God fearing Defi Degen Making entercational YouTube content | Luke 12:22-26 (don’t worry abt tomorrow)

How to get URL link on X (Twitter) App

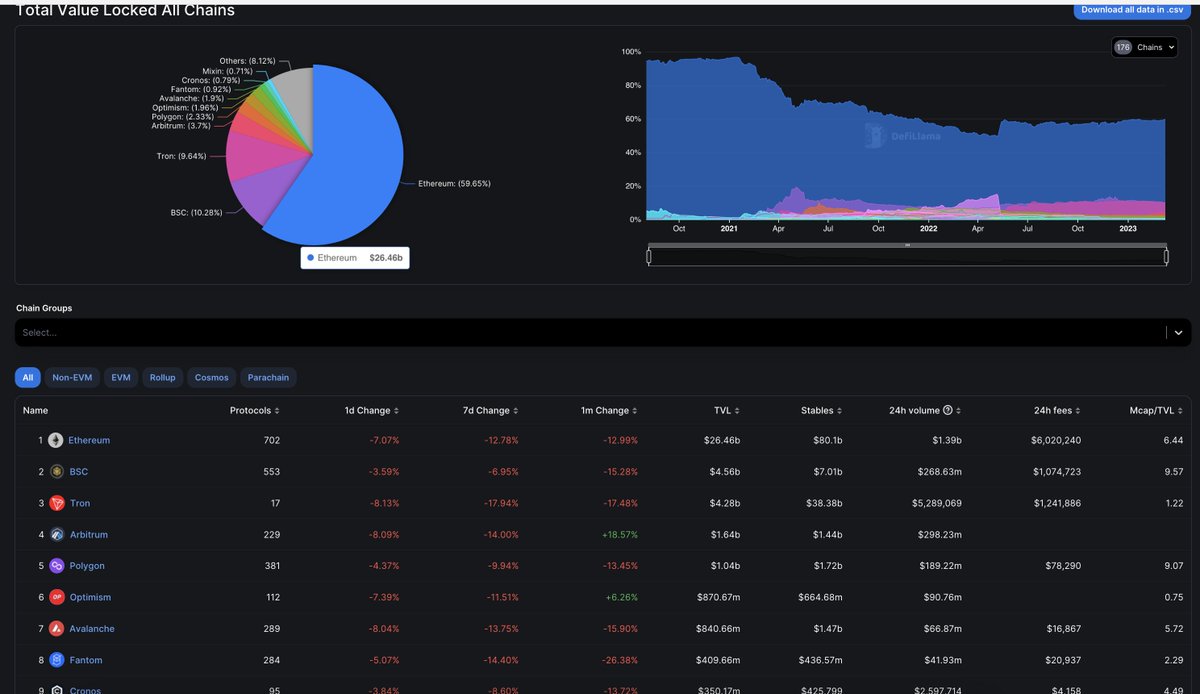

And Most of the projects on Arbitrum have already done multiples with Traders front running the liquidity inflow.

And Most of the projects on Arbitrum have already done multiples with Traders front running the liquidity inflow.

*Note, the reason im talking about some of the ecosystem tokens is because 42+% of the ARB supply is designated to be distributed to protocols to be shared with users.

*Note, the reason im talking about some of the ecosystem tokens is because 42+% of the ARB supply is designated to be distributed to protocols to be shared with users.

To establish trust between hackers and protocols, we require web3 solutions that incentivize responsible bug reporting and improve protocol security.

To establish trust between hackers and protocols, we require web3 solutions that incentivize responsible bug reporting and improve protocol security.

https://twitter.com/BanklessHQ/status/1628757265728536578

https://twitter.com/ETH_Daily/status/1618881195852369920

Buuuuut and its a big but, You have picked the right ones.

Buuuuut and its a big but, You have picked the right ones.

