1/ A Newbie Guide to @Reaper_Farm

A yield aggregator on $FTM network w/ APY often over 1000%

I've been working on this for a few days and with the recent #DeFi drama it seems like a great time to drop

A yield aggregator on $FTM network w/ APY often over 1000%

I've been working on this for a few days and with the recent #DeFi drama it seems like a great time to drop

2/ First, a bit about why I'm doing this and what to expect

As a newb, I feel that research is priority #1 but there's clearly an epidemic of people dumping their life savings into products they don't understand.

As a newb, I feel that research is priority #1 but there's clearly an epidemic of people dumping their life savings into products they don't understand.

3/ Experienced degens seem to always be experimenting w/ new projects but I'm learning the fundamentals and researching tried and true projects

Since I'm researching anyway, I thought I'd help my fellow newbs by giving you a starting point for your own research

Since I'm researching anyway, I thought I'd help my fellow newbs by giving you a starting point for your own research

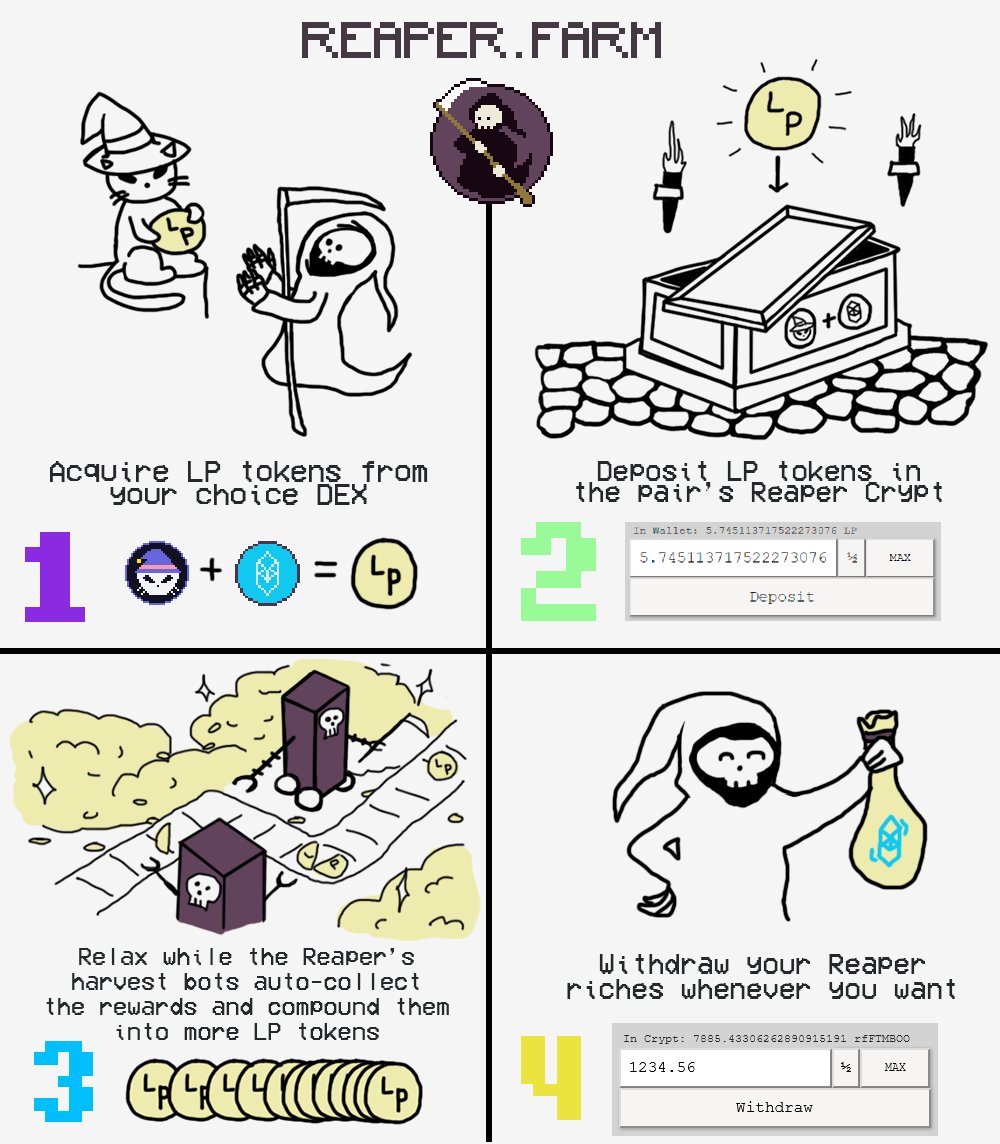

4/ Ok on to the main event

@Reaper_Farm is an auto-compounding yield aggregator maximizing yield via compound interest

This graphic from the reaper docs explains the basics

@Reaper_Farm is an auto-compounding yield aggregator maximizing yield via compound interest

This graphic from the reaper docs explains the basics

5/ Like true degens the team came up with the idea to "aggregate" yield after losing time and profit manually harvesting yield ~20 times on several different sites

When you deposit your tokens into a "crypt" on reaper, every 15 mins bots perform ~17 transactions for you

When you deposit your tokens into a "crypt" on reaper, every 15 mins bots perform ~17 transactions for you

6/ Concepts

Since this thread is for newbs here are some concepts you should already know / research before using Reaper

- Have a MetaMask on Fantom Opera Network

- Liquidity pools

- Yield farming

- Impermanent loss

Since this thread is for newbs here are some concepts you should already know / research before using Reaper

- Have a MetaMask on Fantom Opera Network

- Liquidity pools

- Yield farming

- Impermanent loss

7/ Fees

4.5% taken from harvest profits, sent to treasury

.45% gas fee taken from profits, used by harvest bots for gas

0.1% security fee that prevents malicious bots from abusing the system

Reaper calculates these fees in advertised APY

👉 APY you see, is APY you get

4.5% taken from harvest profits, sent to treasury

.45% gas fee taken from profits, used by harvest bots for gas

0.1% security fee that prevents malicious bots from abusing the system

Reaper calculates these fees in advertised APY

👉 APY you see, is APY you get

8/ Team

Before we get into security let's talk team

AFAIK Justin Bebis @0xBebis_ is the only doxxed cofounder. You can find several interviews with him around the web. Links below.

