In 2005 #Darkpools took up 3-5% of Trading, In 2014 there was 12% of the volume being traded off the lit exchange. Now we are in 2022, certain securities #AMC have👀over 60% of the trading volume go Dark by PFOF brokers sending retail orders through the #OTC to ATS/Darkpools...

The Operations of #Darkpools are very problematic & hinder price discovery. In other words they provide better pricing for big institutional investors who use them to create worse pricing for the rest of us. Although the damage a simple "glitch" can have.

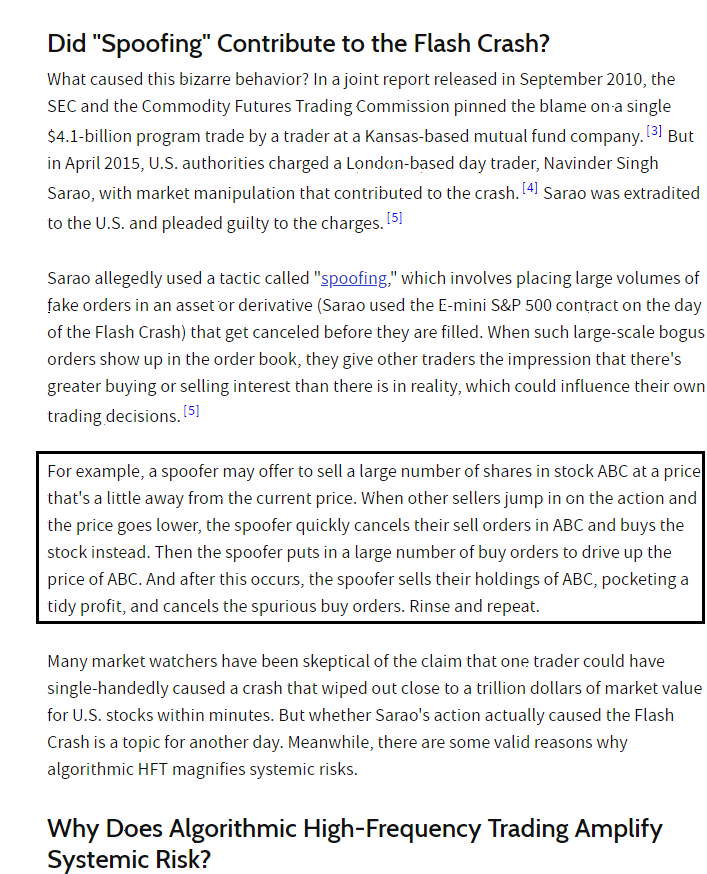

➡️2010-$862B in 20 Mins

➡️2010-$862B in 20 Mins

➡️2014 Around 40% of all U.S. stock trades happen "off exchange" up from 16% 6 yrs ago.

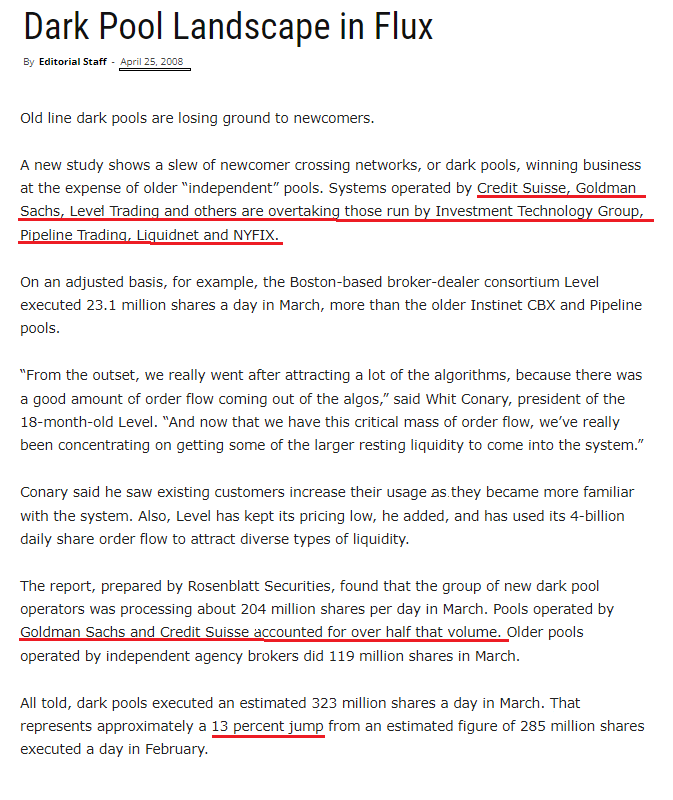

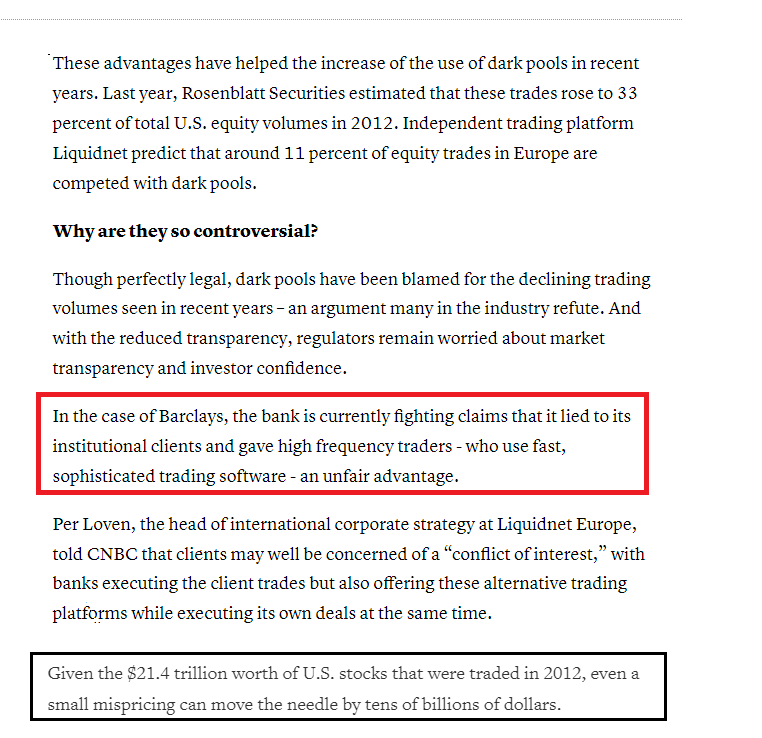

-Credit Suisse under investigation for use of its #darkpools, Goldman Sachs paid $800,000 to settle claims it failed to ensure trades on its platform that took place at best possible price.

-Credit Suisse under investigation for use of its #darkpools, Goldman Sachs paid $800,000 to settle claims it failed to ensure trades on its platform that took place at best possible price.

➡️2014 Around 45 Darkpools and as many as 200 Internalizers compete with 13 Public Exchanges.

➡️TOP Internalizers are...Morgan Stanely, Credit Suisse, and... 🔮Citadel👀

➡️ICE, NYSE, NASDAQ, OMX, and BATS Global Markets have allowed brokerages to place dark-pool style orders

➡️TOP Internalizers are...Morgan Stanely, Credit Suisse, and... 🔮Citadel👀

➡️ICE, NYSE, NASDAQ, OMX, and BATS Global Markets have allowed brokerages to place dark-pool style orders

2019-22 #DarkPoolAbuse is at Insane levels. 60-70 % on Avg for certain securities.

2/3/22 @GaryGensler Says: 90-95% of Retail Orders Go Dark...

This Rule States they can basically ban/shutdown Pfof for 1 year, which would also ban Ats/OTC #Darkpools! sec.gov/rules/final/20…

2/3/22 @GaryGensler Says: 90-95% of Retail Orders Go Dark...

This Rule States they can basically ban/shutdown Pfof for 1 year, which would also ban Ats/OTC #Darkpools! sec.gov/rules/final/20…

The #DarkPoolAbuse & #OTC Needs to End.

This Thread Explains When & Where the #Darkpools began & what they have become... (working on a follow up thread) Plz Share, Knowledge is 🗝️ @AMCbiggums @TheRealDarkPool @StonkVision @StockRetail @you_are_cosmos @FNez_Blogger @SylviaRey

This Thread Explains When & Where the #Darkpools began & what they have become... (working on a follow up thread) Plz Share, Knowledge is 🗝️ @AMCbiggums @TheRealDarkPool @StonkVision @StockRetail @you_are_cosmos @FNez_Blogger @SylviaRey

• • •

Missing some Tweet in this thread? You can try to

force a refresh