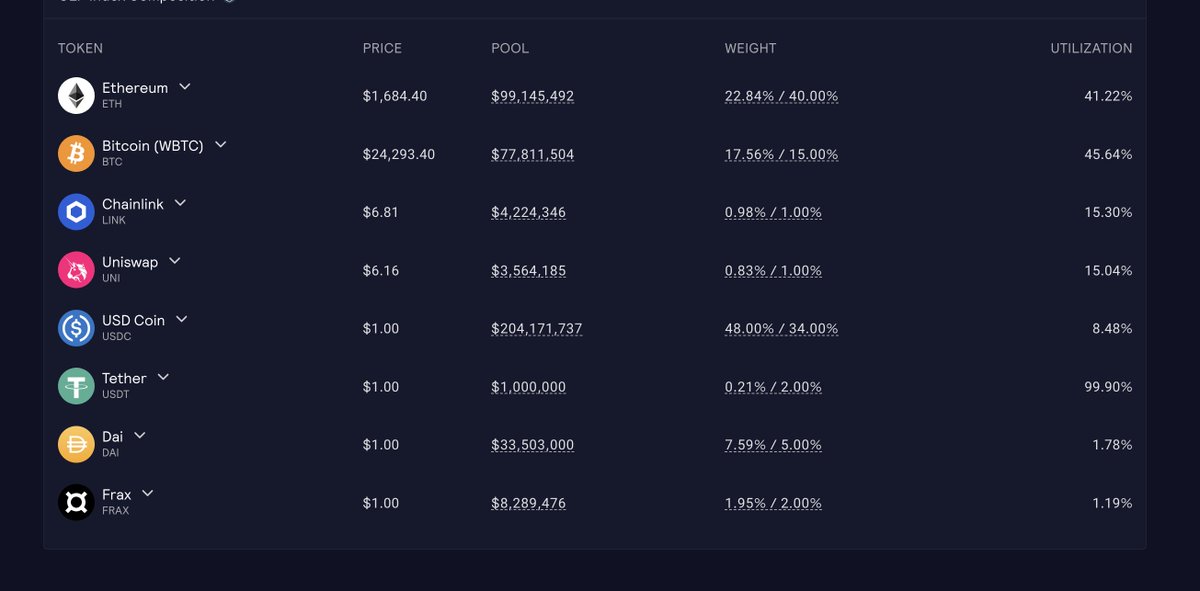

In this thread I will be sharing 5 protocols that are similar to $GMX and what contributed to their success, with one being a low market cap gem that may gain traction

In this thread I will be sharing 5 protocols that are similar to $GMX and what contributed to their success, with one being a low market cap gem that may gain traction

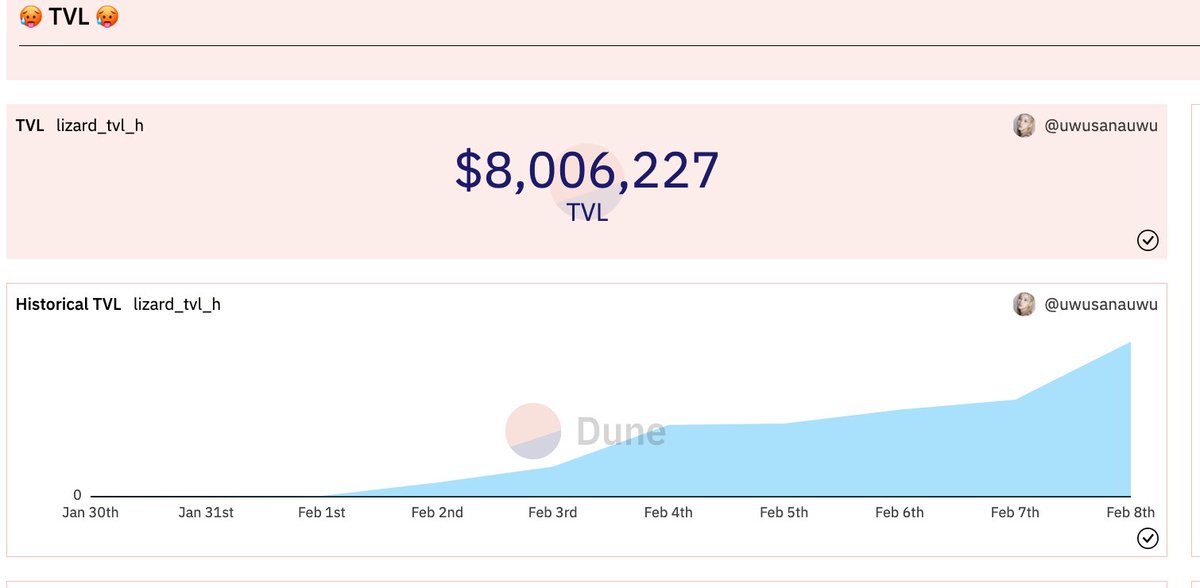

one of the main differences between $sliz and the other VE (3,3) forks is the integration of POL.

one of the main differences between $sliz and the other VE (3,3) forks is the integration of POL.

Tldr it’s infrastructure for vpns. So instead of having something like the $OXT token used for @OrchidProtocol. Other teams in projects can build on top of the $DVPN and create their own VPN service

Tldr it’s infrastructure for vpns. So instead of having something like the $OXT token used for @OrchidProtocol. Other teams in projects can build on top of the $DVPN and create their own VPN service