Some $LINK hopium from /biz. During times like these, it’s all you need to have.

How @chainlink aims at becoming "the only network that matters"

👇🧵

How @chainlink aims at becoming "the only network that matters"

👇🧵

1/ All credits goes to @web3paradigm.

Re-written for the sake of readability (reading long posts on /biz is extremely annoying) and to avoid some vulgarities.

Re-written for the sake of readability (reading long posts on /biz is extremely annoying) and to avoid some vulgarities.

2/ “If you’re an oldfag and know all of this, you can move further. This is for the no-linkers and others who missed this all when it happened, and are still in the dark.

3/ Remember way back in 2019/20 when $ETH was going to scale to 40k TPS and the really very smart (no seriously, they’re smart) kids at @prylabs were going to lead the charge? Guess what also happened back then:

medium.com/offchainlabs/s…

medium.com/offchainlabs/s…

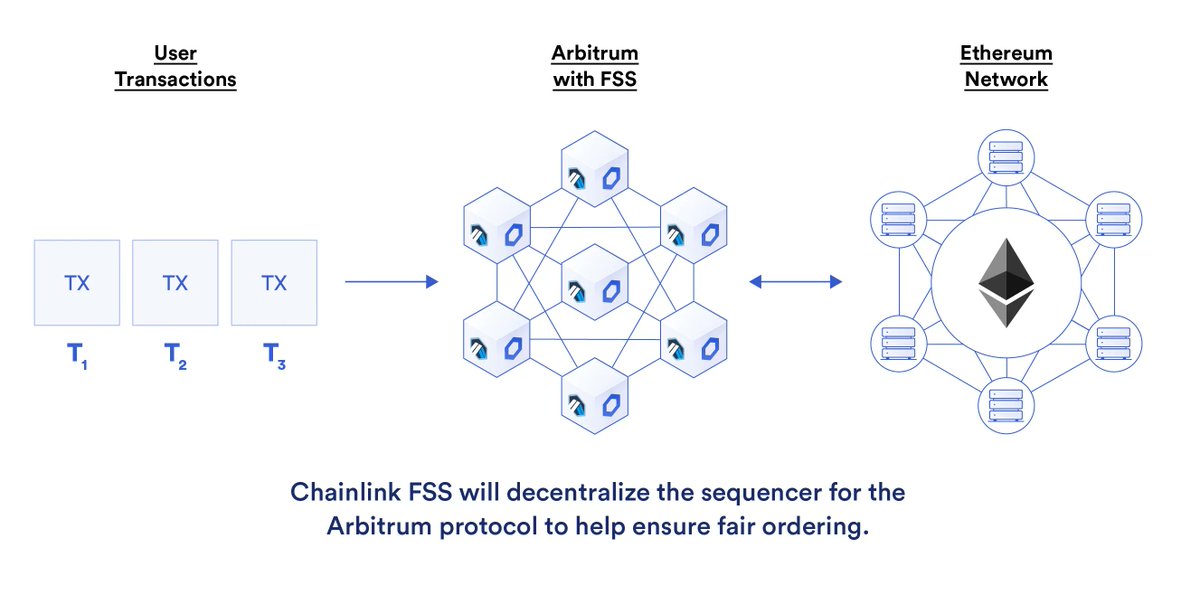

4/ In a time when everyone was saying $ETH scaling was right around the corner, @chainlink team invested time and resources to a (then) weaker scaling model in @arbitrum rollup.

5/ For them to do this they must have:

- had people actually looking at scaling solutions proposed;

- realized that what the people a @ethereum were proposing wasn't going to work;

- had people actually looking at scaling solutions proposed;

- realized that what the people a @ethereum were proposing wasn't going to work;

6/

- scouted the Earth for something that would actually work;

- picked the highest performance rollup available;

- been 100% right.

- scouted the Earth for something that would actually work;

- picked the highest performance rollup available;

- been 100% right.

7/ What are the people at @prylabs doing now?

