Laurus labs concall happened right now.

Very interesting commentary from dr chava sir. 🐂

My key takeaways 👇

Disclaimer: biased, i am adding today. 🙏

Very interesting commentary from dr chava sir. 🐂

My key takeaways 👇

Disclaimer: biased, i am adding today. 🙏

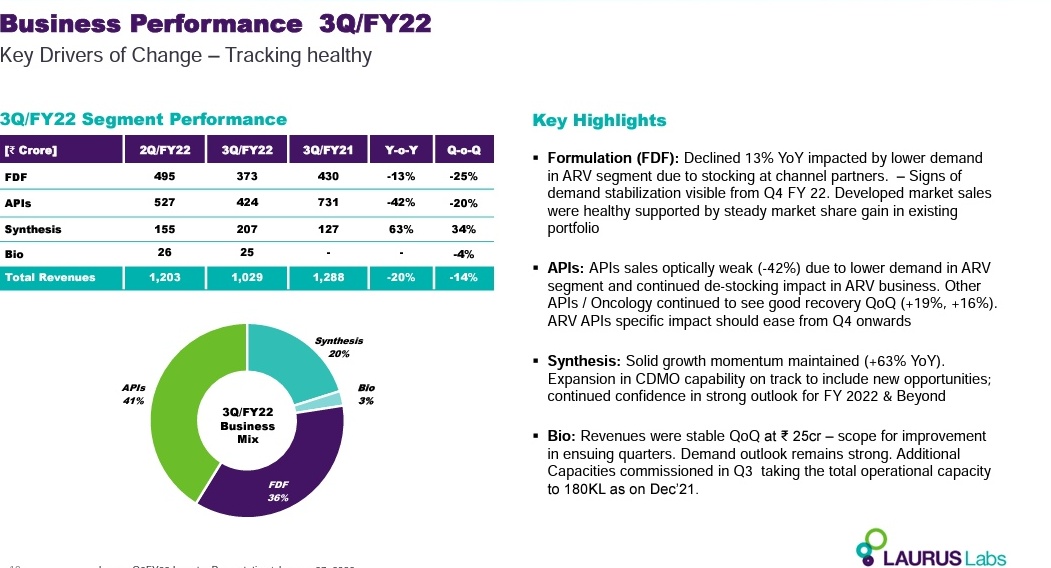

1. Revenue is only 933cr in this Q. 1 B$ sales in fy23 guidance is in tact

In b/w lines: you must have heard by now, the arv sales are down due to inventory stocking by laurus customers. Global customers like global fund did inventory stocking last year. So sale has been low

In b/w lines: you must have heard by now, the arv sales are down due to inventory stocking by laurus customers. Global customers like global fund did inventory stocking last year. So sale has been low

Expecting arv api sales to normalize to 400cr/Q level Q4 onwards

Why is 1B$ revenue 🎯 in tact ?

Coz capex is done. Formulation capacity will double in next 1-2 Q. Non arv biz is growing fast. Cdmo is up 60% YoY. Some other api division approvals got delayed.

Why is 1B$ revenue 🎯 in tact ?

Coz capex is done. Formulation capacity will double in next 1-2 Q. Non arv biz is growing fast. Cdmo is up 60% YoY. Some other api division approvals got delayed.

2. Cdmo is growing fast. Really fast.

In b/w lines: Already it's at around 800cr runrate. Expecting cdmo to be 25% of revenue in 3 years time. This works out to roughly 3x growth in cdmo (bio + chem cdmo) in 3 years. The cdmo trend is quite secular

In b/w lines: Already it's at around 800cr runrate. Expecting cdmo to be 25% of revenue in 3 years time. This works out to roughly 3x growth in cdmo (bio + chem cdmo) in 3 years. The cdmo trend is quite secular

3. Laurus bio did 25cr / Q runrate for last 2 Q. Future is bright.

In b/w lines: Can do 40cr in next few Q as new fermenter comes online. Current capacity is around 200 KL.

LAURUS setting up 1M L capacity but the plant has space for 3M L capacities

In b/w lines: Can do 40cr in next few Q as new fermenter comes online. Current capacity is around 200 KL.

LAURUS setting up 1M L capacity but the plant has space for 3M L capacities

Stage 1 already has 500cr revenue potential scaling directly current capacity.

Total revenue potential might be around 1500cr + to be realised in next many years.

Working closely with clients to design & build the Greenfield capacity.

Total revenue potential might be around 1500cr + to be realised in next many years.

Working closely with clients to design & build the Greenfield capacity.

4. Margins. Gross are up 4-5%. Operating are down 4%

Operating deleverage has resulted in operating margin going down. Some of it is due to non utilization of new capacity

Gross margin are up due to better product mix. Arv used to be 80% of sales not so long ago. Now it's 50%

Operating deleverage has resulted in operating margin going down. Some of it is due to non utilization of new capacity

Gross margin are up due to better product mix. Arv used to be 80% of sales not so long ago. Now it's 50%

Arv api are the lowest value product. Lowest gross margin product. Cdmo is significantly higher gross margin for laurus than arv. Even non Ari api are significantly higher margin. Confident of maintaining 30% ebitda margins.

<End of notes>

I am adding, biased. Not a reco.

<End of notes>

I am adding, biased. Not a reco.

Please don't take anything i share as a reco. I am not an investment advisor do your own due diligence. 🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh