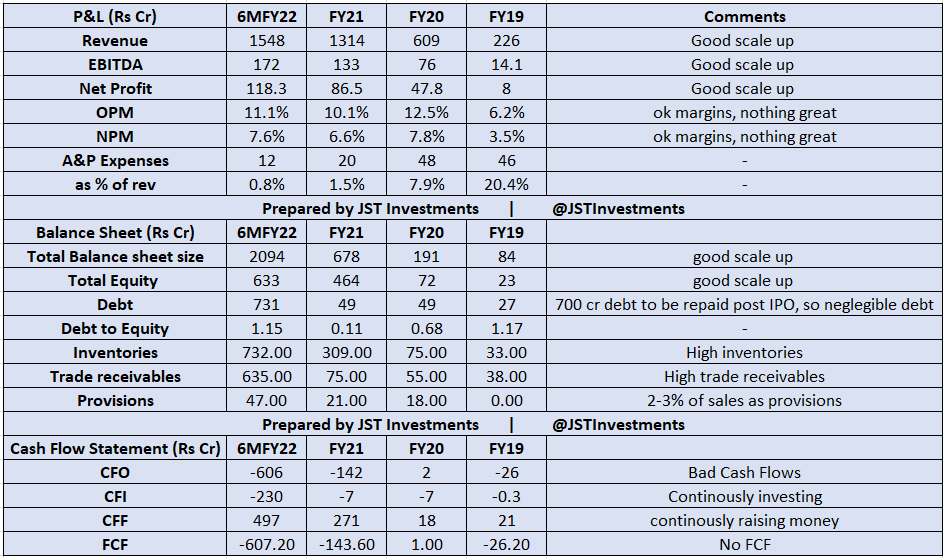

Some Findings from #Boat DRHP -

- Financials have scaled up, but cash flows haven't

- Was valued at Rs 2200 cr (April 2021) when Qualcomm invested and now Eyeing Rs 11250 to 15000 cr Valuation (1.5-2bn$) - Why the 5-7.5x jump in valuations?

- Margins volatile

#IPO

- Financials have scaled up, but cash flows haven't

- Was valued at Rs 2200 cr (April 2021) when Qualcomm invested and now Eyeing Rs 11250 to 15000 cr Valuation (1.5-2bn$) - Why the 5-7.5x jump in valuations?

- Margins volatile

#IPO

Extreme dependence on online market Places and China -

- all of their contract manufacturing is from several manufacturers in China, with a developing group of manufacturers in Vietnam and India

- Online marketplaces accounted for 85% of revenue in FY21

- all of their contract manufacturing is from several manufacturers in China, with a developing group of manufacturers in Vietnam and India

- Online marketplaces accounted for 85% of revenue in FY21

- Top 2 market places accounted for 75% of revenue in FY21 (Amazon and Flipkart)

- 6.4% revenue from distributors including modern retailers

- Warranty expenses 4% of revenue

Revenue mix -

94% revenue from Audio business

4% from wearables

- 6.4% revenue from distributors including modern retailers

- Warranty expenses 4% of revenue

Revenue mix -

94% revenue from Audio business

4% from wearables

So if a 2 bn $ valuation IPO opens and if sales are 3000 cr in FY22 (Annualized)

- an Investor pays 5x sales (if sales come lower, then even higher)

- Doing some rough maths, the PE will be 80-100 times!

- an Investor pays 5x sales (if sales come lower, then even higher)

- Doing some rough maths, the PE will be 80-100 times!

- Again these are very high valuations for a brand dependent on China for manufacturing, Online market places for its sales, and a company that has no Moat

- No moat because the next importer who sells cheaper can displace them!

- No moat because the next importer who sells cheaper can displace them!

- Anyone can import from China and the only value add is branding!

- Now the company's cash flows are also weak, so they will have to keep raising/diluting to import/sell and do more advertisement to keep the brand recall intact.

- Now the company's cash flows are also weak, so they will have to keep raising/diluting to import/sell and do more advertisement to keep the brand recall intact.

- The BIGGEST risk - what if Amazon creates their own products exactly similar to Boat?

They definitely can! Amazon has killed many smaller categories by copying the products as they have all the data and they have a billion $ machinery to reverse engineer anything!

They definitely can! Amazon has killed many smaller categories by copying the products as they have all the data and they have a billion $ machinery to reverse engineer anything!

Rapid growth will have its own challenges especially in a non-sticky consumer-facing category such as audio hardware and wearables that too in a highly price-conscious market like India! (Financial ones separate)

A clear avoid for me.

DRHP disclosures are also just ok.

A clear avoid for me.

DRHP disclosures are also just ok.

• • •

Missing some Tweet in this thread? You can try to

force a refresh