1/ RONIN ($RON), the L2 gov token of the $AXS/$SLP ecosystem went live today. $RON is the first and only legit L2 GT in the market rn and its a hard comp bc it can be viewed as NFT platform, DEX, L1/L2, etc. So what's it worth? Smoll Shill 🧵👇Disclosure: Obvi long $RON #DYOR

2/ Thread Overview a) Total ETH Bridge TVL / DAU growth metrics / NFT Volume (Macro) b) Quantitative Analysis (Pool APRs, Comp Set Multiples, FV) / Qualitative Assessment (Micro)

3/ ETH Bridge TVL - $RON @$3.5B Bridge TVL is the #1 L2 and #4 overall behind L1s FTM/Poly/AVAX (this is after an 27% TVL decrease over the past 7d). Shit bro you're so early @l2beatcom doesn't even know $RON is #1 on the leaderboard yet👀🤫

5/ APR & Sensitivity Analysis: Using the current FUD ~$3.5 FTX perp price, RON is trading at .5 MC/TVL Below is the current pool APRs and a sensitivity table using a TVL weighted APR. Even at these depressed prices, the SLP pool is yielding > 450%

6/ Comp Set: Arb/Opt don’t have a token, so comp set uses L1/L2 TVL and primary DEX volumes/fees for the L1/L2 (assuming fees @.3% and earnings @.05% to normalize): $LRC/LRCAMM, $BOBA/Oolong ($OLO), $METIS/Netswap and MATIC /QUICK (see footnote)

7/ Comp Set Output: Using the Comp Set avgs $RON (whether or not you include MATIC) would be $12 - $14 which is a 3-4x from current levels.

8/ FV: Even using a 1x MC/TVL multiple (generally considered FV by industry standards) $RON prices at $7-$9 (or 700M / 94M), or >2x from market. Note, $RON had $1B in TVL last week and this is after a 40% TVL drop bc the market got nuked.

9/ Qualitative: Ok we’ve analyzed $RON quantitatively, now let’s compare $RON to these “Comps” so i can drill into your mid-IQ brain that one of these is not like the others.

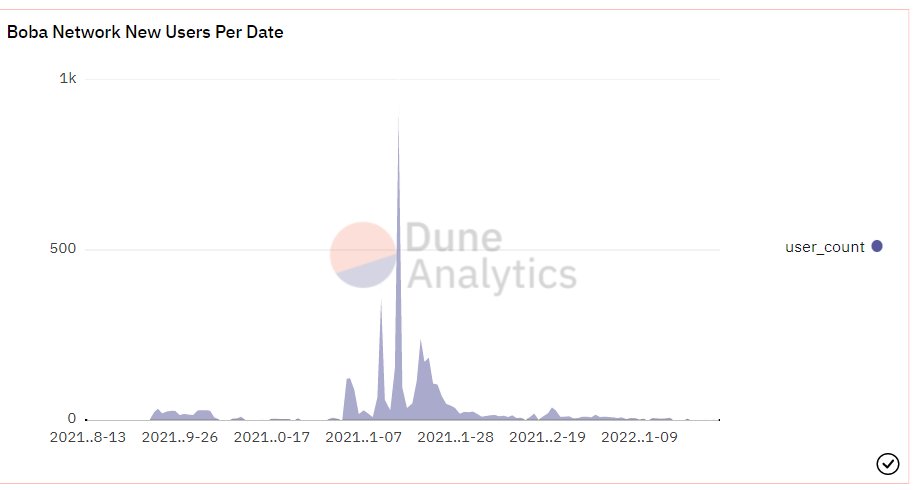

10/ Boba: The first and non-coincidentally the last time I heard about $BOBA was when @AlamedaTrabucco was liquidating fools trying to arb the - FR when OMG was airdropping it. Based on these dune metrics, I’m not alone (3 new users L-O-Fucking L)

11/ LRC: Yeh bro meme coins are cool when it’s #UpOnly or when CT God (read @Hsaka) is tweeting about it, but unfortunately facts are facts and >75% of LRC’s TVL is LRC. I hear you on GME NFT collab but rn this token has 0 utility and the APRs are trash relative to $RON.

12/ Metis / Netswap: Metis / $NETT is a newer L2/DEX going through a major LM program, so while its the best of a weak bunch its probably too early to judge and I fully expect $NETT to come down as more tokens are emitted. Also 39% of METIS's TVL is METIS

13/ Summary: Hey Anon, Ik Tabasco / Daddy Pow are taking you to the cleaners rn but look at the summary chart below and make the right move.

• • •

Missing some Tweet in this thread? You can try to

force a refresh