The @unusual_whales intraday analyst is perhaps the most powerful page on the platform. It's home to many tools, such as but not limited to biggest options trades and P/C ratios (read about that here:

A recent addition is a max pain tool. Let's review:

https://twitter.com/Crowd_Traders/status/1479996355011559428).

A recent addition is a max pain tool. Let's review:

First, start by visiting the intraday analyst page, as mentioned: unusualwhales.com/flow/ticker/ov…

I'll be using $AAPL as an example.

Scroll down to the highlighted section, just below the OI/volume changes charts.

(Be warned, large vertical image!)

I'll be using $AAPL as an example.

Scroll down to the highlighted section, just below the OI/volume changes charts.

(Be warned, large vertical image!)

As to not bury the lede, I'll review quickly how max pain *MIGHT* be useful to some:

Those who use it speculate that as options' expirations draw closer, the market makers (and other option writers) will buy or sell shares in order to drive the stock price to the max pain price.

Those who use it speculate that as options' expirations draw closer, the market makers (and other option writers) will buy or sell shares in order to drive the stock price to the max pain price.

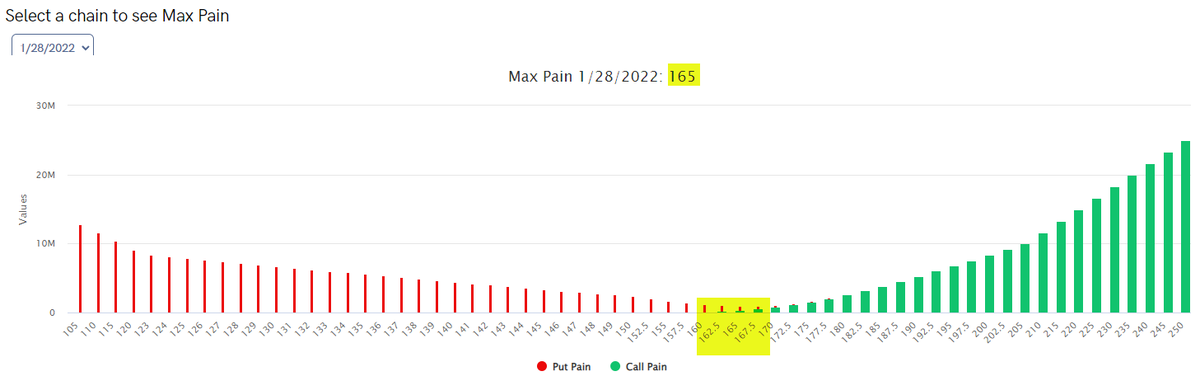

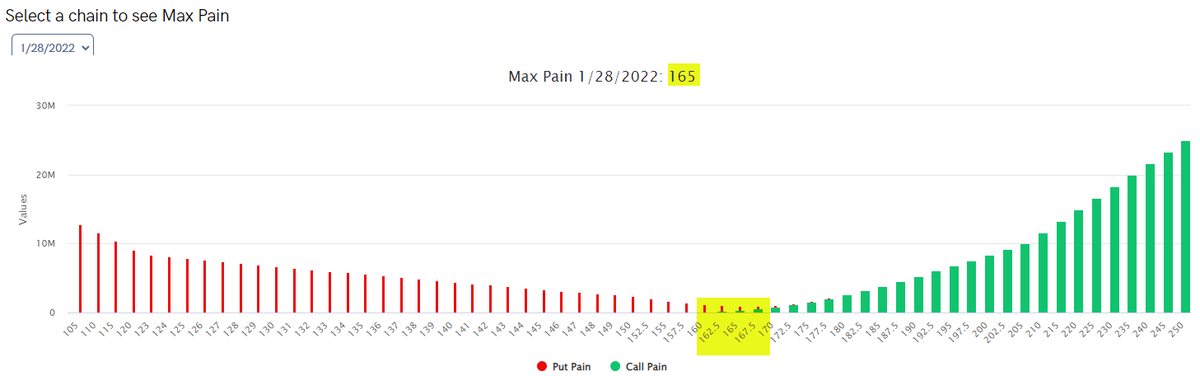

So, as to look at $AAPL (provided larger here), we can see the max pain price on the January 28th expiration is $165. This implies that market makers will hope for $AAPL to end around that price as to ensure the majority of options buyers' contracts will expire OTM.

