If you didn't catch ARK's #BIS2022 summit yesterday, here's some highlights from my latest autonomous technology research:

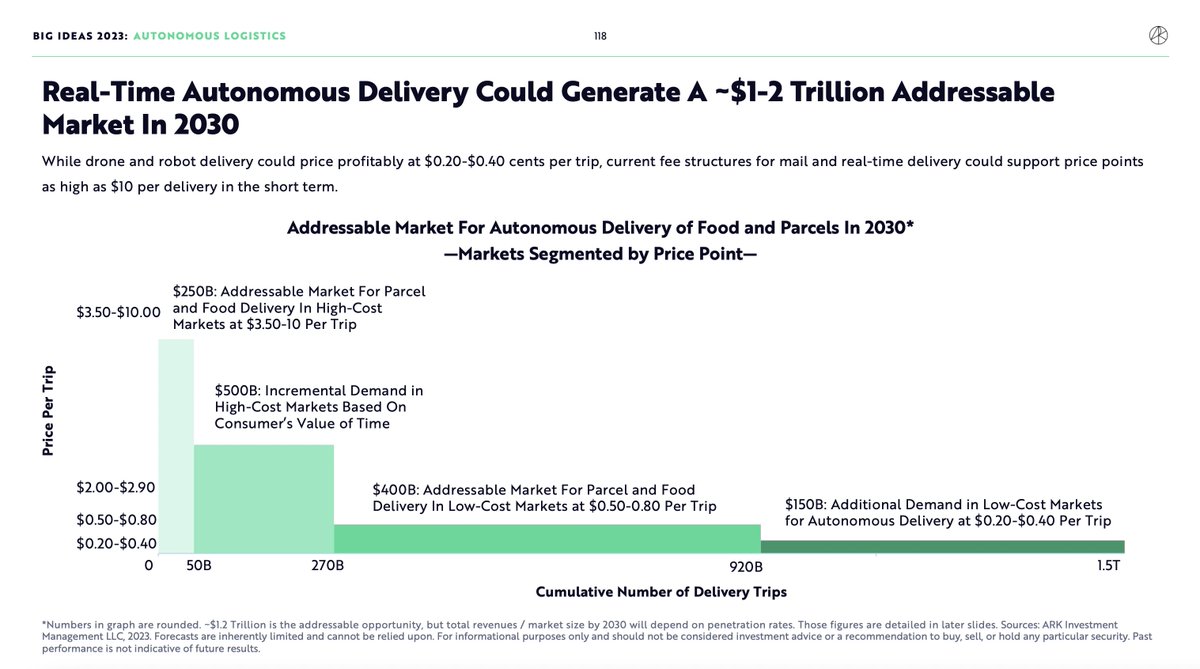

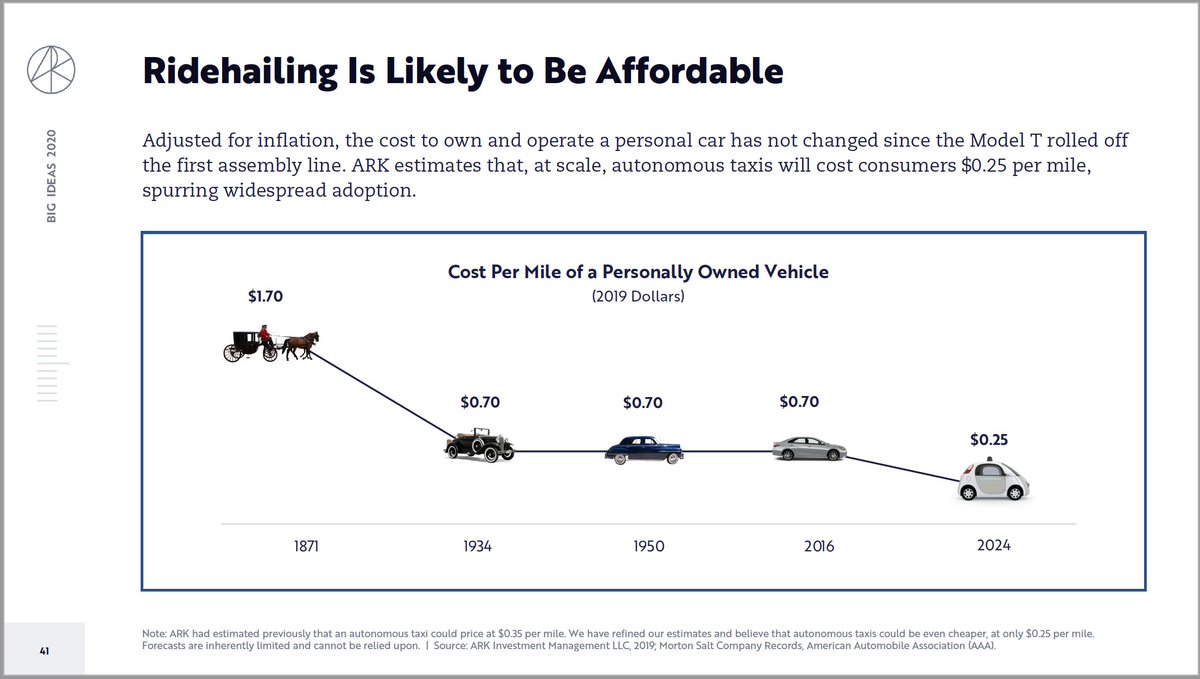

In our original work, we estimated that an autonomous ride-hail service could be priced as low as $0.25 per mile for consumers, while still leaving room for operator profits.

Now, we estimate that there should be substantial demand at higher price points. Note that today's ride-hail services average $2/mile in western markets, higher than consumer's perceived value of time AND higher than the marginal cost to drive your own car.

Takeaway: the low cost and convenience of autonomous ride-hail should win share of miles, even from today's car owners. Consumers already pay up for convenience. And at its lowest price points, autonomous travel is even cheaper than the marginal cost to drive a personal car.