Bebis taught himself to code during COVID, was one of first 100 $FTM wallets

Before we get into security let's talk team

AFAIK Justin Bebis @0xBebis_ is the only doxxed cofounder. You can find several interviews with him around the web. Links below.

Bebis taught himself to code during COVID, was one of first 100 $FTM wallets

9/ The team behind Reaper is @ByteMasons

Several other members can be found on Twitter

@0xGoober (strategist & security researcher)

@Crypto_A_S (biz development)

@FantamSpooky (creative director)

You can also chat with staff & devs on discord discord.gg/reaperfarm

Several other members can be found on Twitter

@0xGoober (strategist & security researcher)

@Crypto_A_S (biz development)

@FantamSpooky (creative director)

You can also chat with staff & devs on discord discord.gg/reaperfarm

10/ Security

Reaper claims their team is largely security experts (being undoxxed we have to take their word for it)

Features:

🔍 Reviews all integrated contracts for vulnerabilities

🔒 Fail-safes withdraw money from 3rd parties if they rug

Reaper claims their team is largely security experts (being undoxxed we have to take their word for it)

Features:

🔍 Reviews all integrated contracts for vulnerabilities

🔒 Fail-safes withdraw money from 3rd parties if they rug

11/ Security cont.

Reaper team are fans of @AndreCronjeTech and built their platform on "battle tested" Yearn @iearnfinance architecture

Reaper has been audited by @SolidityFinance which found no vulnerabilities. You can read the audit here solidity.finance/audits/ReaperF…

Reaper team are fans of @AndreCronjeTech and built their platform on "battle tested" Yearn @iearnfinance architecture

Reaper has been audited by @SolidityFinance which found no vulnerabilities. You can read the audit here solidity.finance/audits/ReaperF…

12/ Yearn Finance itself has been audited by several firms (to mixed, but mostly positive results) linked here

Bottom line is Reaper is thoroughly audited for security

Bottom line is Reaper is thoroughly audited for security

13/ Security cont.

Reaper plans to move to a DAO structure where upgrades (which cause 5 day lockdowns) and treasury keys are controlled by voters

Currently these are controlled solely by @0xBebis_

Reaper plans to move to a DAO structure where upgrades (which cause 5 day lockdowns) and treasury keys are controlled by voters

Currently these are controlled solely by @0xBebis_

14/ Analytics

The Reaper team is super proud of their analytics

Just click the "More Info" button on any crypt to get a detailed breakdown of current & future profits by day, week, month, and year

The Reaper team is super proud of their analytics

Just click the "More Info" button on any crypt to get a detailed breakdown of current & future profits by day, week, month, and year

15/ Reaper V2

There isn't much alpha about V2 but Bebis has said that the current V1 is "almost strictly a power-user platform"

V2 will aim to be "DeFi that everyone... can use"

(I hope more projects are thinking this way too...)

There isn't much alpha about V2 but Bebis has said that the current V1 is "almost strictly a power-user platform"

V2 will aim to be "DeFi that everyone... can use"

(I hope more projects are thinking this way too...)

16/ Everything I've seen from the Reaper team has been community focused. I believe they truly want to community to win and I like how straightforward the platform is.

There are ALWAYS risks in #DeFi so don't enter into any crypts for two random tokens just because it 1200% APY

There are ALWAYS risks in #DeFi so don't enter into any crypts for two random tokens just because it 1200% APY

17/ As newbs it's important to understand IMPERMANENT LOSS when yield farming with LP tokens

Here's a video that does a good job explaining it

Here's a video that does a good job explaining it

18/ If impermanent loss worries you I'd highly recommend @Route2FI guide to Reaper's $FTM - $TOMB pool. I followed this last week and it's several steps but simple if you pay attention

https://twitter.com/Route2FI/status/1469645405445140480

19/ That's about it for the basics. Here r some of my sources for this thread, starting with Reaper's documentation

It sounds boring, but I implore you to READ THE DOCS on any project you use. It's only a few pages & protects u from doing something stupid reaper-bytemasons.gitbook.io/reaper-farms/

It sounds boring, but I implore you to READ THE DOCS on any project you use. It's only a few pages & protects u from doing something stupid reaper-bytemasons.gitbook.io/reaper-farms/

20/ Great interview with @0xBebis_ and other team members from @FTMAlerts

Helped me understand the team better

Helped me understand the team better

22/ Finally, Bebis' Medium page that he posts on fairly regularly about the projects he's involved in 0xbebis.medium.com

23/ I hope this helps someone. Researching can be difficult trying sift thru the bs. Use this as a starting point but go beyond what I've posted here (if you do, please comment with anything you find)

• • •

Missing some Tweet in this thread? You can try to

force a refresh