🧵 Time ......FXS

Why am im bullish Frax well lets break it down

Why am im bullish Frax well lets break it down

2/ lets first talk about the elephant in the room ....Bear or bull market people are going to buy/use stables and who profits off that.....well fxs holders. here is a snapper of the average daily income

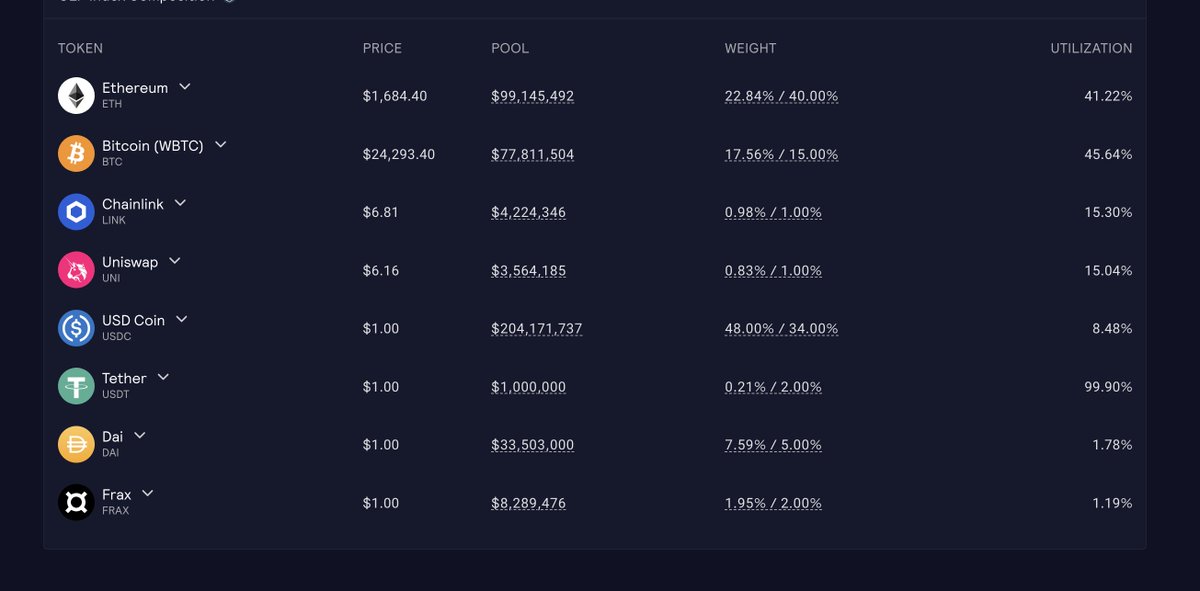

3/ Frax is the only stablecoin that can mint directly into lending pools.....should I say printer go burr....ask yourself why does they us have dominant world power well they have the printer (aka the petro dollar)

6/ capital efficient.....its not fully backed but its also not backed by nothing.......its very capital efficient to be backed by nothing but you are basically a house of cards when a bank run comes....not if but When

9/ now the fpi is important because we are not pegged to the "same junk different day" US dollar which is year over year having steady growth in the wrong way (just flip it upside down and que.....every little thing is gunna be alright by @bobmarley

10/ Fpi is going to be pegged to the purchasing power of a basket of assets this is important because as the dollar is going down it will not have an effect on the purchasing power in-fact you will basically have more dollars over time because it is pegged to

11/ the cost of the asset.

ex:pegging to the cost of a burger back in the 1950's was like .15$ which now is like 3.99$ (not to mention you are getting way less now.....not even real food) @McDonalds come on now 🤦♂️......hopefully you will still hire me 🙏

ex:pegging to the cost of a burger back in the 1950's was like .15$ which now is like 3.99$ (not to mention you are getting way less now.....not even real food) @McDonalds come on now 🤦♂️......hopefully you will still hire me 🙏

12/ .15$ or $3.99 I dont care because the asset is pegged to the item itself so I can still get that burger.....

ex say 1 fpi=1 burger....... it dont matter 1 fpi= 1 burger

ex say 1 fpi=1 burger....... it dont matter 1 fpi= 1 burger

14/ now if you staked you fxs and are like bruh im locked up well chill your buns here ya go....... Users will be able to deposit collateral into Frax, or even use veFXS they have locked up, and take out loans.

15/now lets get spicy Frax AMM - An internal AMM will give FRAX and FPI holders an immediate highly liquid market to use trade against. As the Collateral Ratio lowers, the Frax system will be able to mint directly into different pairs offering more liquidity to different pairs.

18/oh and did I mention the peg is on point (if ur gunna say na bruh look at coingecko, Ill say well look again these are the metrics on eth where it has the deepest liquidity) CG is an aggregator of the price on multiple chains. (the liquidity is being built up as we speak

19/ just let the metrics tell you time to que i'm a believer by Smash Mouth over 64% of fxs locked for an average lock of 1.43 years

20/ -most tokens locked in vefxs

-airdrop coming (buy pressure on fxs)

-fpi coming out

-astronomical frax growth (burns fxs to mint frax)

-Daos that want to control curve (buy fxs for cvx votes)

-and peeps just simply wanting more frax

recipe for #nutsandham

-airdrop coming (buy pressure on fxs)

-fpi coming out

-astronomical frax growth (burns fxs to mint frax)

-Daos that want to control curve (buy fxs for cvx votes)

-and peeps just simply wanting more frax

recipe for #nutsandham

21/ I always say invest in people not ponzis and the frax team is always skating where the puck is goin and not where it is at...... oh and @samkazemian This guy is a giga chad

20b/ oh and frax swap making printer go burr and fxs go burn

if you u liked this thread share and tag anyone you think doesnt want to lose 7% of there burger every year IYKYK 😉

https://twitter.com/Rentahomefast/status/1486507925942190086

Want to credit @TheLonelyCabin for some of the photos and screen shots give him a follow thelonelyghost.substack.com/p/what-the-frax

• • •

Missing some Tweet in this thread? You can try to

force a refresh