Why is this?

Why is this?

First, I'll answer what the max pain theory is, overall:

The max pain price is the strike price with the most open contracts of both puts and calls that would expire worthless for the buyers if they were held until their requisite expiration dates (more on this later).

The max pain price is the strike price with the most open contracts of both puts and calls that would expire worthless for the buyers if they were held until their requisite expiration dates (more on this later).

The term "max pain" stems from the maximum pain theory, which states that statistically most traders who buy and hold options contracts until expiration lose money.

Perhaps you've heard the highly contested argument that "90% of contracts expire worthless".

...Please consider:

Perhaps you've heard the highly contested argument that "90% of contracts expire worthless".

...Please consider:

Per @thebcinvestor, here are some (perhaps obvious) considerations:

- 10% of contracts are exercised

- 55%-60% of contracts are closed out prior to expiration

- 30%-35% of contracts expire worthless (OTM w/ no intrinsic value)

(Source: moneyshow.com/articles/optio…)

Therefore...

- 10% of contracts are exercised

- 55%-60% of contracts are closed out prior to expiration

- 30%-35% of contracts expire worthless (OTM w/ no intrinsic value)

(Source: moneyshow.com/articles/optio…)

Therefore...

Those who utilize max pain speculate that stock prices gravitate toward the points where the most contract buyers would lose the most money *if they let their contracts expire*.

But as I just pointed out, that is not often what the majority of options buyers are in fact doing.

But as I just pointed out, that is not often what the majority of options buyers are in fact doing.

Here are how max pain prices are calculated:

1. Find the intrinsic value of each strike across an expiration by subtracting the strikes from the current underlying stock price.

N.B. OTM calls and OTM puts have $0 value. Writers keep the entire premium at expiration if OTM.

1. Find the intrinsic value of each strike across an expiration by subtracting the strikes from the current underlying stock price.

N.B. OTM calls and OTM puts have $0 value. Writers keep the entire premium at expiration if OTM.

2. Find the open interests (OI) for each strike on the chain and multiply them by the intrinsic values from step 1.

3. Summate all of these values broken down by calls and puts.

3. Summate all of these values broken down by calls and puts.

4. Find the *lowest* value--that is the max pain price for options buyers, as it is where the least amount of value that will be paid out from contract writers exists.

Going back to $AAPL's example, then. Knowing what we know now, market makers want $AAPL's price to gravitate toward $165 by 28-Jan-2022, highlighted here.

In that scenario, the majority of bought to open calls and puts would expire worthless, in the market makers' favors.

In that scenario, the majority of bought to open calls and puts would expire worthless, in the market makers' favors.

But, this rather assumes that market makers are able to control underlying price movements efficiently as some kind of deus ex machina--this in and of itself is a speculative bit, but allow me to lay out what *has* to happen when a market maker sells you a call or put:

Market makers must cover their short positions to remain delta neutral:

- They must buy stock to cover calls they have sold.

- They must sell stock to cover puts they have sold.

- They must buy stock to cover calls they have sold.

- They must sell stock to cover puts they have sold.

*The controversy*, in which case, is whether stock prices gravitate towards max pain by happenstance or as some part of greater manipulation.

As always, let's err on the side of data--currently, there is no research I have read to say max pain is a leading indication whatsoever.

As always, let's err on the side of data--currently, there is no research I have read to say max pain is a leading indication whatsoever.

And so, those who watch max pain price as an indicator speculate that as options' expirations draw closer, the contract writers will buy or sell shares to drive the stock price to the max pain price.

That's it!

As always, let me know if this helped! Have a nice day!

That's it!

As always, let me know if this helped! Have a nice day!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh