilize the full power of the @beethoven_x balancer with a couple clicks of a button

Maximize exposure, minimize single asset risk (imp loss), & earning rewards!

31/ So, where else might you see @beethoven_x? Are there other fee & demand drivers?

Yes…

If you’ve ever used @FinanceFirebird as a DEX aggregator you'll often times see swaps routed through @beethoven_x stable swap AMM

This routing means more swaps & more fees for APR!

Yes…

If you’ve ever used @FinanceFirebird as a DEX aggregator you'll often times see swaps routed through @beethoven_x stable swap AMM

This routing means more swaps & more fees for APR!

32/ @beethoven_x has incredible utility!

What about the token price?

Remember the decreasing emissions schedule? We have to be forward looking.

When emissions slow, token utility grows, buy pressure SHOULD soon outpace sell pressure. We’re in the accumulation phase folks...

What about the token price?

Remember the decreasing emissions schedule? We have to be forward looking.

When emissions slow, token utility grows, buy pressure SHOULD soon outpace sell pressure. We’re in the accumulation phase folks...

33/ Let's look at analytics on @BeethovenX for some measure of health/growth…

What do we see?

Protocol TVL hit a new ATH 8 days ago, 24 HR volume hit a new ATH 8 days ago…

If not for a 🦀 market - this type of monetary momentum usually propels positive price action!

What do we see?

Protocol TVL hit a new ATH 8 days ago, 24 HR volume hit a new ATH 8 days ago…

If not for a 🦀 market - this type of monetary momentum usually propels positive price action!

34/ So, the aforementioned metrics hit all time highs... Know what else did too?

- Swaps: All time high!

- Fees: All time high!

When swaps/fees are soaring, payouts are better for YOU, ME & US!

Remember: 30% of Beethoven X protocol revenue is used to reward $fBEETS holders

- Swaps: All time high!

- Fees: All time high!

When swaps/fees are soaring, payouts are better for YOU, ME & US!

Remember: 30% of Beethoven X protocol revenue is used to reward $fBEETS holders

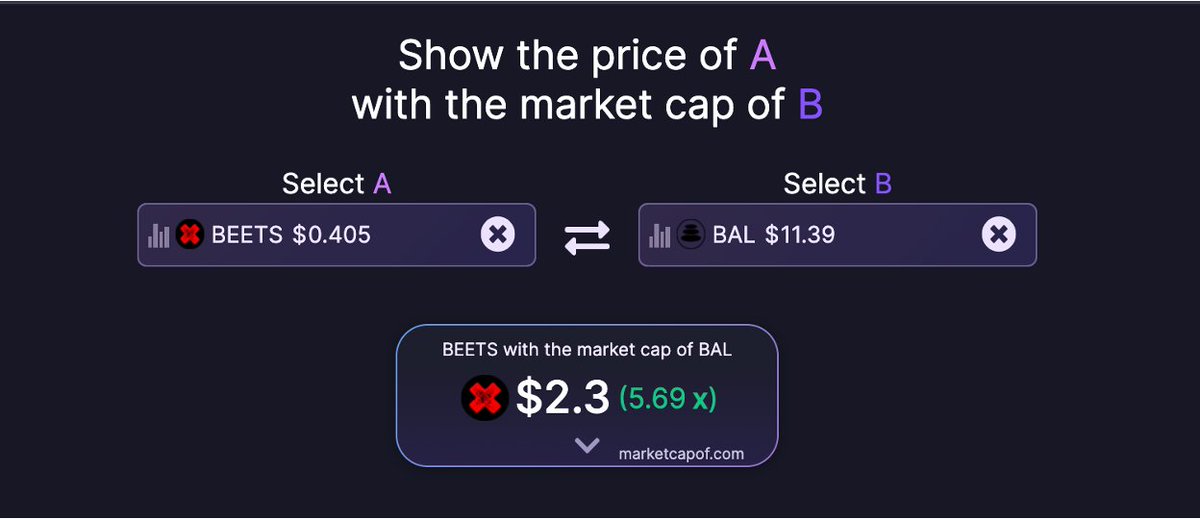

35/ For fun, let’s compare $BEETS price/MC to its predecessor in $BAL

$BEETS would be 5.69X current price at parody. I believe this is conservative with the growth and TVL coming to #Fantom

Of course, there are lots of other factors at play. But, upside is clear!

NFA 🤗

$BEETS would be 5.69X current price at parody. I believe this is conservative with the growth and TVL coming to #Fantom

Of course, there are lots of other factors at play. But, upside is clear!

NFA 🤗

36/ One more thing on $BAL:

Did you know they have the 5th highest TVL of any DEX @ 2.81BB (all chains)?

That JUMPS out to me…

If @BeethovenX had similar success…it’s TVL could 10X from here.