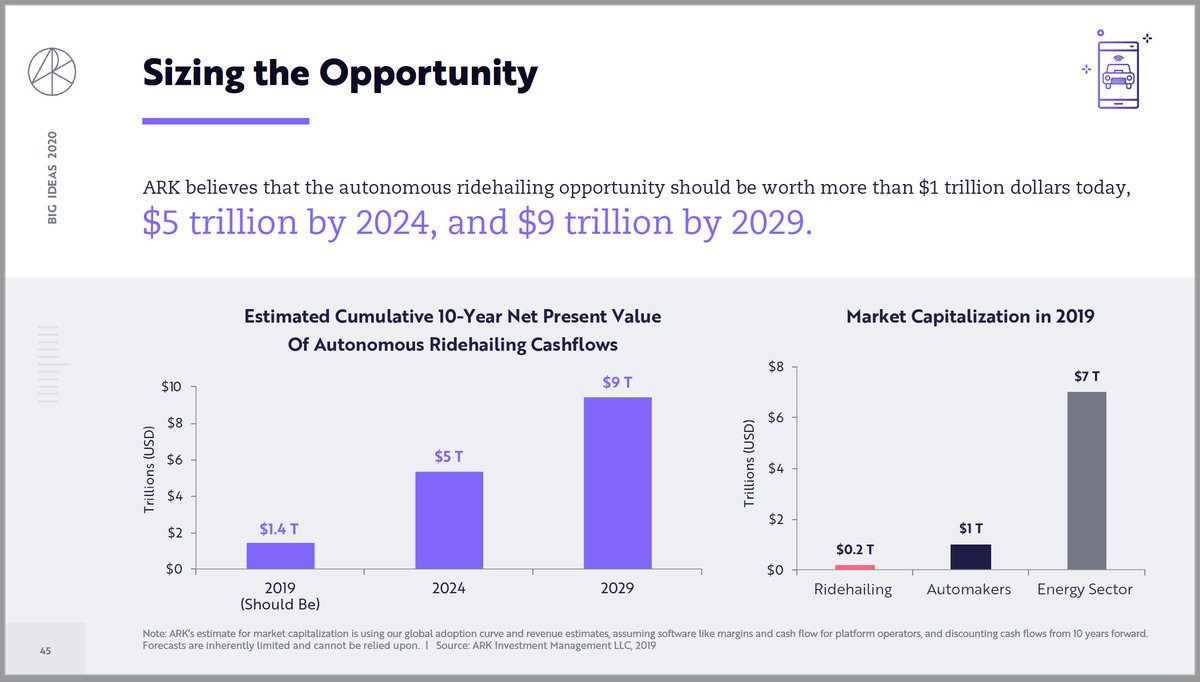

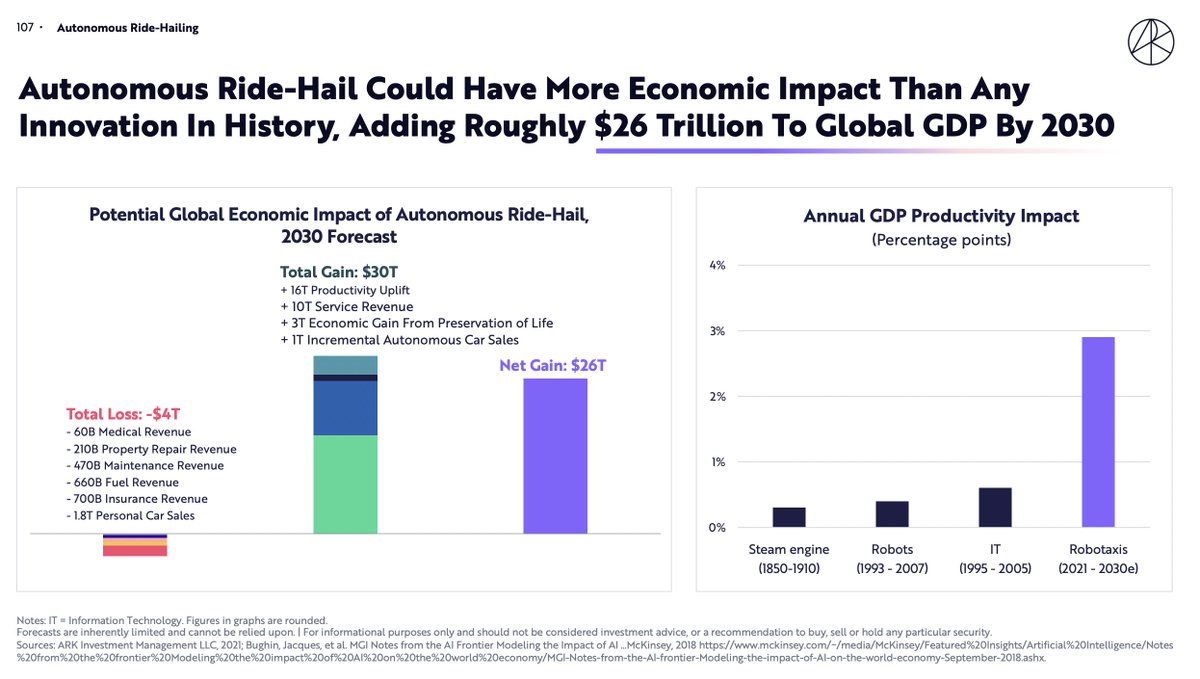

If I've bored you so far, here's why you should pay attention to autonomous cars: we think this could be the most impactful innovation in history. Autonomous ride-hail could add roughly $26 trillion to global GDP by 2030.

