How to use Top Down Approach for Stock Selection ?

Weak Vs Strong Sectoral Analysis

Weak Vs Strong Stock Analysis

A thread 📩

Weak Vs Strong Sectoral Analysis

Weak Vs Strong Stock Analysis

A thread 📩

Step 1 : Choose the Strongest Sector

Use The concept of Relative Strength to identify Strong Sector .

Example Comparing Auto Vs Nifty

Here we can See the 65 RS line is Positive and Increasing meaning A outperformance of AUTO index

2/n

Use The concept of Relative Strength to identify Strong Sector .

Example Comparing Auto Vs Nifty

Here we can See the 65 RS line is Positive and Increasing meaning A outperformance of AUTO index

2/n

How to Apply RS and How to Use It ⏬

3/n

https://twitter.com/JayneshKasliwal/status/1480449068891455488?s=20

3/n

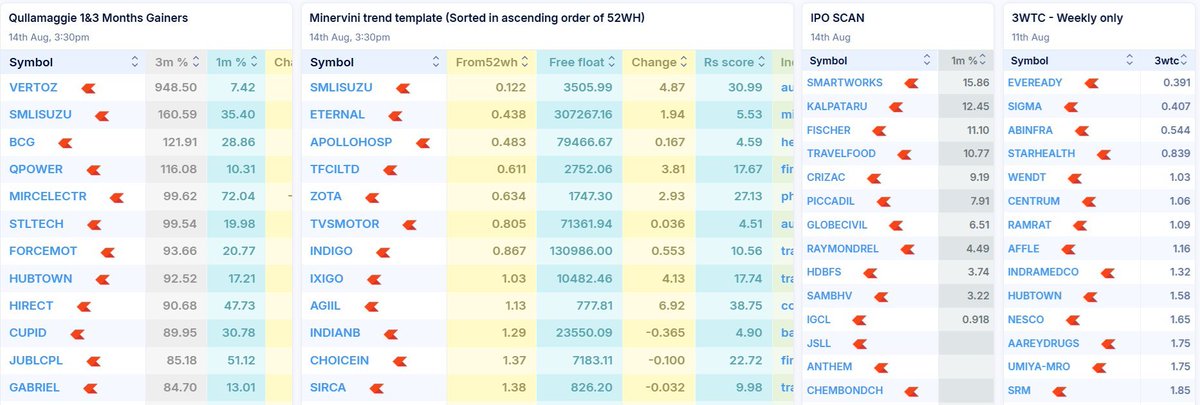

Look For Strongest Sectors

Like : PSUBANKS , AUTO and INFRA

The RS line Should be Preferred Sloping up

Use 65 RS for Short Term and 130 for Midterm Holding

4/n

Like : PSUBANKS , AUTO and INFRA

The RS line Should be Preferred Sloping up

Use 65 RS for Short Term and 130 for Midterm Holding

4/n

What do Weak Sectors Look Like ?

Nifty : Pharma Fmcg It

This Sector Should be completely AVOIDED for trading as the whole sector is underperforming

5/n

Nifty : Pharma Fmcg It

This Sector Should be completely AVOIDED for trading as the whole sector is underperforming

5/n

Now As we have Selected The Strongest Sectors

Lets select the Strongest Stock in that particular Sector Using Stock Vs Sector Analysis

Outperformers : Canara Bank , SBIN

RS settings

6/n

Lets select the Strongest Stock in that particular Sector Using Stock Vs Sector Analysis

Outperformers : Canara Bank , SBIN

RS settings

6/n

Similary in AUTO sector Some Stoccks will be weak and some will be strong .

Bet on the winning hose and not on loosing horse by identifying outperformers .

Example :

Hero Vs Maruti

Which Stock to Select ?

8/n

Bet on the winning hose and not on loosing horse by identifying outperformers .

Example :

Hero Vs Maruti

Which Stock to Select ?

8/n

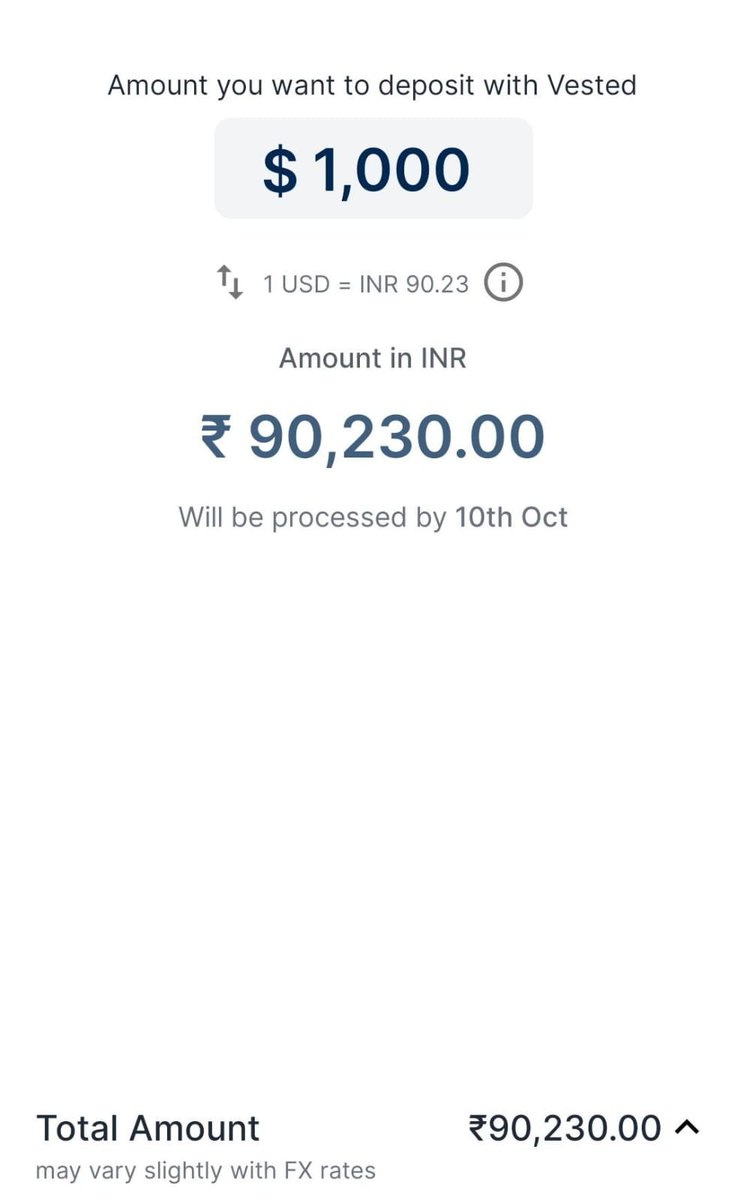

If you Want to Learn Swing Trading

Use the Link Below to Get Recording And attend Live Sessions

app.cosmofeed.com/view_group/61f…

9/n

Use the Link Below to Get Recording And attend Live Sessions

app.cosmofeed.com/view_group/61f…

9/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh