Trend System (TS) update - $ATOM

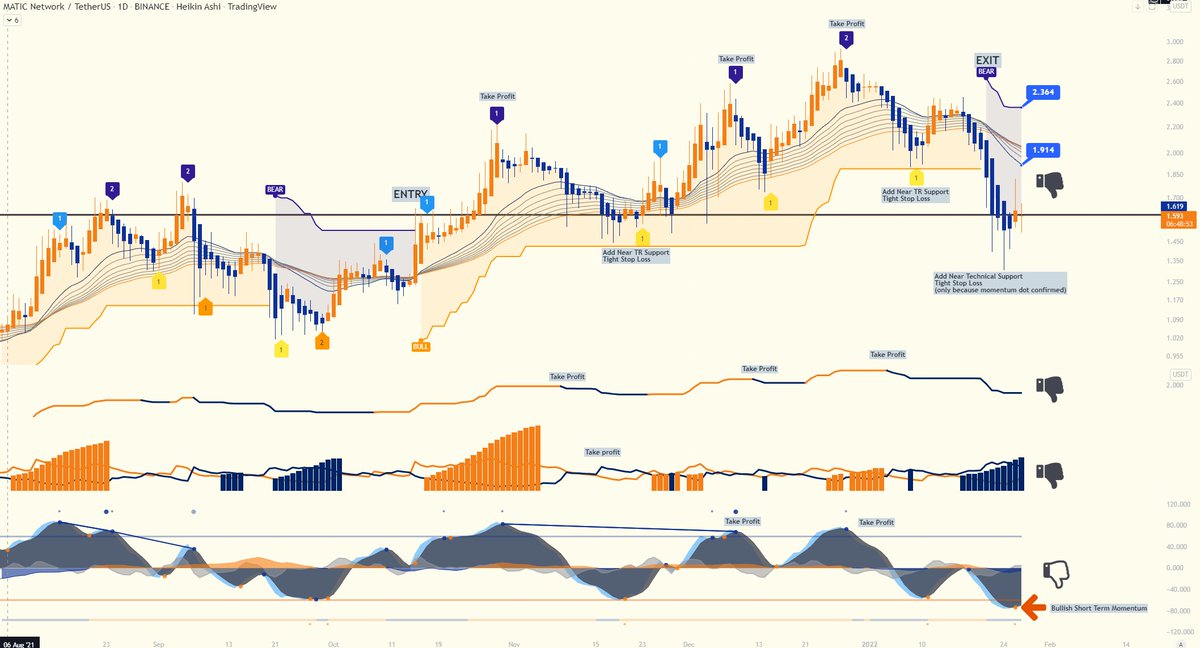

Midterm Bullish

TR Supertrend Support: 27.20

TR Ribbon Resistance: 33.27

So far it has it has been a perfect ride using our Trend System.

What I am doing right now 🔽

Midterm Bullish

TR Supertrend Support: 27.20

TR Ribbon Resistance: 33.27

So far it has it has been a perfect ride using our Trend System.

What I am doing right now 🔽

-I still hold a part of my initial $ATOM position (Took a lot of profits on the way following the TS process)

- I am adding a small position near TR Supertrend support with a tight Stop Loss just below it.

- I am adding a small position near TR Supertrend support with a tight Stop Loss just below it.

- As all the other 3 major trend indicators are bearish, I will close my midterm position if TR supertrend changes bearish too.

Not Financial advice.

Not Financial advice.

Want to be consistently updated and access our custom indicators? Join our Patreon

- Newsletter

- Trend System (TS) Access and Indicators

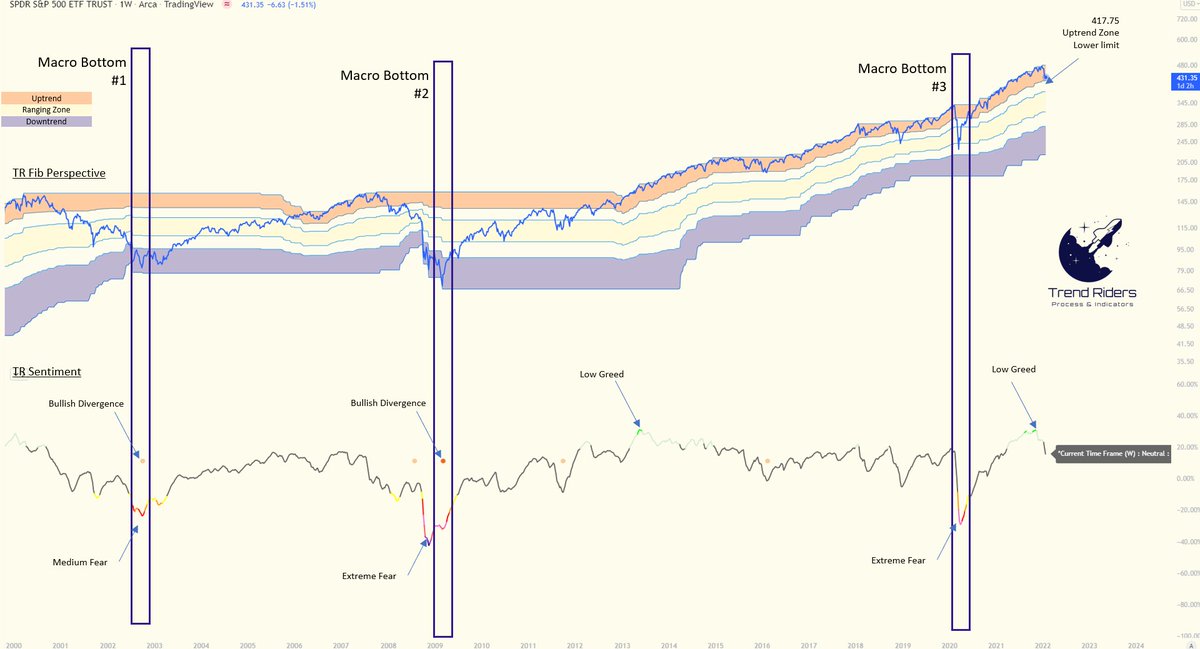

- Max Bottom Identifier (MBI) Access

- Crypto tracker (Updated Trends of major coins)

patreon.com/Trendriders

- Newsletter

- Trend System (TS) Access and Indicators

- Max Bottom Identifier (MBI) Access

- Crypto tracker (Updated Trends of major coins)

patreon.com/Trendriders

• • •

Missing some Tweet in this thread? You can try to

force a refresh