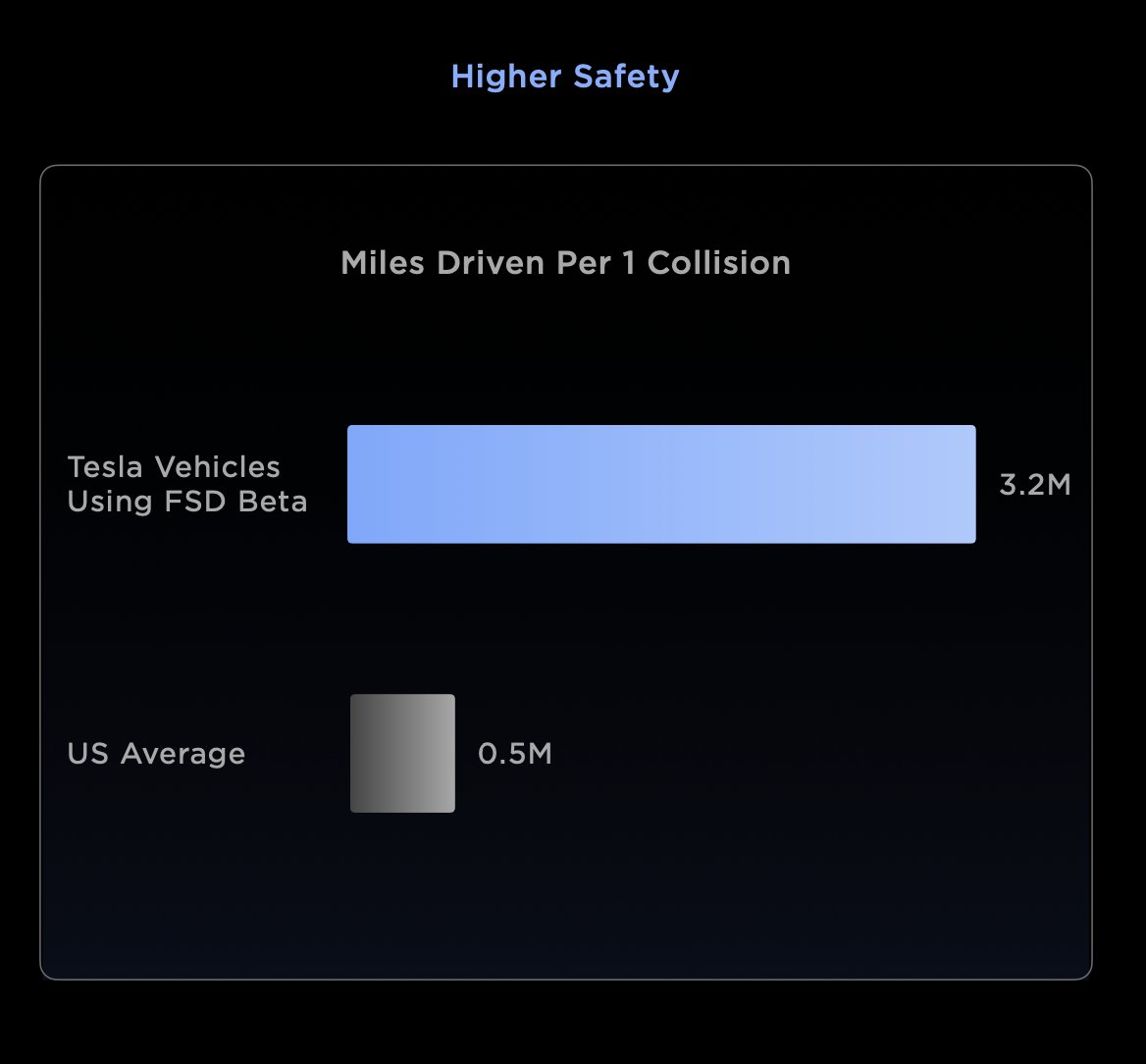

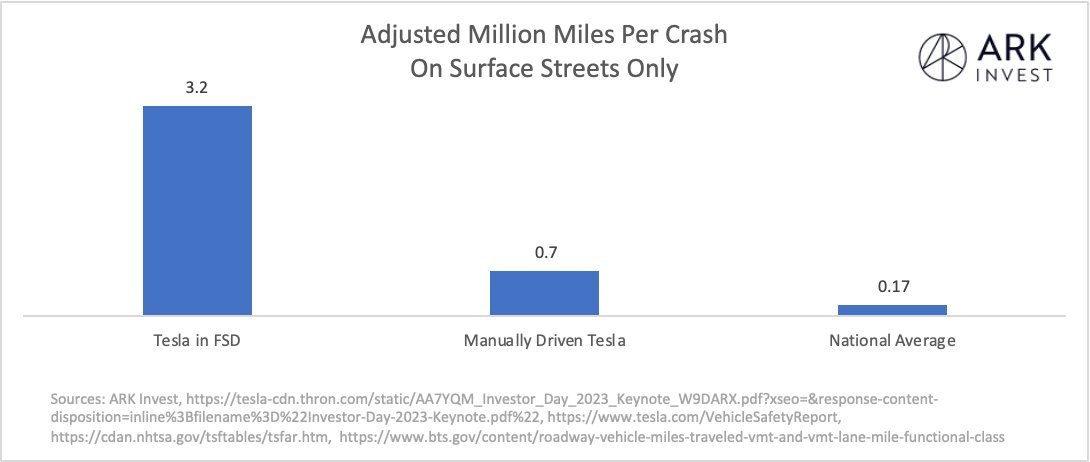

This accounts for losses from gas powered car sales, fuel, maintenance revenues (electric AVs need less of it), insurance (we estimate AVs over 80% safer), and property repair and medical revenue from the accidents prevented from autonomous.

Gains include service revenues from ride-hail, a productivity uplift from freed up time as a passenger (whether you're emailing or watching TV), a gain from saving some of the 1M+ people that die every year in accidents so they can live happy productive lives, and AV sales.