Connect the dots, draw conclusions, monitor progress. Recipe for success frens!

Did you know they have the 5th highest TVL of any DEX @ 2.81BB (all chains)?

That JUMPS out to me…

If @BeethovenX had similar success…it’s TVL could 10X from here.

Connect the dots, draw conclusions, monitor progress. Recipe for success frens!

37/ Also important: many protocols on #Fantom recently made HUGE run ups lately...

$BEETS has never re-entered price discovery since launch

We’d like to see the bowl shape complete (as token emissions decrease) and prepare for new ATHs…

Thus, we're early here $FTM fam

$BEETS has never re-entered price discovery since launch

We’d like to see the bowl shape complete (as token emissions decrease) and prepare for new ATHs…

Thus, we're early here $FTM fam

38/ With how uniquely positioned the @beethoven_x protocol is + the big brains of the team…I foresee far more upside long term!

We’re in inning 1 with #Fantom. I love the utility and differentiation $BEETS has!

SO, what OTHER interesting bullish developments are ongoing?

We’re in inning 1 with #Fantom. I love the utility and differentiation $BEETS has!

SO, what OTHER interesting bullish developments are ongoing?

39/ @beethoven_x announced their partnership with Olympus Pro bonding, generating Protocol Owned Liquidity!

Joining @LiquidDriver & @Spirit_Swap as #Fantom protocols partnering @OlympusDAO for POL, smart!

You can learn more + how to access here bonds:

link.medium.com/OokqR8P4Tmb

Joining @LiquidDriver & @Spirit_Swap as #Fantom protocols partnering @OlympusDAO for POL, smart!

You can learn more + how to access here bonds:

link.medium.com/OokqR8P4Tmb

40/ Remember the importance of LP gauge voting outlined in the Spirit Wars?

@beethoven_X joined the LP gauges party!

Last week they completed their 1st gauge vote for liquidity emission direction influence!

Read more about @beethoven_x gauges here:

link.medium.com/dwwf9Zwx5mb

@beethoven_X joined the LP gauges party!

Last week they completed their 1st gauge vote for liquidity emission direction influence!

Read more about @beethoven_x gauges here:

link.medium.com/dwwf9Zwx5mb

41/ Sticking w/ the Spirit Wars:

@beethoven_x is making moves to acquire $LQDR for governance voting control

Accumulating $LQDR, in the form of staked $xLQDR.

@LiquidDriver also acquiring fBEETS, helping align the interests of both protocols

Details:

snapshot.org/#/beets.eth/pr…

@beethoven_x is making moves to acquire $LQDR for governance voting control

Accumulating $LQDR, in the form of staked $xLQDR.

@LiquidDriver also acquiring fBEETS, helping align the interests of both protocols

Details:

snapshot.org/#/beets.eth/pr…

42/ @beethoven_x is now partnering with @EXODIAFinance on new bonding opportunities in the #Fantom / Exodia ecosystem...

More ways to acquire $fBEETS with bonding discounts for savvy investors…

Details here:

More ways to acquire $fBEETS with bonding discounts for savvy investors…

Details here:

https://twitter.com/EXODIAFinance/status/1484184474795479043

43/ Partnering w/ @SpookySwap

Prop-010 - Farm swap with Beets!

This new proposal extends expired partnered staking Farms and introduces a Farm Swap with @beethoven_x

The new Farm introduced is FTM-BEETS with a weight of 0.5x. BEETS

Details here:

vote.spookyswap.finance/#/spookyswap.e…

Prop-010 - Farm swap with Beets!

This new proposal extends expired partnered staking Farms and introduces a Farm Swap with @beethoven_x

The new Farm introduced is FTM-BEETS with a weight of 0.5x. BEETS

Details here:

vote.spookyswap.finance/#/spookyswap.e…

44/ There's tons going on at @beethoven_x, even in a down market!

Depending on your situation, this is a great time to reallocate your holdings and get into new projects at great prices!

Accoooomulators!

Plus now you can now get $BEETS 50% cheaper than you could 6 days ago!

Depending on your situation, this is a great time to reallocate your holdings and get into new projects at great prices!

Accoooomulators!

Plus now you can now get $BEETS 50% cheaper than you could 6 days ago!

45/ As always, make sure you follow @FTMAlerts for all updates on #Fantom!

Tune into #FantomUnchained every Thursday for discussions on evolving $FTM topics

If you have thread ideas don’t be shy! We’re one community in this thing together!

Education is key & ya'll rock!

Tune into #FantomUnchained every Thursday for discussions on evolving $FTM topics

If you have thread ideas don’t be shy! We’re one community in this thing together!

Education is key & ya'll rock!

• • •

Missing some Tweet in this thread? You can try to

force a refresh