Oh dear, Facebook filed its motion to dismiss for the Delaware shareholder suit I called the "mother of all lawsuits" because it includes charges of insider trading and governance failures related to Cambridge Analytica cover-up. I still think it may bring Facebook down. /1

I find this amusing. In a number of places in its response to the court, Facebook argues there was a failure to allege "red flags." How would the board even know that there were "red flags????" /2

I mean subpoenas from state AGs all over the country, the Federal Trade Commission and international governments wouldn't necessarily indicate anything, right? /3

I mean just the mere fact the FTC was investigating Facebook doesn't mean the board knew Facebook violated its consent order with the FTC, right? /3

speaking of "red flags," by golly that's exactly the term the SEC used when it did its stealth settlement with Facebook the same day they paid off the FTC $5 billion so Zuckerberg wouldn't be exposed to discovery and deposition around the cover-up, the very basis of this suit. /4

about that $5 billion, it's mere pocket change - a "fraction" - compared to what Facebook states the FTC originally wanted despite being many billions more than other prior FTC settlement. So don't worry about the cover-up, respect the deal it received. /5

and certainly don't worry about the insider trading allegations for 80mil shares of stock during the cover-up because that may seem like billions to us mortals, it's a rounding error to a CEO that controls all the stock, board and desperately wanted to avoid deposition. /6

and in the category of normal, misleading statements by Facebook, for the thousandth time, there was no legal certification with Cambridge Analytica. It was a flimsy one-page letter with no legal value 15 months later in 2017 after more press reports surfaced scaring them. /7

and this seems like bad lawyering by Gibson Dunn (who must be making a killing off all of these cases). They make a point the whitelisted apps that had data for another 3+ years had already ceased at the time of NYT's report but earlier noted a few hadn't. Slippery at best. /7

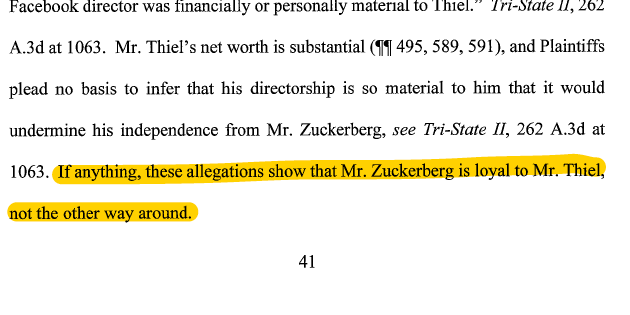

On the probably irrelevant arguments, apparently Mark Zuckerberg has no "emotional depth" in his relationship to his board member and at least one-time friend, Houston. That must hurt some feelings. /8

ok, I'll stop there. Here is the thread of the original lawsuit which is much more important to understand than Facebook's motion to dismiss. I'll keep you posted, this is a big one. /10

https://twitter.com/jason_kint/status/1440304941428473857?s=20&t=jyHGOcmUjo91AkUdBQs0Fw

• • •

Missing some Tweet in this thread? You can try to

force a refresh