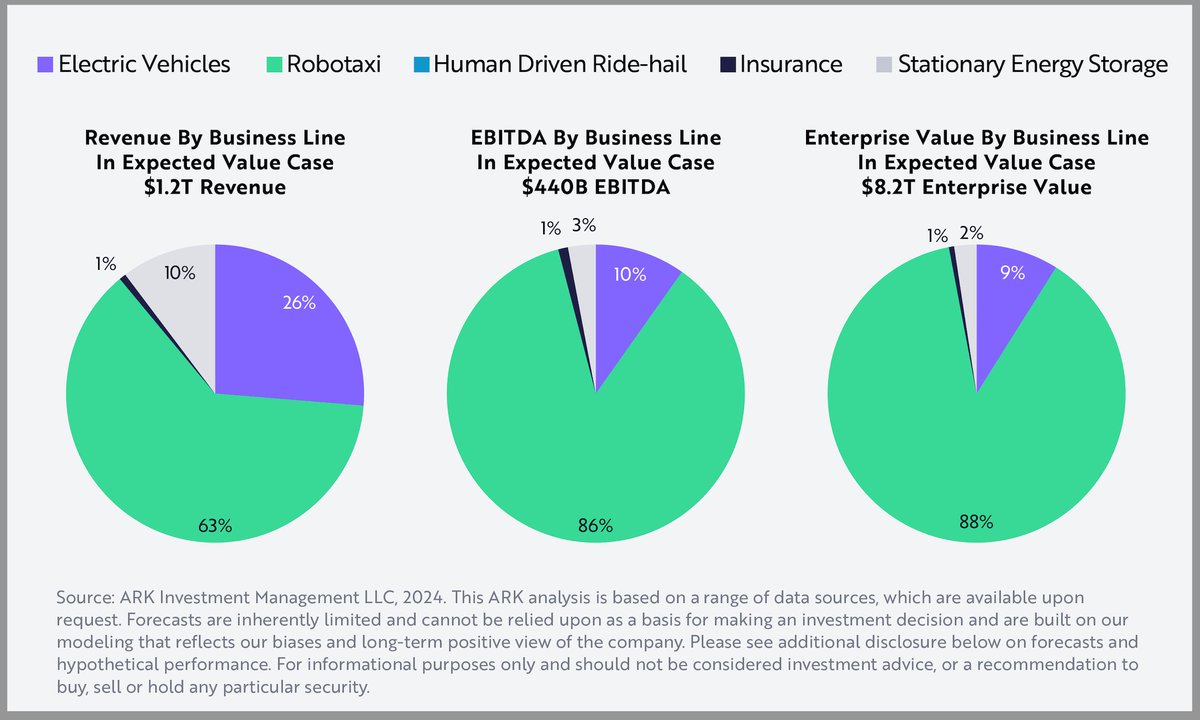

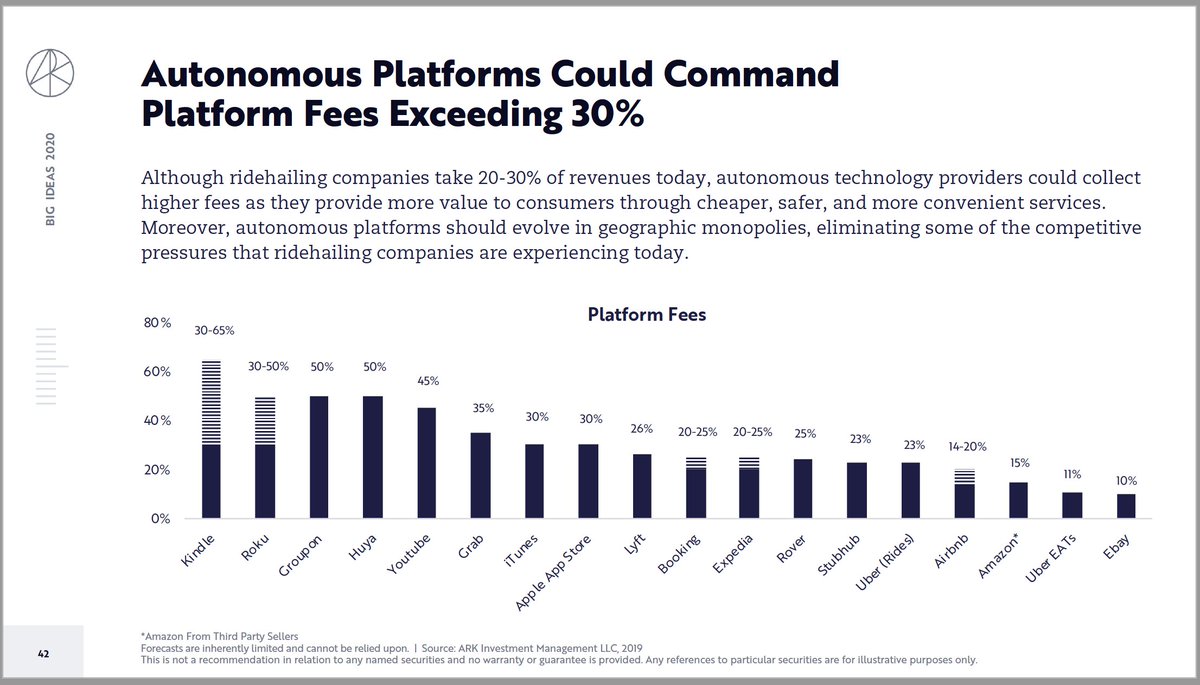

That's all to say that this is a HUGE opportunity. AVs should save money for consumers, benefit public health, boost economic growth, and create a massive investable market - autonomous platform providers could be worth over $11T in enterprise value in 2030.

• • •

Missing some Tweet in this thread? You can try to

force a refresh