Their scaling project is making the client for POS, which isn't a scaling improvement…

But wait, it gets better…

prysmaticlabs.com/#projects

Their scaling project is making the client for POS, which isn't a scaling improvement…

But wait, it gets better…

prysmaticlabs.com/#projects

8/ The greatest bend of the knee in Second Gen Blockchains happened when @VitalikButerin started modifying @ethereum to bend the knee for rollups through additional CallData allocation. Admitting that his solution wasn’t going to work and begging daddy @EdFelten to save him.

9/ On face he had to support things like ZKs but he (and Ed) knew the only option was Multiround Rollups and Ed was kind enough to absolutely annhilate the ZK side with problems that the ZK architects weren't even aware of.

But wait, it gets better…

ethereum-magicians.org/t/a-rollup-cen…

But wait, it gets better…

ethereum-magicians.org/t/a-rollup-cen…

10/ @EdFelten and @SergeyNazarov decided that if the space was going to block them (by delaying @chainlink’s progress to solve scaling for $ETH) that they’d be bullying @VitalikButerin the whole way through.

11/ Remember @arbitrum Nitro? How’d those kiddos pull more performance out of the already top performing L2? They did the usual optimization work and added an in-node instance of Geth. But wait, isn't that an L1 client? You’re damn right it is.

medium.com/offchainlabs/a…

medium.com/offchainlabs/a…

12/ So now when you spin up a @chainlink node:

- You get all what @chainlink does that pays you (VRF, Keepers, CCIP, …);

- You get all what @arbitrum does that pays you(batching/validating and eventually FSS)

- You also get an @ethereum client where you can stake for L1

- You get all what @chainlink does that pays you (VRF, Keepers, CCIP, …);

- You get all what @arbitrum does that pays you(batching/validating and eventually FSS)

- You also get an @ethereum client where you can stake for L1

13/ You literally monopolize the entire pay stream. And also you get defacto control over the POS $ETH network. Think about what the whole stack in one node really means: there are now two classes of clients on POSeth:

14/

1. Standard clients that stake $ETH and are paid in $ETH for L1 transactions. These clients can only benefit from this one revenue stream;

1. Standard clients that stake $ETH and are paid in $ETH for L1 transactions. These clients can only benefit from this one revenue stream;

15/

2. @chainlink/@arbitrum clients who get:

- All the revenue of the standard client;

- All of the revenue for the traffic on @arbitrum (paid in $ETH);

- All of the revenue for Chainlink services (paid in $LINK);

2. @chainlink/@arbitrum clients who get:

- All the revenue of the standard client;

- All of the revenue for the traffic on @arbitrum (paid in $ETH);

- All of the revenue for Chainlink services (paid in $LINK);

16/ Plus (and this is the most important part) a #CCIP enabled stack that allows transactions routing to whichever @ethereum equivalent network is fastest/cheapest, which will always be @arbitrum, since the node that benefits from Arbitrum’s use is the one making the decision.

17/ Overtime, the majority of fees will be on the @arbitrum layer, accumulating $ETH on @chainlink enabled nodes at faster rates. People aren't stupid: if you spin up ETH2 nodes and get paid x or you spin up @chainlink nodes and get paid 3x, you’re going to do the latter.

18/ So what does that mean in a POS system? $ETH, the voting asset for ETH2 is on a downhill slope into the hands of @chainlink stakers who will eventually control not only the $LINK network, but also the base layer @ethereum.

19/ Now do you get why @VitalikButerin is so salty about @chainlink?

This all fucking starts to dawn on every pink haired diversity coder once #CCIP goes live and people understand what staking means.

This all fucking starts to dawn on every pink haired diversity coder once #CCIP goes live and people understand what staking means.

https://twitter.com/VitalikButerin/status/1270480977152798721?s=20&t=aRjThDKnSf5RtTR53bGphQ

20/ Get ready for the entire space to watch @Smart_Contract/@OffchainLabs drink their milkshake and there’s nothing they can do about it.

21/ We are about to see a crypto bear like none other: where every hype driven bit of bullshit value is sucked into the unstoppable only network that matters: @chainlink.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh